Are we headed for the next bubble? The book ‘Technological Revolutions and Financial Capital – The Dynamics of Bubbles and Golden Ages‘ won’t answer that question. But it does a good job analysing technological changes in the past and identifying patterns. The author Carlota Perez develops a model of the repeating interplay between finance and the drivers of technological evolution. Published in 2002 the book’s content seems timeless. I recently read it and can recommend it. Available at Amazon US, Amazon UK and Amazon DE.

Are we headed for the next bubble? The book ‘Technological Revolutions and Financial Capital – The Dynamics of Bubbles and Golden Ages‘ won’t answer that question. But it does a good job analysing technological changes in the past and identifying patterns. The author Carlota Perez develops a model of the repeating interplay between finance and the drivers of technological evolution. Published in 2002 the book’s content seems timeless. I recently read it and can recommend it. Available at Amazon US, Amazon UK and Amazon DE.

innovation

Whatthefintech

Yesterday I spent my day at the ‘Whatthefintech 2’ event at Startplatz Cologne. The attendees were an interesting mix from startups, banks, service companies and interested users.

While none of the pitches and startups were focused on p2p lending, it was highlighted several times as one of the use cases. An interesting discussion evolved around the question whether startups have sustainable business models or just fill in a gap that is there for a limit time span. One argument was that too many fintech startups just add an incremental improvement rather than solve a big problem. An example given was that many startups can deliver a much better user experience than banks, so they win users now. But banks are learning and will catch up on the field of presentation and user experience and when the playing field is leveled then the startup has not much to show as the data and backend processes are still owned by the bank.

I think this is an important point but one that is answered by p2p lending marketplaces – they have a business model that adds real value by offering a more efficient process than banks do. While some p2p lending marketplace use and cooperate with banks, they certainly have developed own technologies which are a core for their product and are not a mere sales-frontends as some of the criticized fintech models.

The banks certainly are eager to open up to the developments. Jana Koch of comdirect bank presented the ‘Startup Garage’ program of comdirect bank, which is a essentially co-working space with mentoring from the bank professionals for teams which have just an idea yet and want to bring that to the first development stage. The bank pays the team to enable them to concentrate on the development of their idea, but does not expect equity or ownership of the idea. From the banks viewpoint the program will be kind of an outsourced research and development offering fresh impulses to the thinking of the bank’s executives.

Some other viewpoints out of the banking sector surprised. Two persons from major banks stated that they expect the branch to play a very important role in the next 20 years as a sales channel for banks and only thereafter to become obsolescent. Maybe this is the paradox that Bankstil also commented last week. What banks publicly say is that the branch is essential and used even by their young and technology liking clients. But what they do is that they close branch after branch after branch.

I liked the presentations, especially those by Peter Barkow who talked about the relationship between German fintech and venture capital and Gernot Overbeck of Fintura, a comparison tools which promises to find the cheapest bank loan for SMEs within 15 minutes and close it within 72 hours.

The pitches of the 3 pitching fintech startups were well crafted (they had 7 minutes each).

As usual the most interesting part for me was the networking.

I am really looking forward to the next conference I’ll attend, which is LendIt in London in 2 weeks. If you register you can still use discount code wiseclerkvip to get 15% off.

Impression from the event. More photos on Twitter.

Banks Need to Understand Their Customer’s Needs Better – FAST

I just finished reading Bank 2.0 by Brett King. If I would work in middle-management of a bank – any bank – then I would be scared now, because the book clearly shows that banks are changing to slow. Or they simply deny that the world around them is evolving faster and faster and still try to continue business as it used to be.

I just finished reading Bank 2.0 by Brett King. If I would work in middle-management of a bank – any bank – then I would be scared now, because the book clearly shows that banks are changing to slow. Or they simply deny that the world around them is evolving faster and faster and still try to continue business as it used to be.

Banks still spend too much time trying to solve the wrong questions like how to design branches or think about channel distribution. What they need to understand is that a customized solution fitted to the needs the customer has right now is needed.

If bank management does not foster innovations quickly they will lose contact to the customer. Banking function will continue but the interface to the customers might in future be held by p2p payment providers, p2p lending services, telcos, aggregators or other non-banking “insurgents”.

The book is filled with ample examples and observations from the authors work experience in banking. Available at Amazon US, Amazon UK and Amazon DE.

Can P2P Lending Cross the Chasm?

This is a guest post by Tuomas Talola, CEO of coming Finnish P2P lending site Lainaaja and blogger at Cloudfunder.

Peer-to-peer lending has been growing rapidly since the inception in 2005. Lending amounts are small compared to traditional banks, but potential is immense. What would it take to really break into mainstream and become a potential option to large customer masses?

What Is the Chasm and Target Customers?

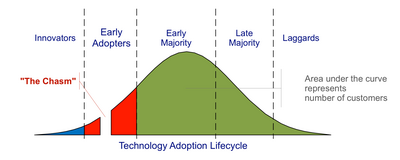

Geoffrey A. Moore wrote a highly appraised book called Crossing the Chasm in 1991. The book was about high-tech products marketing during the early stages and the difficulties of reaching majority of customers. In this post I’ll take a look what can be learned from the insights of the book and how to apply it to P2P lending.

Crossing the Chasm - Source:Wikpedia

According to Moore, there is a chasm between early adopters (technology enthusiasts and visionaries) and the early majority (pragmatists). Visionaries and pragmatists have very different expectations and this might be the reason why many technology products fail. Selling to the Early Adopters is easier, they are people who are always looking the new revolutionary technologies. As a group, they are easy to sell but very hard to please. Continue reading

The Innovation Process at Banks and why Neglecting P2P Lending Is Rational Behaviour For Bank Managers

I finished reading “Innovation and the Future Proof Bank” (available at Amazon.com, Amazon UK and Amazon.de). The author James Gardner publishes the Bankervision blog, which I am a long time reader of.

Gardner defines categories of incremental, revolutionary and breakthrough innovations and further differentiates between disruptive and sustaining innovation. The book discusses innovation theories and models. Many examples and case studies are given. While the topic is innovation in banks, I felt that much of it applies to innovation in large companies that are incumbents in other industries, too.

An innovation team will evolve through 5 capacity stages: Inventing, Championing, Managing, Futurecasting and Venturing.

Gardner propagates Futurecasting as a method to assess trends from a strategic perspective. By building scenarios the innovator creates descriptive images of possible future impact of trends in combination with the banks approach on it.

Gardner uses p2p lending as an example in many chapters. E.g. in chapter 4.4 he creates analysis possible scenarios in a futurecast on p2p lending.

If you want to understand why so many banks currently ignore p2p lending as a trend the book offers some interesting arguments. However the other example often cited, Paypal, shows what happens, if banks wait too long without reacting.

The book contains a wealth of information, thoughts and examples. Too much to cope with in this short review. I enjoyed reading it and highly recommend this book to anyone interest in fostering innovation, the innovation process and how banks could react to an ever faster changing business environment.

Buy your copy at Amazon.com, Amazon UK or Amazon.de.

Will P2P Lending be Disruptive?

In this – rather long – article I’ll examine if and why p2p lending has the potential to become disruptive and displace the “conventional” way banks hand out consumer loans.

A good read to get some opinions before continuing is reading these posts:

Zopa blog: ‘Why the banks need Zopa‘, which led to the post of

James Gardner, ‘Zopa’s strategy is to be immaterial to banks‘, which was contradicted by

Chris Skinner, ‘Why social finance and particulary Zopa matters‘, countered by

James Gardner: ‘Followup: Zopa isn’t disruptive‘

What is a disruptive innovation?

Wikipedia gives the definition that Clayton M. Christensen has coined in 1995:

Disruptive technology and disruptive innovation are terms used in business and technology literature to describe innovations that improves a product or service in ways that the market does not expect, typically by being lower priced or designed for a different set of consumers.

Disruptive innovations can be broadly classified into low-end and new-market disruptive innovations. A new-market disruptive innovation is often aimed at non-consumption (i.e., consumers who would not have used the products already on the market), whereas a lower-end disruptive innovation is aimed at mainstream customers for whom price is more important than quality.

Disruptive technologies are particularly threatening to the leaders of an existing market, because they are competition coming from an unexpected direction. …

In contrast to “disruptive innovation”, a “sustaining” innovation does not have an effect on existing markets. Sustaining innovations may be either discontinuous (i.e. “revolutionary”) or “continuous” (i.e. “evolutionary”). Revolutionary innovations are not always disruptive.

There are multiple examples in the Wikipedia article. I want to give two others here. The newspapers ignored or at least failed to adapt to what the internet meant to their classified ads business. As a result they were one of the first to loose offline business to totally new competitors (multiple ad sites, Ebay, Craigslist and others). The music industry fought a downhill battle not to let CDs be replaced by replaced by (initially pirated) digital distribution.

In both cases the shift to the internet was inevitable, because the new technology offered a better process with superior customer experience at lower cost. The question here is if, had the dominant players faster reacted to the new medium, would they have retained (a larger part of) their dominant market position?

Cutting out the middleman?

One of the argument of p2p lending companies is that they are “cutting out the middleman”, meaning the bank out of the lending process. The way p2p lending works today, that is an argument open to attack. Continue reading