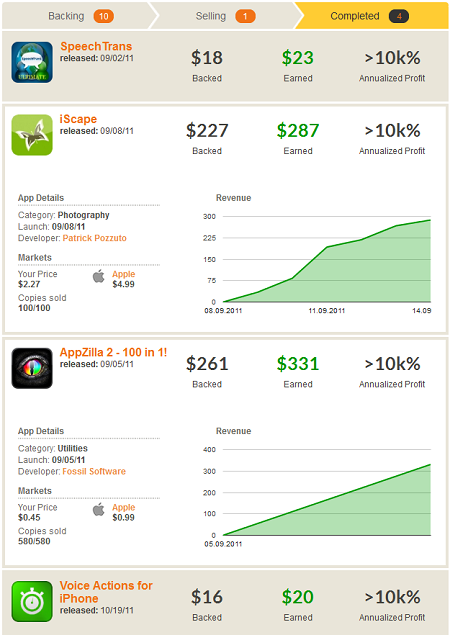

Appbackr is a marketplace where everyone can crowdinvest in IPhone apps and Android apps. The way it works is that investors prefund future sales of apps. The investor buys the copies at a lower wholesale prices and makes a profit later, when the copies actually sell in the app store. I described the concept in more detail in my article ‘Experimenting with Appbackr – Promising and Trecherous‘. In the 6 month that have passed since that review, my experience turned worse.

There are two major problems with Appbackr

There are two major problems with Appbackr

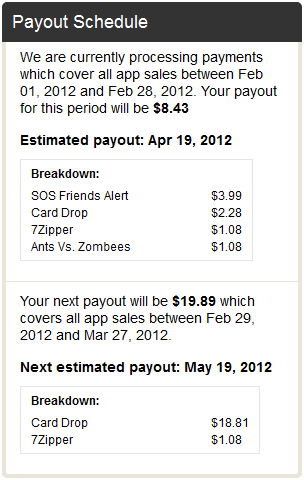

- Even when Apps achieved the sales of the copies the investors have pre- purchased, then it still frequently happens that the investors do not get payed on time. The information given in the dashboard (see screenshot) is useless, because the given dates lapse without payment or notice. On March 24th, the payout schedule said I would be paid 53 US$ for sales of the SOS Friends Alert App – the date passed, no payment arrived, no information was given.

Even worse the interface is no help at all in keeping track – it just pretends the payment arrived (for the SOS Friends Alert app the status is ‘Completed’ saying 57 US$ earned 12 US$ profit, while in reality I did not receive any payments for this app so far. The backrs are left to manually keep track on their own. - Appbackr has no means to enforce agreements with developers. Two concept apps I funded (Boogie Monster and Glass Ceiling) are 6 and 4 months past announced launch date – again no notice, nothing happening. Vy Nguyen, Manager Finance at Appbackr answered my complaints in January saying: ‘appbackr will try its best to enforce the contracts facilitated on its marketplace, but as the actual contract is between the Developer and Buyer, we can only negotiate on your behalf. Similar to other marketplaces, the main communications should be between the Developers and Buyers, with appbackr’s role being to facilitate that communication. Our goal in making payment details available in the myappbackr dashboard was to help backrs of multiple apps reconcile their monthly payments from appbackr, track down exactly which payments, if any, have been delayed, and contact the developer directly as necessary. We do have a late payment notification in place, but it is only set to go out to backrs when the payment is delayed for longer than 1 month.’. That sounds pretty weak to me.

Furthermore Appbackr is taking steps in the wrong direction. They removed (without explanation) the statistics tab which I predominately used to screen and select IPhone apps on the marketplace to invest in. Continue reading