As there is no Zopa loan statistics site, it is not possible to track the Zopa growth daily. You have to wait for the instances where Zopa announces milestones.

Today Zopa – in an announcement to celebrate it's third birthday, said:

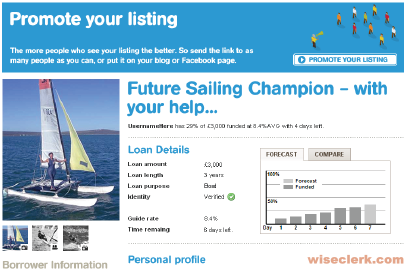

Since we launched in March 2005, £20 million in unsecured personal loans have been arranged at Zopa in the UK. More recently growth has been boosted by the global credit crunch which is driving unprecedented demand for P2P personal loans as banks become less competitive and tighten their lending criteria. All of this has also pushed up returns to Zopa lenders to an all time high.

At the current exchange rate that is approx. 40 million US$.