Giles Andrews on building Zopa, it’s brand and differentiating from banks.

Zopa

Zopa Member Video Competion – Explain P2P Lending

Zopa has run a member competition, asking members to explain how Zopa works for a borrower or a lender.

I watched several of the created videos. My favourite is the video below by Glenmation.

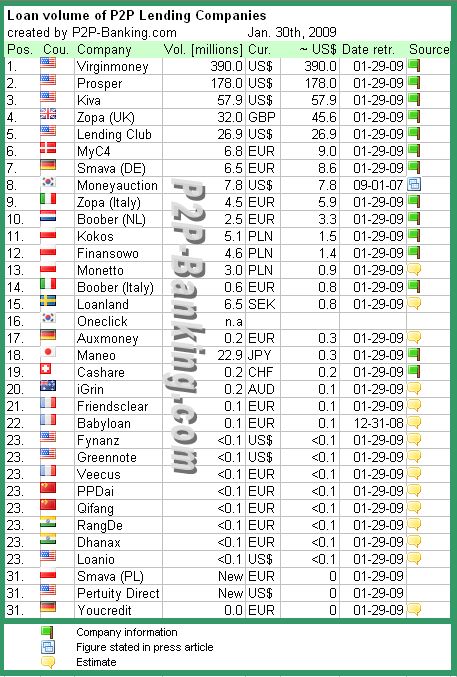

P2P lending companies by loan volume – Jan 09

P2P lending is spreading internationally. While the biggest loan volumes are generated in the US market, many p2p lending websites have been established in other international markets.

P2P-Banking.com has created the following overview table listing services that are in operation and ranked them by loan volume. The loan volumes are not directly comparable for they are cumulative since launch of each service and represent different time spans.

In total approx. 740 million US$ have been funded through peer to peer lending/social lending services so far worldwide.

This image may be reprinted on other internet sites, provided it is not altered or resized and the following text (including the direct link to this article) is given as source directly below the image:

Source: P2P-Banking.com

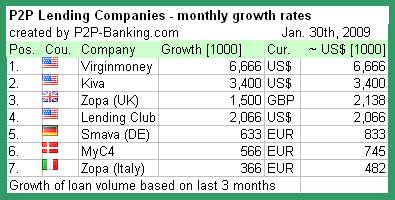

Since the previous version of this table especially Zopa (UK), Lending Club and Kiva thrived. With Prosper, Loanio and Fynanz halted, Lending Club profits from the situation.

This image may be reprinted under the same conditions as the first one.

P2P lending and the financial crisis

It has been said before – there might have been no better time to establish p2p lending. With the established system shaken and many consumers not getting loans as easily as before the market environment is good for peer-to-peer lending.

P2P lending gets good media attention. The Uncrunch.org initiative (in which Lending Club takes part) in the Change.org vote for new ideas finished in the Top 15.

On the demand site all p2p lending companies benefit from the crisis. On the supply site, in my opinion the effect is mostly positive too, but some lenders are hesitant to invest their money in a new, innovative model and rather seek a save haven for it.

P2P lending sites that have demonstrated low default rates over a longer time and therefore low risk fared best – especially at Zopa UK supply rose strongly lately.

Bonmot from Spanish Comunitae:

Pues no sabemos si la crisis es buena para Comunitae, pero de lo que no cabe duda es de que Comunitae es buena para la crisis.

Translates to: “Well, we do not know if the crisis is good for Comunitae, but what is certain is that Comunitae is good for the crisis.”

Prosper faces class action lawsuit; pays 1M US$ in fines to states

![]() The SEC cease and desist order against Prosper offered the legal arguments on a plate, now the first class action lawsuit filed against Prosper Marketplace Inc. uses the SEC filing as exhibit A to state it’s case. Regarding numbers and affected lenders the lawsuit by The Rosen Law Firm, New York, states

The SEC cease and desist order against Prosper offered the legal arguments on a plate, now the first class action lawsuit filed against Prosper Marketplace Inc. uses the SEC filing as exhibit A to state it’s case. Regarding numbers and affected lenders the lawsuit by The Rosen Law Firm, New York, states

“…As of October, 2008 approx. $21.7 million of loan notes purchased by Class Action members have become worthless because the borrowers did not pay the loans to Prosper. Additional loan notes will become worthless as more loans are charged off as uncollectible.

…

there are tens of thousands, and perhaps hundreds of thousands of, loan note purchasers that are class action members…”

Prosper is required to file a written response within 30 days. The first court date is set for May 1st, 2009.

On the same issue – selling unregistered securities – but in an otherwise unrelated case Prosper agreed to pay a 1 million US$ fine in a settlement to the states to avoid individual states suing against Prosper. More information on that in the press release of the North American Securities Administrators Association (NASAA).

This is somewhat surprising to me as Prosper did obtain licenses in over 25 states and conducted lending under those, before it switched to the model using the WebBank. (see ‘Prosper riding the state-by-state roller coaster‘ and ‘Prosper goes national with 36 percent max interest rate‘). The same states that granted the licenses now wanting to sue Prosper?

Last week Zopa’s CEO Giles Andrews commented that regulation issue were the reason why Zopa did not use it’s UK model when it entered the US market.

While Lending Club has completed SEC registration and therefore is in compliance with the rules of the SEC, it might still face some risks. An article of the Oregonian on the NASAA settlement states:

“Oregon regulators also are investigating 40billion.com, owned by Atlanta-based 3 Guys in a Garage, and is currently reviewing a registration request by Sunnyvale, Calif.-based Lending Club, Anselm said.”

P2P lending companies by loan volume

P2P lending is spreading internationally. While the biggest loan volumes are generated in the US market, many p2p lending websites have been established in other international markets.

The services can be divided in three categories:

- p2p lending marketplaces (e.g. Prosper, Zopa, Lending Club, Smava) – participants driven mainly by economic motives

- social lending services enabling micro financing (e.g. Kiva, MyC4) – participants driven mainly by social motives

- other concepts (e.g. Virginmoney which is special in the way that it does not do the matchmaking between borrowers and lenders, but supports the process between persons that already had offline relations- slogan “We manage loans between family and friends“)

Sites funding student loans can fall into any of these three categories or combine motivations.

P2P-Banking.com has created the following overview table listing services that are in operation and ranked them by loan volume. The loan volumes are not directly comparable for they are cumulative since launch of each service and represent different time spans.

Asked for a figure, a Microplace spokesman pointed out “…it is important to note that MicroPlace is not a P2P site. We are a platform that offers investments to the retail public.“. No loan volume was quoted, but he stated “investments purchased on our site have enabled over 26,000 microfinance loans.”

In total approx. 685 million US$ have been funded through peer to peer lending/social lending services so far worldwide.

This image may be reprinted on other internet sites, provided it is not altered or resized and the following text (including the direct link to this article) is given as source directly below the image:

Source: P2P-banking.com

If you are a representative of a p2p lending service and want your service to be included in the next update of this table, please send me an email with information about your company.