Wokai, which funded microloans in China, is closing down. According to the announcement Wokai did not succeed in finding a new CEO. Read earlier articles on Wokai’s launch in 2008.

Wokai

Wokai launch

Wokai.org launched today. Wokai allows contributers to aid small entrepreneurs in China through microfinance. A month ago I wrote a preview about Wokai.

Wokai.org launched today. Wokai allows contributers to aid small entrepreneurs in China through microfinance. A month ago I wrote a preview about Wokai.

Here is what founders Casey Wilson and Courtney McColgan wrote about launching:

Dear Friends,

We are delighted to report that Wokai.org is now live! Just two years ago, we were students in Beijing, dreaming about starting a microfinance organization.

Now, thanks to our advisors, chapters, designers, donors, families, field partners, friends, interns, investment committee, lawyers, pilot participants, programmers, volunteers and so many more, this idea has transformed into a dynamic international organization with an amazing website, to empower people in China to lift themselves from poverty.

We needed you and you were there, and for this we can’t thank you enough. Over the next two years, 44OO families from all across rural China will receive loans through Wokai. These loans will enable people to start and grow businesses in their communities. With the proceeds, they will send their children to school, and invest in their housing and health and brighter futures.

In the words of an entrepreneur we met in Ningxia province, “Microfinance allowed us to go from existing to living … existing is merely finding enough food to eat, but living is truly feeling the substance of life, our hearts, and minds.â€

Thank you so much!

Wokai preview – donate to enable microfinance

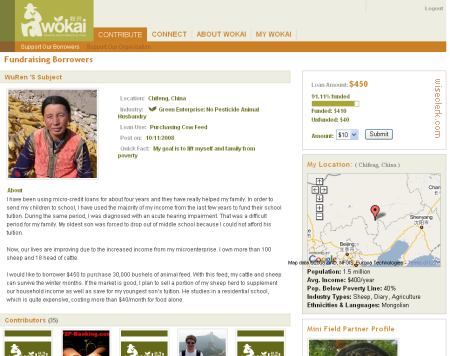

Non profit Wokai.org will allow contributers to donate to give microfinance loans to borrowers in China. Like Kiva and MyC4, Wokai partners with local MFIs which identify and screen potential microentrepreneur clients. Selected clients are then posted on the Wokai website through profiles that outline their business ventures and loan request. Contributers can select borrowers to fund and pay via Google Checkout, the money is then transferred to the MFI who disperse the capital to the microentrepreneurs. Field partners charge interest rates typically ranging from 8-20% to cover the high costs associated with providing loans, training, monitoring and support services to our borrowers. At the end of the loan-cycle the money is collected and re-issued by the MFI for new loans – so there is no payback to the contributers.

Non profit Wokai.org will allow contributers to donate to give microfinance loans to borrowers in China. Like Kiva and MyC4, Wokai partners with local MFIs which identify and screen potential microentrepreneur clients. Selected clients are then posted on the Wokai website through profiles that outline their business ventures and loan request. Contributers can select borrowers to fund and pay via Google Checkout, the money is then transferred to the MFI who disperse the capital to the microentrepreneurs. Field partners charge interest rates typically ranging from 8-20% to cover the high costs associated with providing loans, training, monitoring and support services to our borrowers. At the end of the loan-cycle the money is collected and re-issued by the MFI for new loans – so there is no payback to the contributers.

See this video for a good overview on Wokai.

The name “Wokai” means “I start” in Chinese.

Wokai has not launched yet, but I could participate in a pre-launch test drive. The platform has more social networking features then other platforms allowing for discussions and users asking questions to the MFIs/borrowers.

Wokai began in the fall of 2006 when Wokai co-founders Courtney McColgan and Casey Wilson met while studying advanced Chinese at Tsinghua University. The idea of Wokai gradually transformed into a plan of action and, with the help of a team of supporters, evolved into a startup nonprofit.

Wokai screenshot (pre-launch 10/20/08)