Kiva.org, which allows everybody to help funding microloans to entrepreneurs in developing countries, will achieve the milestone of 25 million US$ loan volumn within the next two days.

Kiva.org, which allows everybody to help funding microloans to entrepreneurs in developing countries, will achieve the milestone of 25 million US$ loan volumn within the next two days.

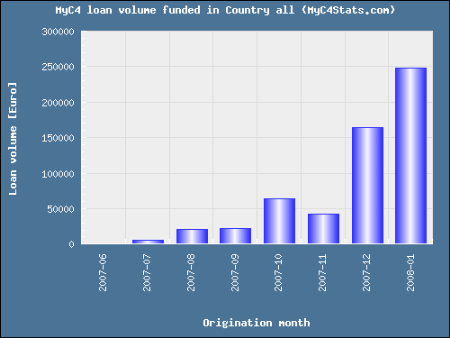

Launched 2005 the amazing growth curve can be seen on this Kiva stats page. The growth accelerated in 2007 driven by major media coverage. Up to now more then 260,000 individual lenders have funded more than 37,000 loans in 42 countries.

The current default rate is only 0.11%. While Kiva lenders do not receive interest, borrowers pay interest to the local Kiva Field partners (microfinance institutions).

Kiva, founded by Matt and Jessica Flannery (picture), is a non-profit which currently has 16 employees paid by optional 10% lenders can donate on top of loans. Apart from them many volunteers aid the Kiva cause.

A February 2006 survey showed that Kiva donors were evenly distributed between 25 and 60. Slightly over half were males, and 65% made more than $50,000 a year. But a $25 cap on individual donations is causing the demographics to spread; more older, younger, and less-well-off people are signing up. Kiva has about 15,000 to 20,000 visitors a day coming to the site now.

While lenders may withdraw funds via Paypal upon repayment, 90% decide to reinvest the money into new loans.

(Picture courtesy Kiva.org)

A year ago

A year ago