Not only the stock markets, but also the p2p lending sector is heavily impacted by the current coronavirus situation. In this article I’ll try to give an overview of what’s currently the situation.

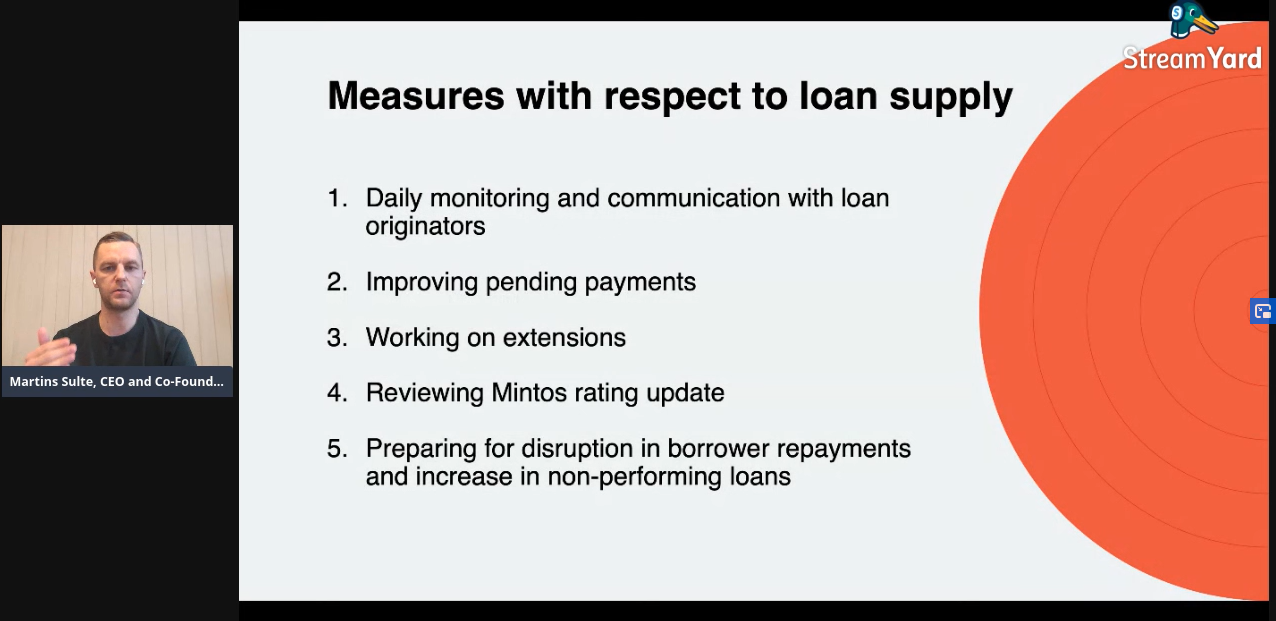

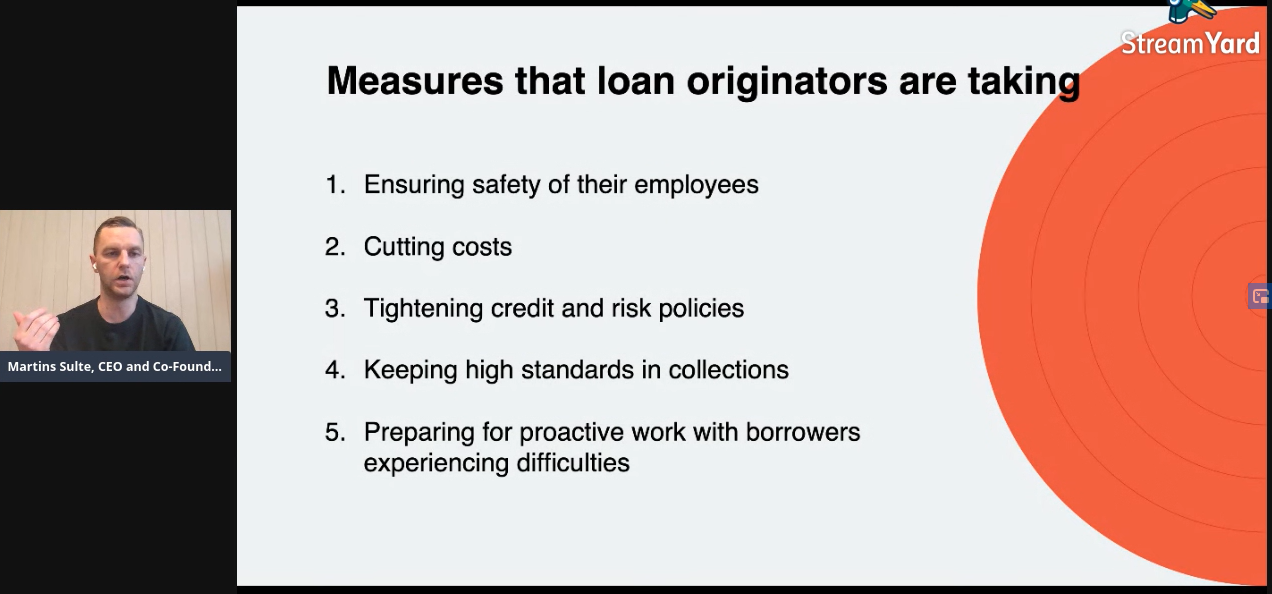

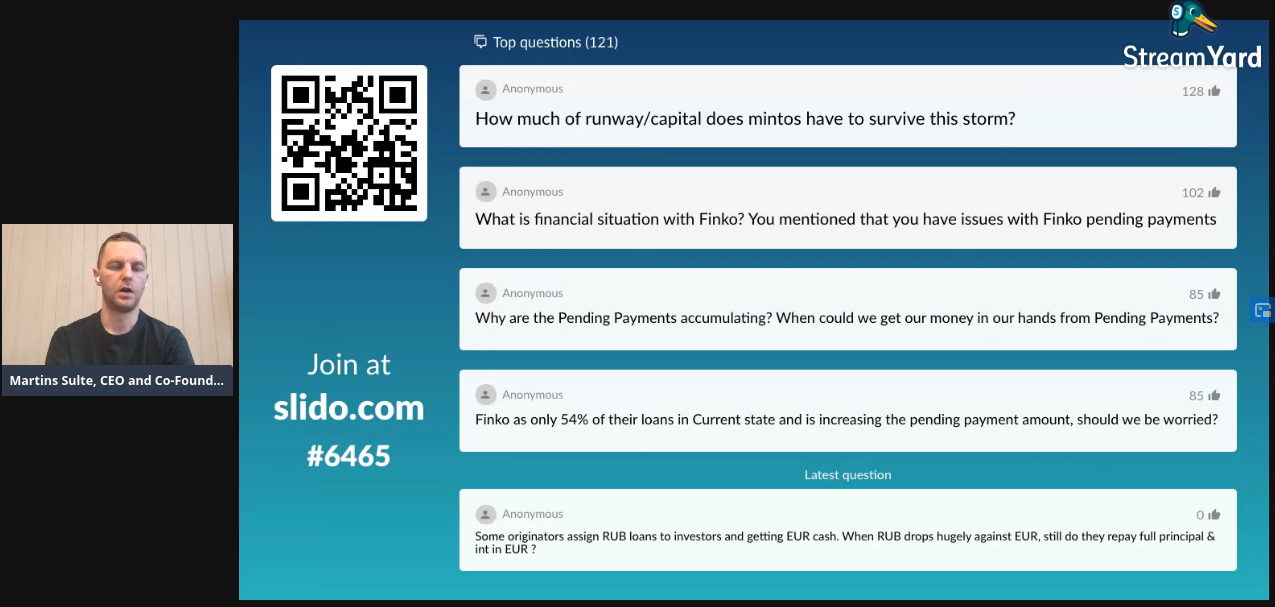

I watched the Mintos* live webinar on the current situation for the past 90 minutes. Some screenshots of the slides shown are at the end of this post. About 800-900 Mintos investors were watching and I think they highly appreciated the time and effort Mintos took to communicate. CEO Martins Sulte spent over 45 minutes answering questions. And there are a lot of questions investors have in times like these.

My take is, that the biggest trend we saw in p2p lending in the past week is the hunger for liquidity. Both on the investor side as on the loan originator side (on those marketplaces that work with loan originators).

105 German investors participated in a poll I ran over the past two days. Of these

- 11% say they increase their p2p lending investment, to buy and profit from loans that are available at (large) discounts on secondary markets

- 3% say they are increasing their p2p lending investment for other reasons

- 30% reinvest as usual

- 26% are withdrawing money as the want to reallocate it to the stock money

- 20% are withdrawing money as they think the risk is too high

So even in this small, non-representative poll nearly half the investors are saying they are withdrawing money.

How that impacts the p2p lending marketplaces can be observed exemplarily on Mintos* :

- loans on offer rose and still rise sharply both on the primary market (900,000 loans) and on the secondary market (1.7 million loans)

- as many investors scramble to exit, this is only possible for them if they offer extreme discounts on the secondary market (the highest discount for current loans on offer is currently -20.1%, resulting in YTMs of 30% and higher for the buyer)

- Congruously the Invest&Access product of Mintos got very illiquid. Withdrawals are very delayed and partial.

- The volume of newly financed loans on the primary market has tanked

- Interest rates offered on the primary market rise (current maximum 21.1%, Mintos even had to adapt the range the slider in the UI could show), together with cashbacks on offer and there are also measures to tie in capital longer.

In the current situation most investors in the discussion seem to assume that elevated risks come by the potential inability of borrowers to repay the loans, due to economic downturn. That may well be, but would impact the yield mid- or long-term (weeks or months).

In my view there are two very short-term risks that many investors overlook:

- The currency risks for many Mintos loan originators: Many have issued loans to borrowers in weak currencies like RUB, KZT or GEL, but need to pay Mintos investors in EUR. The sharp change in exchange rates could pose major problems for the liquidity of the loan originators.

- Many loan originators were growing fast and required constant cashflow to finance their lending and operations as they were not yet profitable. Some were even leveraged. External refinancing might be very hard to impossible to obtain in current market conditions (see for example investors reaction on trading of the Mogo Finance bond). And as said the volume financed on Mintos primary market is slowing. Again this could pose liquidity problems to originators.

An industry insider I spoke to said he would expect at least 2-3 loan originators to fail short term. CEO Sulte acknowledged in answering the questions on the webinar that “not all” could be expected to make it in the current situation, pointing to the large number of loan originators active on Mintos.

The two cited short term problems are especially a concern on those p2p lending market places that operate with loan originators. Of course the investors are also withdrawing increased amounts on “classic” p2p lending marketplaces like Assetz Capital, Bondora, Ratesetter and Zopa, but this poses no short-term risks to the stability of these marketplaces in my view.

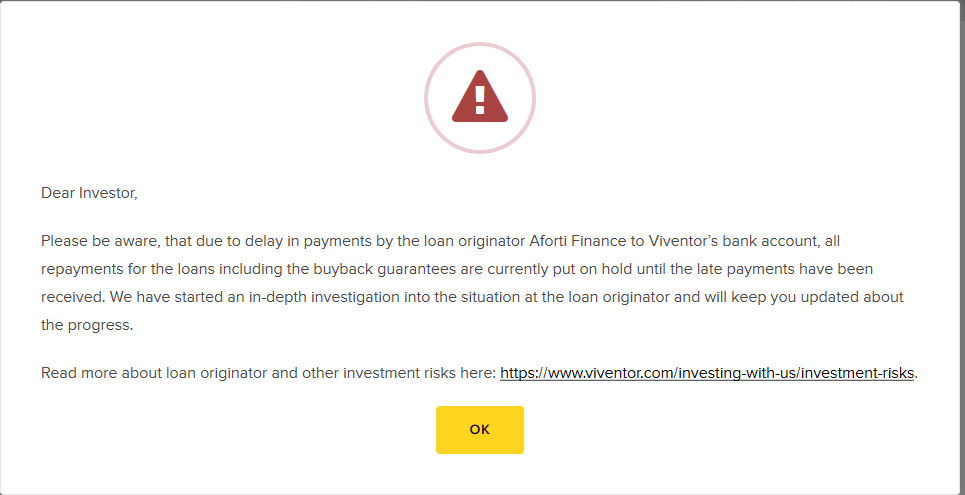

Other investors share this opinion, pointing to the different levels of discounts on different secondary market (for current loans: Mintos* -20.1%, Viventor* -6%, Iuvo* -5.7%, Finbee* -5%, Savy* -5%, Neofinance* -5%, Bondora* -3%)

The platforms have reacted by four ways: communication, temporarily suspending borrower repayment requirement (especially SME loans, e.g. Linked Finance, October, Neofinance* ), and stepping up marketing and increasing interest rates:

- Bondora* runs a raffle for investors which can win a BMW, minimum investment 1 EUR required.

- Lendermarket* has increased interest rates from 12 to 14% and offers 2% cashback for any investment increase

- Twino* has increased interest rates to 14%

- Swaper* increased interest rates to 14% (16% for VIP customers, 5K minimum required)

- Robocash* increased interest rates to 14%

- Estateguru* interest rates have increased slightly

Below are screenshots of some of the slides shown in the Mintos webinar today: