With the majority of my p2p lending investments I hold the loans I invest in to maturity. Observing the market over the years I have observed patterns on the secondary markets that can be used to actively trade loan parts with the hope to increase achieved yields and I sometimes tried these.

I never specialized in this, so I never used fully automated bots, but did in some cases use some automation (Selenium or third party browser plug-ins). This article is not meant to be a how-to guide giving concrete instructions, that readers could just follow, but rather a list of things to consider and look for, should investors want to start testing strategies on the secondary markets themselves.

This article does not name or link any specific platforms, as I believe the same patterns and chances could evolve on new p2p lending marketplaces, and can be used there, you just need to look for them. Nevertheless all of the examples are real examples observed at the past by me.

Required market environment

The marketplace needs to have a secondary market that allows investors to buy and sell loans parts at premiums and discounts. Ideally without charging any transaction fees, but some strategies can absorb moderate fees. Furthermore it is advantageous if specific individual loans can be bought or sold rather than just random from the market or the investor’s portfolio.

The effect of premiums on yield

One central piece to understanding why trading (or flipping) strategies can be highly attractive is the effect of even small premiums pocketed on the portfolio yield. Take an investor that invests into a 100 (whatever currency) loan part and sells that part for 100.40 after holding it for 5 days. That is only a 0.4% premium, but the annualized yield is 33.8%. There is a big IF to that annualized yield number – it is only meaningful if the investor can seamlessly reinvest all his money in similar trades without any interruptions. So cash drag (effects of not invested cash) are very important.

The psychology

One would think that investors would always use rationale when investing into loans. However, I feel that a significant number of investors show one of these behaviors and the question an investor with a trading strategy should pose himself, is whether he can use that to his own advantage:

- Scarcity

If there is little left / available of a loan, investors fear of missing out - Unusual collector’s passion

P2P Lending investors are told everywhere that diversification is vital (I tell them too). But especially on platforms with few loans, it seems that some investors strive to have a COMPLETE collection of loans in their portfolio and in pursuing that aim pay higher than average prices to acquire loans they ‘miss’ in their portfolio - Herd behavior

Happens for example when investor (over)react scared by a news bit on a loan. In p2p lending that mostly effects the selling side rather than buying - Investors overvalue the realization of small gains

Many investors are very happy to sell at small premiums –it just gives them a sense a positive achievement, not realizing that the market conditions for this specific loan part would have allowed selling at a higher premium - Blended by high numbers

High nominal interest rates, and high YTM (yield to maturity) figures displayed by the platform overly attract investors

Two main strategy approaches

Investors can

A) Invest on the primary market and then sell the loan later on the secondary market

or

B) Buy loan parts on the secondary market which they deem underpriced and then sell at a higher price. Be it buying at discount and selling at a lower discount, or already buying at premium and selling at an even higher premium.

While yields achievable in strategy B might be higher in percentage, this strategy is much harder to execute, as the competition will most likely use automated bots. Also the total market size for attractive loans will limit the scalability. I never tried strategy B on a larger scale myself. For example I was never found of buying already defaulted loans at a huge discount. Nevertheless I know of some investors that fare quite well buying defaulted loans and selling them at a lower discount, pocketing any payments and recovery that occur while they hold them as an additional bonus.

Following I will concentrate on strategy A) Invest on the primary market and then sell the loan later on the secondary market – as I have used this myself on several platforms over time.

One important point, is that market conditions change, usually good opportunities will stop working after a few months or weeks either because too many investors try to use them, or more general  the demand/supply ratio changes or the marketplace itself changes the rules how the market functions.

- First an investor will want to look how loan information is presented on the primary and secondary market. Especially what sorting and filtering mechanisms there are on the secondary market. It is highly desirable that the loans the investor wants to sell later, will be listed on top of the list of all loans on the secondary market with either the defaulted sorting, or with an obvious choice of filtering (e.g. sort by descending YTM)

- Understand the allocation mechanism on the primary market. How does the autoinvest feature work exactly? If there is no autoinvest, then are there chances to heighten the probability of investing in attractive new loans? Either through automation, or just because new loans are released at specific times?

- When is interest paid? Does it accrue for each of the day held, or does the investor holding the loan at the date of the interest payment gets full interest credited. This is important, because if in the example at the start of the article the investor not only makes a 0.40 capital gain but also collects interest for the 5 days he held the part, it will have a huge impact on yield

- Usually for this strategy longer duration loans are more attractive. This is simply because they will allow higher premiums without making the YTM value unattractive for the potential buyer

- Usually smaller loans are more attractive. As there will be less supply it will be more liquid on the secondary market and more sought (see collector’s passion). No rule without exception. On one platform the biggest loans were the most attractive to be invested in on the primary market for the trading strategy. Why? Because this platform used dutch autions to set the interest rate and the bigger the loan the less the interest rate would go down. And of course loans with higher interest rates could later be sold at higher premiums

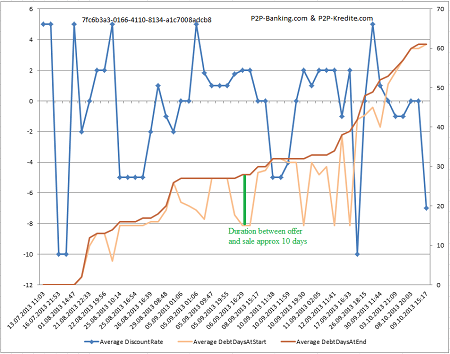

- Usually the time span a trading investor wants to hold on to a loan part, will be as short as possible (days). However there might be patterns observed where it could be desirable to hold for longer time spans. For example if on a marketplace there are repeated alternations between lots of new loans and time without any new loan, it might make sense to hold the loan parts till there are no loans available on the primary market and only then offer them on the secondary market

- Strategies that allow to hold parts only at a time when the status of a loan cannot change can be attractive. For example there was a time when it was possible to invest into very high interest, extremely high risk loans on the primary market of a specific platform and sell them at a premium BEFORE the first loan payment was due. Most parts sold within days, and the ones that did not sell at a premium, could be sold at par shortly before the date of the first loan repayment (this strategy worked due to a combination of factors: sorting by YTM, blended by high numbers (see above), and platform design – instant selling of loans offered at PAR).

So why is all this possible. Mostly due to market inefficiencies and lack of transparency and experience. The marketplaces are young, selecting and evaluating loan parts on the secondary market is not an easy task. And on many marketplaces investor demand outstrips loan supply . Usually the yields achievable with trading strategies go down as marketplaces grow (but the volume that can be used in these strategies might grow over time).

The most prominent question is, if an investor can scale strategies he uses to a level that is worth the time invested and the inherent risks.

One advantage of

One advantage of