I started lending on Kiva.org 6 month ago. At Kiva everone can lend to small entrepreneurs in developing countries. At first I funded only 4 loans each with the minimum amount of 25 US$. Lenders do not earn interest on Kiva loans. Usually loans are for terms between 6 and 18 months. When I started I did not really expect all my loans to be repaid. But I wanted to support it, since I thought it was an innovative approach to a good cause. Meanwhile I changed my mind. One of my loans was already repaid in full recently and the others are paid on time. This led me to the decision to fund more loans on Kiva microfinance.

social lending

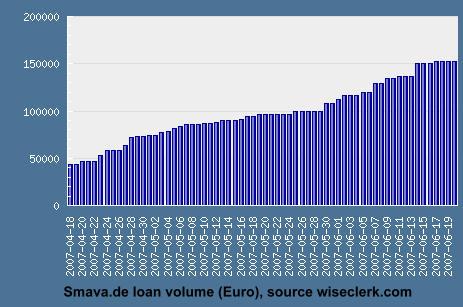

Smava with no lates but slow growth

It's been roughly 3 month since the launch of German p2p lending service Smava.de and I want to do a short résumé on the results so far. One huge achievement is that all borrowers made their first payment on time – no lates so far. While it certainly is to early for conclusions, since only one payment cycle (first repayment in the beginning of June) has taken place, the outlook for Smava concerning low default rates is very good. Looks like Smava will be much nearer to Zopa then to Prosper in this point.

Smava has a very restrictive approach for admitting borrowers and loan applications. Not only does Smava verify identity, credit score and income documentation – it goes one step further and calculates if the borrower's financial situation is well enough to allow repayment of the desired loan sum. Only after completions of all these checks is the borrower allowed to publish is loan listing.

As a result the majority of borrowers (about 70 to 80 percent of all applicants) are declined from using Smava. While this strict validation is good for quality it does slow the growth of Smava.

Since the launch Smava enjoyed large and positive press coverage (newspapers, magazines, TV, internet). Despite the good PR, Smava funded only about 50 loans with a loan volume of about 150000 Euro in the first 3 month. There are enough lenders – Smava lacks borrowers. The low volume contrasts sharply from the figures Boober.nl achieved in the Dutch market (see previous post)

The majority of loan listings that were published did get funded. Smava has two interesting functions that are unique and not used on other p2p lending services:

- Borrowers can close the loan early provided it is more than 50% funded

At Smava, listings usually run 14 days. However a borrower can decide to take the funded amount (provided it is at least 50% of the total amount) and close the listing early. Several borrowers have used this function. A borrower can open another listing (provided he has not reached his personal maximum repayment allowance) instantly for the remainder (he can even choose a different interest rate for subsequent listings) - Borrowers can increase the offered interest rates on their open listing. If this happens the change is applied for all bids on this listing. This is a widely used feature. Many borrowers start with (ridciously) low rates. After a few days they realise their loan will not fund and they increase their interest rate – often in several steps

Smava has yet to find a good concept for groups. While there are groups their purpose is yet to be defined. Consequently the majority of borrowers did not bother to join a group.

I will continue post updates on the development of Smava here on P2P-Banking.com.

Social lending voted as the future of finance by the banking industry

Astonishing. Traditional bankers awarded Zopa the Banker Technology Award for Best Internet Project. Now, should we expect to see banks setting up project teams to launch their own social lending services? Or how will banks leap forward to be a part of the "future of finance"?

Source: FirstRung via TheBankWatch

Download Zopa default rate figures

British Zopa.com just published a spreadsheet with Zopa default rate figures. The weighted average of overall defaults is a tiny 0.1% ! Even more interesting all defaulted cases happened in 2005 or the first half of 2006.

Another interesting read is this case study on Zopa (published late 2006).

P2P Lending in Denmark offered by Fairrates.dk

Today I received an email from Arkadiusz Hadjuk of Fairrates.dk informing me, that his company started to offer p2p lending in Denmark. Most of the following information was supplied by him.

At Fairrates.dk:

- There are individual listings, both lending and borrowing

- There are no groups

- There is auction bidding down interest rates, both lending and borrowing

- In case of non-payment (for over 1 month) a lender is assisted with

a collection procedure - Minimum loan is 1000 DKK (approx. 135 Euro; approx $100)

- There is no maximum a lender can lend

- Maximum per loan is 50.000 DKK (approx. 6700 Euro; approx. $5100)

- Borrower can request minimum 1000 DKK

- Borrower can request maximum 50000 DKK until his income information

is verified – then the limit is lifted up - Minimum bid is 1000 DKK

- Only people over 18 years old with Danish CPR number and Danish bank

account can lend/borrow - No interest on unlend deposits

- Simple fee structure (borrower pays 1% of loan amount)

- Risk assessment is based on information and documentation provided

by borrowers.

I did technorati and Google searches for additional information. Since I don't speak Danish I could not find much additional information, only a profile of Arkadiusz Hadjuk and a CV of Robert Pawel Bialek (CEO).

Judging by forum activity at Fairrates.dk there is not much traffic yet.

![]()

Smava.de – the business case

Following the previous post on Smava.de here is a look on the business case of the smava startup and the chances for profit.

Currently Smava earns only when a loan funds. Smava charges the borrower a 1% fee of the loan amount. Only other fee are 10 Euros per dunning letter (which is covers the costs of the dunning letters but is otherwise neglectable).

Possible reason for the low fee (in comparison to Prosper and Zopa) are the low interest rates in Germany which might not allow for higher fees. Loans range from 500 to 10.000 Euro. Assuming an average loan amount of 3000 Euro Smava would earn 30 Euro.

Looking at transaction costs, we have:

- Identity check of borrowers and lenders via PostIdent (approx 5 Euros each)

- Creditgrade check (estimate 1 Euro)

- Validation of documentation for borrowers (estimate 5 Euro, based on typical call center cost, actual inhouse costs could be higher or lower)

- Validation of documentation for lenders (estimate 3 Euro, based on typical call center cost, actual inhouse costs could be higher or lower)

Even looking at this transaction costs without taking into regard marketing, overhead, legal and setup costs it seems that Smava faces quite a challenge and will have to focus on automation of processes.

A critical factor in my view is the fact, that costs for lender and borrower identification are incurred before anything happens and regardless if borrowers and lenders become active. Learnings form Prosper.com are that 103.000 listings created only 9000 loans, which means 90% of listings gounfunded. Of the 230000 Prosper.com members about 23000 have the role lender. Only 12000 of these were active in the last 30 days.

Prosper does some verification only when a listing will fund.

An interesting factor of Smava is the high minimum fee of 500 Euro (which Colin Henderson was quick to point out).

In a call founder Eckart Vierkant reasoned that a lower minimum was not necessary due to the automatic risk spreading through the Anleger-Pool (see previous post).

The 500 Euro minimum has 2 interesting effects:

- since the lowest unit is 500 Euro, deposits from 0 to 499 Euro will accumulate on the lender accounts. Lenders collect non interest on these unloaned amount. Assuming an average 'parked' amount is 200 Euro and that the bank partner of Smava invests this money earning a return of 5 % that would mean 10 Euro profit per year and active lender

- the 500 Euro minimum keeps small lenders out (at least in theory since anybody can register for free)

It will be interesting to see how Smava deals with that challenge in future.