This is part II of a guest post by British investor ‘GSV3Miac’. Read part I first.

Most of my concerns about P2P lending revolve around its relative immaturity. Even ZOPA, the oldest in the UK, has only been around 10 year or so, and have changed ‘just about everything’ at least twice. Funding Circle (“FC”)have 3-4 years history, but there have been no two years where the business has actually been stable (maximum loan sizes, loan terms, Institutional participation, etc. have all changed pretty much continually over the period I’ve been investing). How well the companies, and their borrowers, would survive a real recession, can only be guessed at.

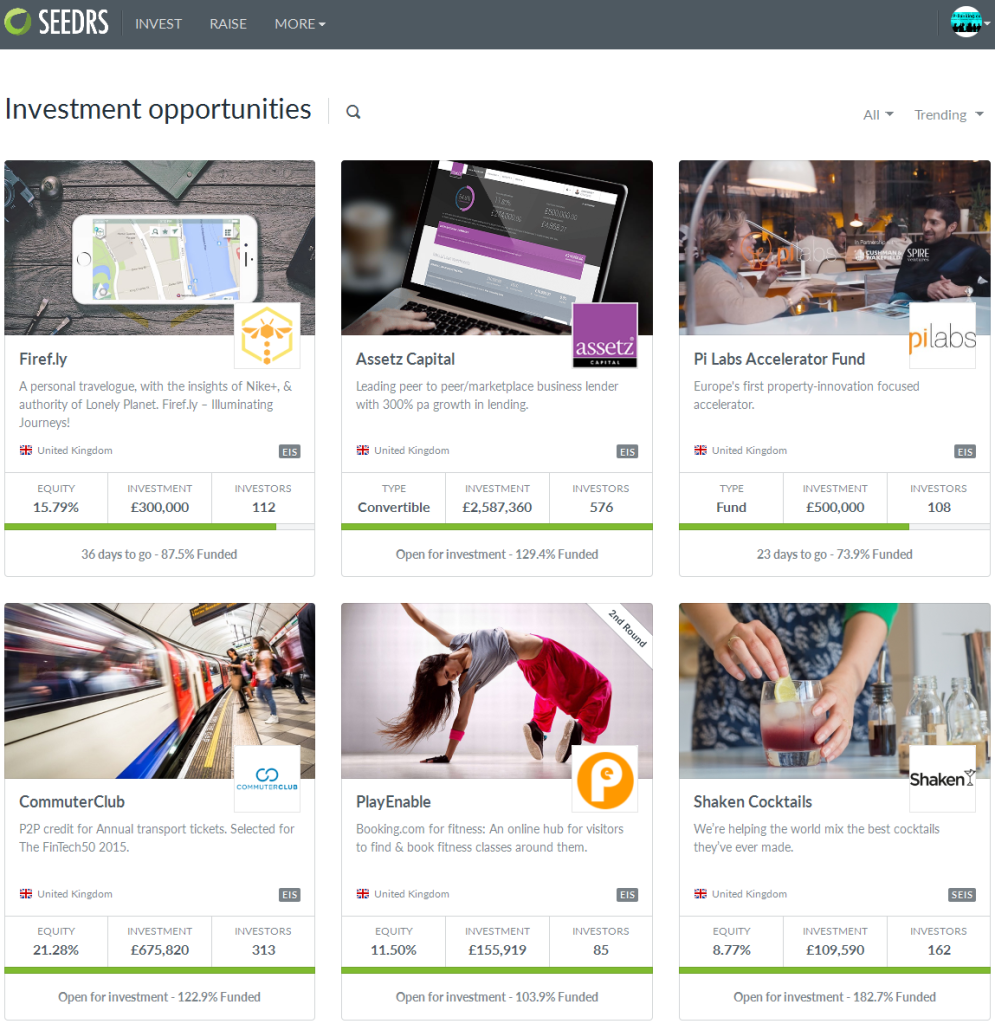

What do I actually invest in? Well practically anything if the rate looks good. My ‘core holding’ is in RS, but there is nearly as much spread across the P2B platforms. For extra P2P related risk (and maybe reward) I also signed up to invest in the Assetz and Commuter Club capital raises (via SEEDRS). With EIS investments some of the money at risk is renated tax, which you had a 100% certainty of losing to the government anyway.

I do not plan to hold most of my investments (particularly in FC) for the full 5 years. After a few months the financial data is well out of date (much of it is already out of date when the loan is approved!) and unless you want to spend time checking how the company is doing, it is easier to sell the loans on and start anew.

Similarly if rates start to move dramatically, it’s time to ‘flip’ or ‘churn’ .. selling a 7% loan part when rates move to 9% is possible, but might sting a bit. Selling a 7% loan part when rates have moved to 14% is going to hurt a lot, or might be completely impossible. If rates move the other way, selling a 7% loan part when average rates are 6% is not only easy, it may be profitable (assuming the platform allows marking up). You might wind up with un-invested funds, but as someone succinctly put it on the P2P forum, ‘un-invested is a lot less painful than lost’.

The future looks equally interesting .. we are promised P2P investments within an ISA (do NOT hold your breath, this seems to be moving at a glacial pace so far), which could result in a ‘wall of money’ arriving on the scene. We are promised P2P losses to be tax deductible (against income, rather than capital gains), which has an impact on the worth of a protection fund. We will inevitably see some new entrants appear as the P2P area grows and become more attractive (Hargreaves Lansdown, a very large fund management player, has already indicated they might get involved, I believe). We will equally inevitably see some more of the current players merge or vanish, and many of the loans default.

As I may have mentioned a couple of times, nothing has been very stable so far .. most of the platforms are still ‘feeling their way’ with immature software (this is polite-speak for ‘bugs’), and business models/systems which are still evolving. The basic P2P premise of connecting people with money with people who want it, without too much activity in the middle, does not appear to scale too well when the number of each side get big (a million people bidding to fund a thousand loans each day is not something to contemplate lightly). Platforms need to grow to survive and they need to grow in balance – if they double the number of lenders, they need twice as many willing borrowers, and vice versa .. Asymmetrical growth just annoys whoever is on the surplus side, distorts the rates, and results in no growth at all – you need both a lender and a borrower to have any business. It is obvious, but very hard to manage. Continue reading →

![]() ING Bank partners with equity crowdfunding service Seedrs and reward based crowdfunding platform Kisskissbankbank to tackle the markets in Belgium and Luxembourg. Through this partnership, ambitious businesses will have a fast-track service for equity crowdfunding on Seedrs. The partnership will also raise the awareness of equity crowdfunding in the wider business community.

ING Bank partners with equity crowdfunding service Seedrs and reward based crowdfunding platform Kisskissbankbank to tackle the markets in Belgium and Luxembourg. Through this partnership, ambitious businesses will have a fast-track service for equity crowdfunding on Seedrs. The partnership will also raise the awareness of equity crowdfunding in the wider business community.