![]() Exactly 4 months ago I deposited money at Saving Stream and started lending. Saving Stream is a UK p2p lending marketplace operated by Lendy Ltd. that facilitates bridging loans, that is short-term loans for typically less than a year, secured by commercial property. Investors can see valuation documents for each listed loan. Saving Stream operates since January 2013 and with 25 million GBP loan volume originated since launch it is one of the mid-sized p2p lending sites in the UK.

Exactly 4 months ago I deposited money at Saving Stream and started lending. Saving Stream is a UK p2p lending marketplace operated by Lendy Ltd. that facilitates bridging loans, that is short-term loans for typically less than a year, secured by commercial property. Investors can see valuation documents for each listed loan. Saving Stream operates since January 2013 and with 25 million GBP loan volume originated since launch it is one of the mid-sized p2p lending sites in the UK.

Saving Stream is open to international investors; you don’t have to be a UK resident. Investors are paid 12% interest, accumulating starting at the day they bid on a loan. The interest is paid monthly (starting with drawdown); the principal amount is repaid at the end of the loan term. Saving Stream does not charge investors any fees.

Since I don’t have a UK bank account I used Transferwise when depositing money in order to save on bank fees. For larger amounts (approx. >1,000 EUR) it might be even more efficient to use Currencyfair so check that too.

Some of the smaller loans (e.g. 200,000 GBP) fill within hours of coming onto the marketplace. I do like that I can deposit money (Cashier>Deposit>Step 1) and bid with this money without having to actually wait for the money to arrive (which usually took 1-3 days with Transferwise).

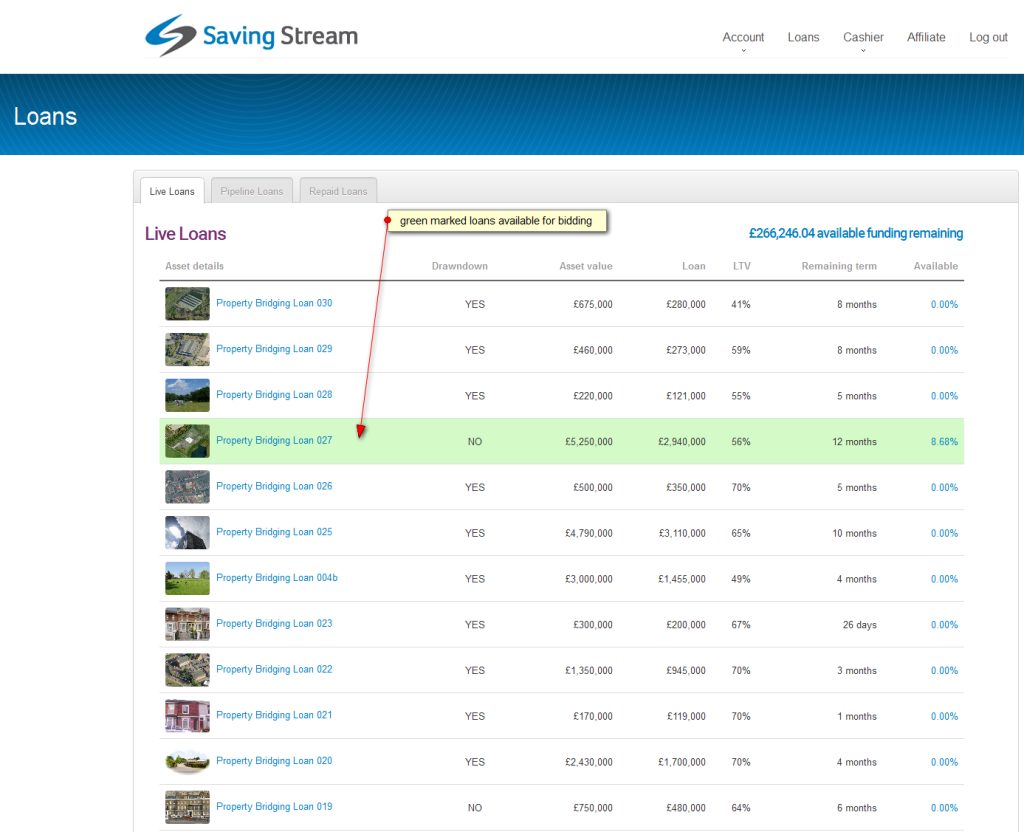

Screenshot of Saving Stream loans listed

The Saving Stream p2p lending marketplace is very simplistic and easy to handle. There is a view of the live loans. Only the green ones have amounts open for bidding. The secondary market does not have a seperate view but is integrated into the live loans view. There are no fees and markups/discounts when buying and selling on the secondary market. So when a loan part is listed for sale, the amount is just added to the available amount for this loan. Continue reading