Guest article by Peter Petrovics, co-founder of Noba

First of all, let me thank Wiseclerk for the opportunity to post this guest piece on his blog.

I am excited to announce the January launch of the first Hungarian p2p lending service:

Also, as a regular reader of Wiseclerk’s posts, I am hoping to be able to draw on the wisdom of his readership in a particular legal problem we have run into while setting up our initiative.

My name is Peter Petrovics, and I have some modest experience working with online communities, while Charlie Szabo, my partner in Noba, is an accomplished former banker. We both have been deeply interested in the entire concept of p2p lending since we first heard of it. We started our project in our native Hungary last summer .

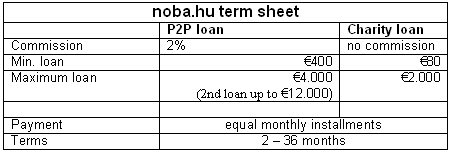

We opted on a dual system: one is dedicated to the P2P lending model, where we hope to see micro projects raising money through friends, family, social network and eventually anyone interested enough in the given venture.

The other section is dedicated to channel loans to the high number of people living in deep and prolonged poverty around the country. We call these “charity†loans, and this part of noba.hu is similar to Kiva.org with the difference that it is limited to Hungary. Applicants for these loans are assisted by a mentor, who is typically an NGO or social worker, in managing their loan applications and projects.

We hope, that noba.hu will not only allow a flow of funds, but will eventually create synergies between lenders and borrowers in terms of know-how, contacts, partnerships.

Both types of loans are intended to allow lenders to make real profit, hoping on the long run to attract a larger community of private and institutional lenders.

This is however the part where we run into a very tenacious obstacle: under Hungarian law, lending (on interest) is a privilege strictly reserved to banks – private individuals are allowed to give a single loan per year, the second loan would be considered as providing commercial banking services without legal authorization. This means that the people who are willing to participate in a P2P loan project as lenders are only allowed to lend the money with a 0% interest, unless these natural persons are founding registered financial institutions.

I would be grateful for any input regarding this problem. We have made some research, and found that similar regulatory restrictions have been overcome by other initiatives in the UK, the Netherlands and Germany, but I would be interested to hear any new ideas from you.

Does anybody have any idea if the whole issue could not be approached from an EU regulatory side? Could prove to be an easier path, than pursuing separate battles against the local legal systems.

Thank you for your attention, and looking forward to your comments.

Peter

Asked to comment on the recent developments,

Asked to comment on the recent developments,