Ratesetter yesterday introduced a new sellout function that allows lenders to exit their contracts early.

Ratesetter yesterday introduced a new sellout function that allows lenders to exit their contracts early.

How does it work?

Lenders request the amount they wish to have returned to their Ratesetter Holding Account. Ratesetter works out whether this is possible and calculates the cost of doing so. The Lender confirms their wish to go ahead and then Ratesetter processes all the necessary assignments. The Borrower will remain entirely unaffected by this.

What are the costs involved in exiting early?

Ratesetter charges a fee made up of three elements:

•   The exiting Lender’s interest is reduced to the level they would have received based on the length of time they have ended up lending for. This is based on the Market Rate and products available on the day they originally lent. So, for example, if the lender had lent into the 5 Year Income market nine months ago and choose to exit now, the lender would only receive the interest the lender would have got from lending in the Monthly Access market for that period of time; if the lender had lent 13 months ago the lender would only receive what the lender would have got from lending in the 1 Year Bond market; if the lender had lent 37 months ago, the lender would only receive what the lender would have got from lending in the 3 Year Income market. With regard to an early exit from the Monthly Access market, the cost is that the lender forgoes all the interest for that month. The purpose of this charge is to ensure there is no incentive to lend for five years if the intention is only to lend for two years;

•   A fixed charge for administering the exit which is 0.25% of the oustanding contract amount (currently waived for existing Lenders for a period of one month)

•   An “Assignment Fee†to ensure that if the interest rate in the relevant Ratesetter market has gone up the exiting Lender can still exit. This will calculate and deduct from the exiting Lender the amount required to be added to the interest rate to ensure the incoming Lender gets what they expect. In circumstances where interest rates are the same or lower there will be no Assignment Fee.

Can the lender choose which individual contracts I sell?

No, the contracts will be automatically selected, starting with the most recent contracts.

Where does the incoming Lender come from?

From the same market as the exiting Lender.

Are there any circumstance when the lender would be unable to exit early?

It is Ratesetter’s intention that the lender will be able to exit all contracts at any time. However, it may not always be possible to do so:

•   If there are insufficient funds in the relevant market. This will be determined by a “buffer†of available funds (of which the amount in each market will be periodically reviewed) designed to keep the smooth running of the Ratesetter markets.

•   If an individual contract is less than £10, the current minimum reinvesment size.

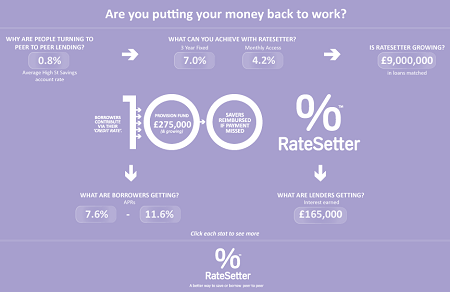

Offering a secondary market (regardless in which form) is becoming a basic functionality that lenders expect as a core feature from a p2p lending service. The 3 major British services Zopa, Ratesetter, Fundingcircle as well as American Lending Club and Prosper now offer the ability to sell loans. In other countries regulation makes the setup of a secondary market difficult.