The Wikipedia article on Prosper was for months subject to heated editing and deleting. Not much diplomacy. Some edits wanted to get as much criticism in as possible while others removed as much negative tone as possible to get it more neutral. Currently the article is locked.

See the discussion on what should be stated in the article in the future when it will be unlocked again.

prosper.com

Prosper starts blog

With several posts by CEO Chris Larsen Prosper.com starts blogging.

Welcome to the new Prosper Blog.

We’ll be using this blog to create a place to find up-to-the-minute news on the latest Prosper enhancements, enlightening and thoughtful Personal Finance opinions, touching Prosper Member Stories, and more. Your contributions are welcome. Please feel free to submit comments to any of the blog posts or send new articles and ideas to us at blog @ prosper.com (please remove spaces before using this email address) or submit a guest post.

We’ll be adding in posts regularly, so please stop back in again soon.

Warmly,

Prosper

The blog has been in preparation for some time. I believe we can look forward to some interesting articles by Prosper staff, borrowers, lenders and other guest writers.

Changes at Prosper

Prosper.com applied several changes as described in this announcement. Some of the changes were expected as plans had been known, some were surprises.

Portfolio plans

Portfolio plans allow the lender to automatically build a conservative, balanced, moderate or agressive portfolio. That means the lender no longer picks individual loans to bid on but chooses to invest in a plan. The feature is implemented based on Prosper's standing orders. The difference is that it uses standing orders predefined by Prosper, not by the lender. Prosper shows "estimated returns" for each portfolio – currently ranging from 8.37 to 11.06 percent.

Comment: Lendingclub introduced this concept earlier on. Lenders are currently examining and debating on which rationale Prosper did build the standing orders behind the portfolios.

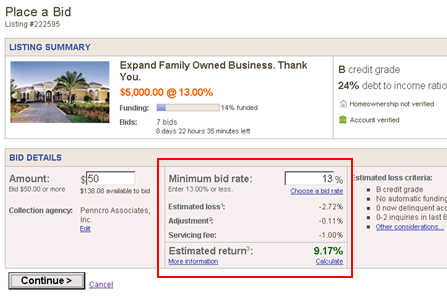

Estimated ROI is shown in listings

Prosper now shows the estimated return on each listing, including predictions for defaults and costs for the servicing fee. The default estimate is now based on Prosper's own data (past performance) rather then Experian data.

Comment: This display does improve lender information especially for unexperienced lenders.

Ended listings hidden (surprise!)

Prosper now hides all data of expired listings. Continue reading

Is identity theft a possible threat to the p2p lending concept

On most peer to peer lending services (Prosper, Lendingclub, Smava, Boober) the identity of the borrower is hidden to the lender. Only the service itself knows the identity of the borrower. Therefore the lender has no means to check if information given is accurate and has to trust the platform.

The service has to

- ensure that it takes adequate measures to verify the identity the borrower has stated at registration is correct

- instill trust to the lender that the fraud risk of borrowers impersonating under a false identity is minimal, non-existant or while existant not covered by the lender.

Prosper gives a "100% Identity Theft Guarantee" and in case of identity theft repurchases the fraudulent loan:

Prosper reserves the right to buy back loans at any time. If Prosper buys back a loan, the outstanding principal balance will be returned to lenders and the loan will be marked as "repurchased".

Prosper typically repurchases loans in accordance with Prosper's 100% Identity Theft Guarantee, under which Prosper has agreed to repurchase loans from lenders if the loan is found to involve identity theft of the named borrower's identity.

Prosper is committed to providing a safe and secure marketplace, and works with law enforcement authorities to prosecute to the fullest extent perpetrators of identity theft.

Rateladder had one of his loans repurchased today. But how often does this occur?

Looking at the Wiseclerk Prosper loan stats by status, the column Repurchased shows a value of 400000 US$. Out of the total loan value of 96 million US$ that is about 0.4%. Not all of the repurchased loans are due to identity fraud.

Prosper checks identity by several measures like checking documentaion supplied by the borrower, calling him, verifying bank adresses, sending postcards to his adress… There have been several discussions on this topic with details on the Prosper forum.

Other services use other measures. German Smava.de uses the PostIdent-process a service that requires the registering service to produce a government id (passport) in person. The Postident process is used by nearly all German online banks and is considered quite safe.

P2p lending services can tolerate only a low level of identity theft cases. The innovative approach of p2p lending requires that lenders trust the concept and the service. Fraud cases endanger that trust.

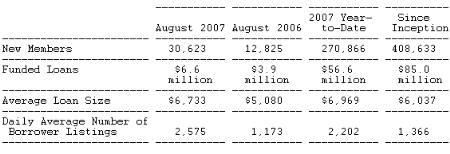

Prosper announces monthly figures

Prosper.com published a "People to People Lending Market Survey" for August. The Survey covers Prosper data and gives a commentary by Chris Larsen, CEO of Prosper.

Excerpt:

Membership and Loan Volume Statistics

In the commentary the main point is the focus of lenders on higher credit categories: "…At the same time, lenders on Prosper are exhibiting rational behavior by steering their bids toward borrowers in the higher credit categories and being far more cautious about chasing higher rates offered by subprime borrowers. Evidence of this flight to safety is seen in Prosper's mix of funded borrowers. For example, the subprime category accounted for only 9 percent of loans funded in August 2007, a marked decrease from August 2006 and the 2007 year-to-date average of 25 percent and 14 percent, respectively. What remains to be seen is whether lenders on Prosper will start placing less weight on homeownership as a factor in their bidding strategies…"

When studying the figures careful attention should be given to the definitions. HR loans are completely excluded from the Estimated Annual Return on Prosper Select Index and the Average Borrower Rates on Prosper Select Loans table. Furthermore loans that did not fit criteria on delinquincies, credit inquiries and DTI are also not included in these tables.

Prosper revenue in August $118K

As Mike has calculated, the revenue Prosper.com earned in August was $118,000. No figures on the cost structure of Prosper's operations are available.