Prosper.com applied several changes as described in this announcement. Some of the changes were expected as plans had been known, some were surprises.

Portfolio plans

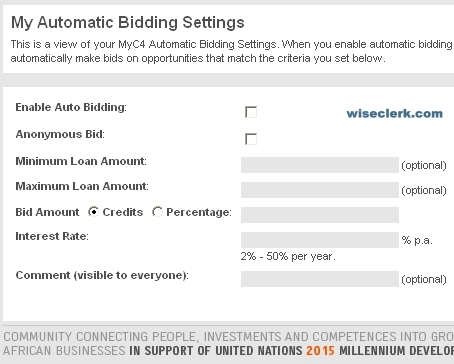

Portfolio plans allow the lender to automatically build a conservative, balanced, moderate or agressive portfolio. That means the lender no longer picks individual loans to bid on but chooses to invest in a plan. The feature is implemented based on Prosper's standing orders. The difference is that it uses standing orders predefined by Prosper, not by the lender. Prosper shows "estimated returns" for each portfolio – currently ranging from 8.37 to 11.06 percent.

Comment: Lendingclub introduced this concept earlier on. Lenders are currently examining and debating on which rationale Prosper did build the standing orders behind the portfolios.

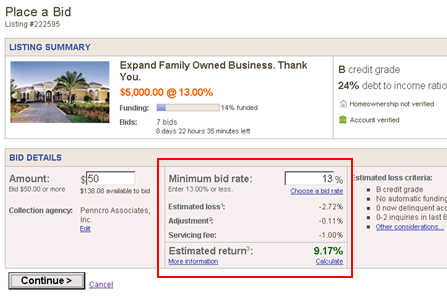

Estimated ROI is shown in listings

Prosper now shows the estimated return on each listing, including predictions for defaults and costs for the servicing fee. The default estimate is now based on Prosper's own data (past performance) rather then Experian data.

Comment: This display does improve lender information especially for unexperienced lenders.

Ended listings hidden (surprise!)

Prosper now hides all data of expired listings. Continue reading