‘P2P Income Partners‘ is a new investment fund by Symfonie Capital that will invest capital in p2p loans. The founder, Michael Sonenshine, an ex-investment banker, told P2P-Banking.com that he plans the first tranche to be 25 million Euro. He says: “Initially we will invest in loans issued by sites such as Prosper, Lending club, Funding Circle, Zopa, Isepankur and we will add fonds to the mix as we see fit. The P2P market is not only web-based. Â There are opportunities to make direct loan across Europe. Â The key to success is spreading the risk and doing careful due diligence.”. The fund is open to qualified investors. Minimum investment is stated as 100,000 US$.

Prosper

P2P Lending Year-End Review 2010

As the end of 2010 approaches here is a selection of main peer-to-peer-lending news and developments covered by P2P-Banking.com:

- January: Focus on Zidisha with an Zidisha review and an interview with Zidisha founder Julia Kurnia; P2P Lending companies Monetto and Bankless Life close

- February: Isepankur introduces B2B Loans

- March: Smava turns 3, merges polish operations into Finansowo; Prosper raises more capital

- April: Moneyauction wins Savings Bank as Lender; Lending Club raises 24.5 million US$ series C round

- May: Auxmoney uses cars as collateral for p2p loans

- August: Guest article: Does P2P Lending work for microfinance?; FundingCircle Launches P2C lending in UK; map of p2p lending sites in Europe; Zopa expects record loan growth

- September: Interview with CEO of new British player Yes-Secure

- October: Ratesetter and Quakle are more newcomers in UK

- November: Kotikonttori family and friends beta launch; Aqush gets Venture Capital; Zopa Rapid Return Secondary Market starts

- December: Money360 is the first site to try p2p real estate loans; Prosper abandons auction model; CommunityLend starts interesting FinanceIt service.

(Photo by paul (dex))

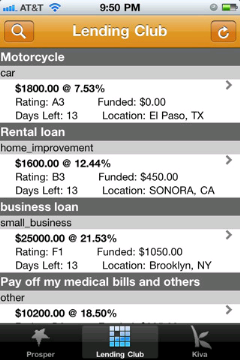

Gimmick – App for P2P Lenders

I just saw the first iPhone App that is to support lenders in using p2p lending services. It aims to help them keeping up to date with the latest listings at Prosper, Lending Club and Kiva.

I just saw the first iPhone App that is to support lenders in using p2p lending services. It aims to help them keeping up to date with the latest listings at Prosper, Lending Club and Kiva.

The features of this app are rather basic, but with the number of people lending at p2p services there could be a market for a sophisticated app that really helps lenders select loans while on the move.

Update: There are in fact two other free apps to browse Kiva loan listings.

Prosper Moves To Pre-Set Rates; Abandons Auction Model

P2P Lending site Prosper.com changed its business model today.

P2P Lending site Prosper.com changed its business model today.

The company announced: ‘Our site has a new look, and we’ve eliminated the auction and simplified our loan process so that we can connect lenders and borrowers more efficiently. Borrowers will receive pre-set rates and lenders cannot be outbid. We hope you’ll appreciate this streamlined and even more prosperous experience.‘

Prosper is still lagging far behind competitor Lendingclub in monthly loan volume funded. While Prosper’s new loan funding process resembles the one of Lending Club more after Prosper did away with the auction it remains to be seen if it will help Prosper to regain market share.

The main problem of Prosper was not the auctions, but high default rates leading to lender churn.

Another change, according to a recent SEC filing, is that Prosper now allows partial funding of loans. Continue reading

Prosper Adds 1-Year and 5-Year Loans

Prosper.com adds 1 and 5 year loan terms. So far only 3 year loans were available on the p2p lending platform.

Prosper Asks to Be Regulated Like a Bank

A Bloomberg article reports that Prosper seeks to be regulated like a bank in order to avoid the jurisdiction of the SEC.