What is Blend Network about?

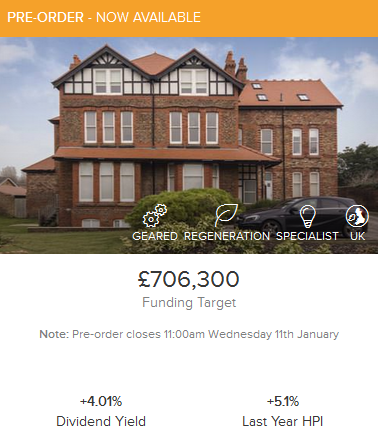

Blend Network is an online property lending marketplace that focuses on lending to established property developers in high-growth areas across the UK but outside London. Since its official launch in January 2018, Blend Network has already lend £1.5 million GBP to 6 projects across Northern Ireland, Scotland and Norfolk with an average fixed return of 12.2% p.a. Lenders can join for free and manage their loans through a user-friendly dashboard. Borrowers are double-vetted by both Blend Network and a sponsor before being listed on the Blend Network platform. In addition, Blend Network loans are only made against security to help ensure the protection of lender money in the default scenario.

What are the three main advantages for investors?

- Access to niche markets: While most P2P property lenders focus in the London market due to its convenience, we focus in less crowded markets outside London that are outperforming not only the London market but also the average UK market. We have done loans in Northern Ireland where according to the recent RICS UK Residential Market Survey Report the outlook is considerably more positive than in some other UK regions, with prices rising, a growing number of potential new buyers active in the market, robust demand and overall stronger sentiment. Similarly, according to the latest UK House Price Index data, Scotland was the only UK region where average year-on-year house prices in 2017 where higher than in 2016 (In England, Wales and Northern Ireland the pace of price growth moderated, although more significantly in England).

- High returns: Our focus in high-growth, high-yield pockets of the UK property market outside London enables us to return up to 15% return p.a. – right at the top-end of the P2P lending marketplace. Our average return for the 6 loans since launch is 12.2%, significantly above the average of around 8% return across other P2P property platforms according to our own calculations.

- Strong due diligence and credit risk assessment: We pride ourselves by the strength of our due diligence process. Borrowers are double-vetted by both Blend Network’s Credit Committee and a sponsor before being listed on the Blend Network platform. Our Credit Committee is chaired by senior banker Charles Lamplugh who has 35 years of experience successfully winning and running corporate relationships for Lloyds Banking Group. In addition, Blend Network loans are only made against first charge on the security as well as personal guarantee from the developer.

What are the three main advantages for borrowers?

- Access to finance: Most property lenders pulled out in places such as Northern Ireland after the 2008 financial crisis and many haven’t gone back yet, but paradoxically Northern Ireland is one of the fastest growing UK property markets. For small developers in those markets, getting access to finance is simply not easy. Small and Medium Enterprise (SME) developers have the flexibility and the desire to build on brownfield sites, to redevelop derelict buildings and to maximise the potential of property which may no longer be viable for commercial use. Figures from the Federation of Master Builders (FMB) House Builders Survey 2017 suggest that a shortage of available small sites, combined with a lack of finance, top the list of barriers facing SME house builders.

- We bring knowledge and understanding of developers’ true requirements: We operate in areas where the constrained nature of most mainstream lenders has led to many opportunities for small developers being delayed, frustrated or lost. In contrast, we pride ourselves for our understanding of the true requirements in the development process. As one borrower put it ‘It was very refreshing to work with a company that understood the process well so could recognise the opportunities available and thus able to finance accordingly.’

- No exit fee for early repayments: If our borrowers are able to complete their project before the maturity, great! They can repay the loan with no exit fee. It’s a win-win.

What ROI can investors expect?

Between 8% and 15% fixed return p.a. Our average since launch is 12.2% fixed return p.a.

Is the technical platform self-developed?

Is the technical platform self-developed?

The platform was developed for us, we own it.

How is the company financed? Is it profitable?

The company has been self-financed so far. It is profitable but we have just decided to take the whole team on an offsite to Miami, so we spent all our profit! J J

What were the main challenges when launching your platform?

Frankly, our main challenge so far has been trying to explain why the returns are so good! In today’s markets, there are not many investments that offer an average of 12% return p.a. with no volatility. One might think it is too good to be true. It is not. The simple answer is that the UK housing crisis and lack of available homes is at its worst since the 1970s, and small developers with tight access to funding are willing to pay a premium to get funding for redevelopment projects and bridge loans. This is why we can pay up to 15% return p.a.

Do you plan to offer an IFISA?

We will assess this later in the year and decide whether we want to implement an IFISA for the next financial year.

Is Blend Network open to international investors?

Yes, it is. Our current lenders on the platform include a range of nationalities across Western Europe, the Middle East and Far East Asia.

Which marketing channels do you use to attract investors and borrowers?

The platform has already attracted a string of high-profile lenders among the high net worth bankers and hedge fund managers of Yann’s circle of personal connections. These have lent nearly 1.5M GBP since the platform launched and the proposal is attracting significant ‘word of the mouth’ attention among current lenders. In addition, we have prepared a 2-year strategic marketing plan highlighting the relevance of branding, social media, PR but most importantly word of the mouth by current lenders who are more than happy to recommend the product.

What factors do you see impacting the British property market in the near future?

We see Brexit as a key challenge (or in our case opportunity) for the UK property market in the next 2-5 years. The UK property market is a 2-speed market, with on the one hand the London market and on the other hand the rest of the UK market. We believe the London market is set to undergo a further correction due to being directly exposed to a number of sectors hit with Brexit: the financial sector and the global elite’s appetite towards prime London property ownership after Brexit. On the other hand, the rest of the UK suffers from an endemic housing crisis and lack of available homes: after decades of failure to build the homes the country needs, public concern about housing is the highest it has been for 40 years according to several heavyweight reports into Britain’s housing crisis.

Where do you see Blend Network in 3 years?

At Blend Network we are not trying to reinvent the wheel; we are simply offering an improved product for both lenders and borrowers. While we don’t want to be the only P2P property platform in the market, in 3 years we certainly want to be the best in terms of:

- Returns – keeping our current position at the top-end of the P2P lending marketplace

- Customer experience – continuing to enhance the functionalities on our platform to keep delivering top navigational and interface tools that our lenders love using

Access to deals – Continuing to source top deals for our lenders

P2P-Banking thanks Yann Murciano for the interview.

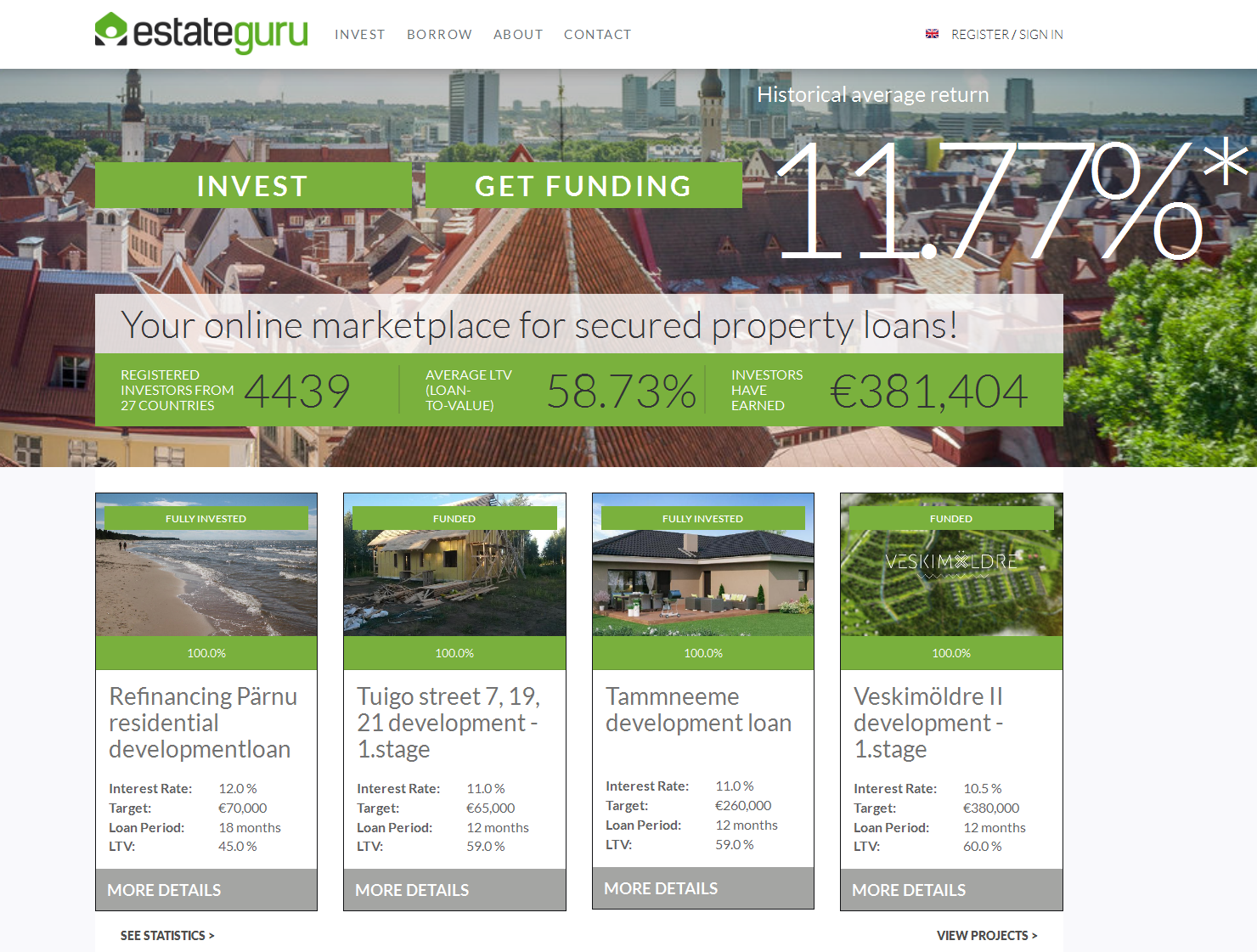

P2P Lending marketplace

P2P Lending marketplace