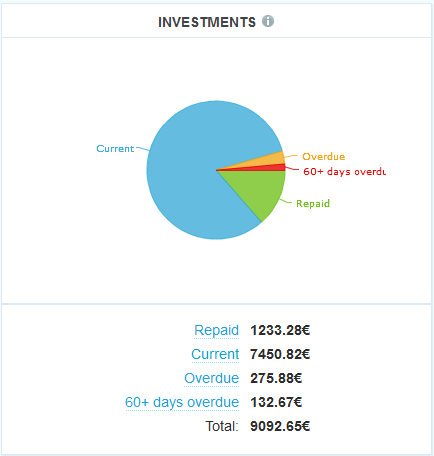

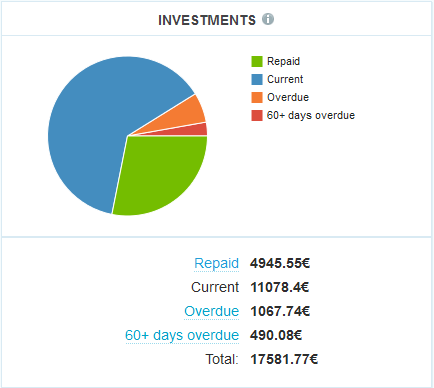

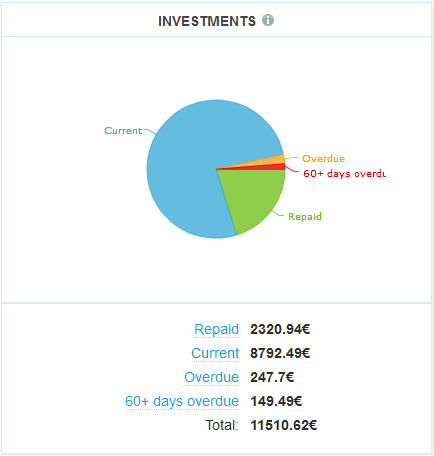

It’s been one and a half years now since I started p2p lending at Isepankur. And since my last report another 4 months have gone by. Since the start have deposited 10,000 Euro (approx. 13,750 US$). I hold over 650 loan parts – the diversification achieved is very good. Together the loans add up to 12,636 Euro outstanding principal. Loans in the value of 1067 Euro are overdue, meaning they (partly) missed one or two repayments. 490 Euro are in loans that are more than 60 days late. I already received 4,945 Euro in repaid principal back (which I reinvested).

Chart 1: Screenshot of loan status

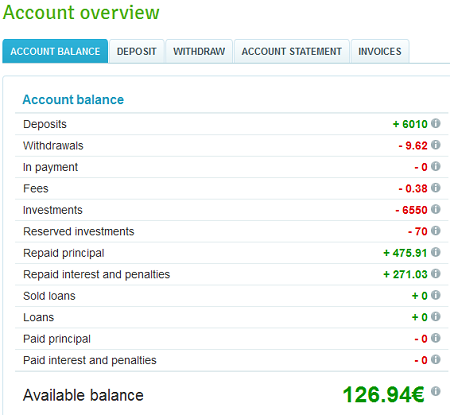

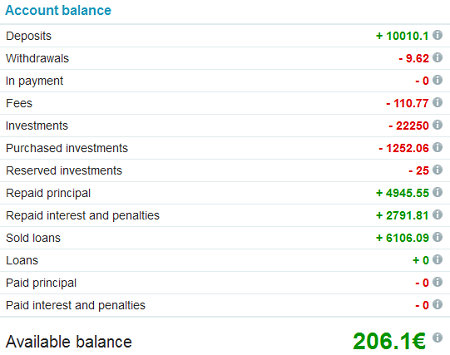

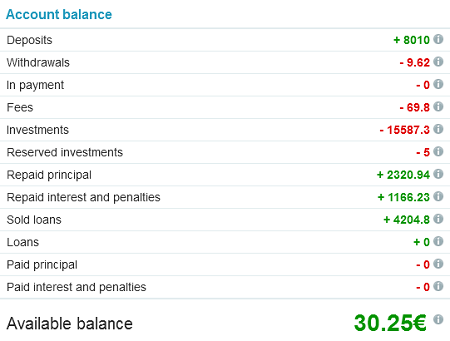

Right now I have 206 Euro cash in the account which is up from close to zero around the middle of the month. 25 Euro are tied in bids on current loan listings and will originate in the next few days.

Chart 2: Screenshot of account balance

Return on Invest

Currently Isepankur shows my ROI to be over 27.5%. In my own calculations, using XIRR in Excel, I currently get a 25.6% ROI. In the first months there was a considerable gap when comparing these differently calculated ROI figures. As my portfolio ages, the gap is closing. The statistic section tells me, that I am currently the lender with the 15th best ROI (counting all lenders that have invested for at least 12 months and at least 10,000 Euro). Continue reading

When p2p lending service

When p2p lending service