MyC4.com has a great concept with an ambitious goal: ‘Let’s end poverty by 2015’. Lenders can invest in African businesses of small entrepreneurs. MyC4 gained a lot of positive media coverage and received awards.

MyC4.com has a great concept with an ambitious goal: ‘Let’s end poverty by 2015’. Lenders can invest in African businesses of small entrepreneurs. MyC4 gained a lot of positive media coverage and received awards.

The realization of this concept is an enormous task, facing many hurdles. Since MyC4 is transparent and lenders earn interest problems do impact the user experience. Current user discussions deal with issues like defaults, currency risks, transaction costs, pending time, information accuracy and communication.

While I am sure that Kiva has to overcome similar problems, the difference is that on Kiva these issues are more dealt with in the background and the average user is not or less aware of them.

Like Kiva, MyC4 partners with local microfinance institutions (called ‘providers’ on MyC4 – see overview of provider results) that screen loan applicants. These partners are trying hard to validate the business of the applicant as good as possible, but conditions and environment complicate the task.

Furthermore the partners are on a learning curve – a process that MyC4 supports. Data accuracy of the loan details listed by the provider sometimes is questionable – this was one of the causes MyC4 cancelled some Ivory Coast loans earlier.

Example: an active listing that raises questions

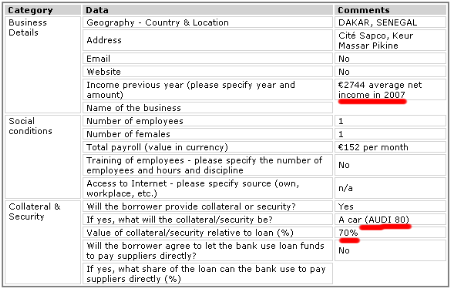

Alima Thiam, retail shopkeeper in Senegal, seeks a 13,873 Euro loan.

: About :

Married and a mother of 2 children, Alima has been trading items for 8 years. Her business grew so fast that in April 2007, she was able to open her first store. Her business is still growing at a fast pace and she needs additional working capital to increase her inventory of goods and add new items.Objective of the opportunity:

With a loan of €13873, Alima seeks to increase her stock provided that it would guarantee more interesting sales. She wants to buy her goods early to avoid paying higher prices, hence keeping her costs down. She will use the increased margin to introduce new items.

The information provided in the listing raises the following plausibility questions:

- The relation of the loan amount to the yearly income seems very high

- The listed collateral – an Audi 80 – is given with a value of 9,711 Euro. This seems a very high value for a very old car model. (independent of issues whether the collateral could really be secured in case of default)

- The location pictured does not look like it is in proportion to the amount of goods that could be bought for the loan value.

What reasons could have caused possible inaccuracy of information in this loan listing?

Githa Kurdahl, doing an internship with Ivoire Credit has described her findings regarding inaccurate descriptions in an excellent post on Oct. 21st. In summary she pointed out the following causes:

- mistakes due to manual calculations

- mistakes in translation

- lack of business records

- exaggerated projections

- optimistic borrowers

- mismatch between European and African business context.