Prosper.com published a "People to People Lending Market Survey" for August. The Survey covers Prosper data and gives a commentary by Chris Larsen, CEO of Prosper.

Excerpt:

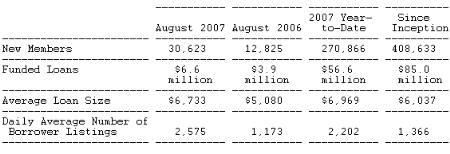

Membership and Loan Volume Statistics

In the commentary the main point is the focus of lenders on higher credit categories: "…At the same time, lenders on Prosper are exhibiting rational behavior by steering their bids toward borrowers in the higher credit categories and being far more cautious about chasing higher rates offered by subprime borrowers. Evidence of this flight to safety is seen in Prosper's mix of funded borrowers. For example, the subprime category accounted for only 9 percent of loans funded in August 2007, a marked decrease from August 2006 and the 2007 year-to-date average of 25 percent and 14 percent, respectively. What remains to be seen is whether lenders on Prosper will start placing less weight on homeownership as a factor in their bidding strategies…"

When studying the figures careful attention should be given to the definitions. HR loans are completely excluded from the Estimated Annual Return on Prosper Select Index and the Average Borrower Rates on Prosper Select Loans table. Furthermore loans that did not fit criteria on delinquincies, credit inquiries and DTI are also not included in these tables.