In August the FCA posted a call for input preceeding a planned review of the current regulation of p2p lending and crowdfunding for equity. Today the FCA publishes interim feedback. The feedback statement provides a first response to the feedback received and sets out next steps.

Based on a review of the feedback received, issues seen during the supervision of crowdfunding platforms currently trading and consideration of applications from firms seeking full authorisation, the FCA believes it is appropriate to modify a number of rules for the market.

Initial findings

Loan-based and investment-based crowdfunding

For both loan-based and investment-based crowdfunding platforms the FCA has found that, for example:

- it is difficult for investors to compare platforms with each other or to compare crowdfunding with other asset classes due to complex and often unclear product offerings

- it is difficult for investors to assess the risks and returns of investing on a platform

- financial promotions do not always meet our requirement to be ‘clear, fair and not misleading’ and

- the complex structures of some firms introduce operational risks and/or conflicts of interest that are not being managed sufficiently

Loan-based crowdfunding

In the loan-based crowdfunding market in particular the FCA is concerned that, for example:

- certain features, such as some of the provision funds used by platforms, introduce risks to investors that are not adequately disclosed and may not be sufficiently understood by investors

- the plans some firms have for wind-down in the event of their failure are inadequate to successfully run-off loan books to maturity

- the FCA has challenged some firms to improve their client money handling standards

Proposals for new rules to be considered in Q1 2017

The FCA plans to consult on additional rules in a number of areas. These include more prescriptive requirements on the content and timing of disclosures by both loan-based and investment-based crowdfunding platforms.

For loan-based crowdfunding the FCA also intends to consult on:

- strengthening rules on wind-down plans

- additional requirements or restrictions on cross-platform investment

- extending mortgage-lending standards to loan-based platforms

The FCA’s current rules on loan-based and investment-based crowdfunding platforms came into force in April 2014. They aimed to create a proportionate regulatory framework that provided adequate investor protection whilst allowing for innovation and growth in the market.

The call for input in July 2016 launched a post-implementation review of these rules. The paper summarised market developments since 2014 and some of the FCA’s emerging concerns.

Andrew Bailey, Chief Executive of the FCA, said:

“Our focus is ensuring that investor protections are appropriate for the risks in the crowdfunding sector while continuing to promote effective competition in the interests of consumers. Based on our findings to date, we believe it is necessary to strengthen investor protection in a number of areas. We plan to consult next year on new rules to address the issues we have identified.†Continue reading

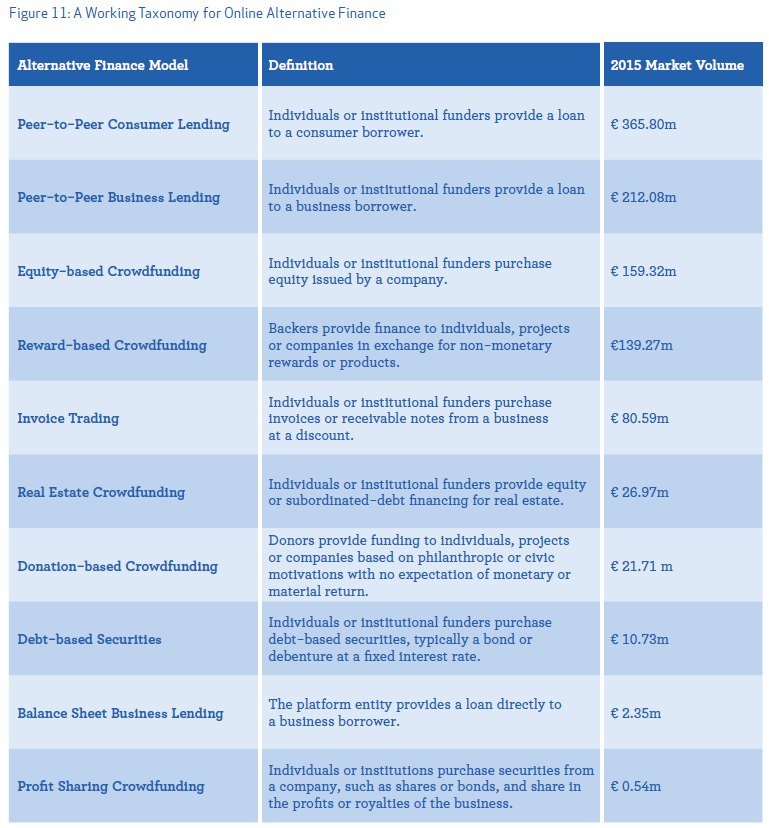

The European online alternative finance market, including crowdfunding and peer-to-peer lending, grew by 92 per cent in 2015 to €5.431 billion, according to the results of the 2nd Annual European Alternative Finance Industry Survey conducted by the Cambridge Centre for Alternative Finance at University of Cambridge Judge Business School, in partnership with KPMG and supported by CME Group Foundation.

The European online alternative finance market, including crowdfunding and peer-to-peer lending, grew by 92 per cent in 2015 to €5.431 billion, according to the results of the 2nd Annual European Alternative Finance Industry Survey conducted by the Cambridge Centre for Alternative Finance at University of Cambridge Judge Business School, in partnership with KPMG and supported by CME Group Foundation.