As announced Mintos* launched the first notes today. For an introduction what notes are please refer to my previous article.

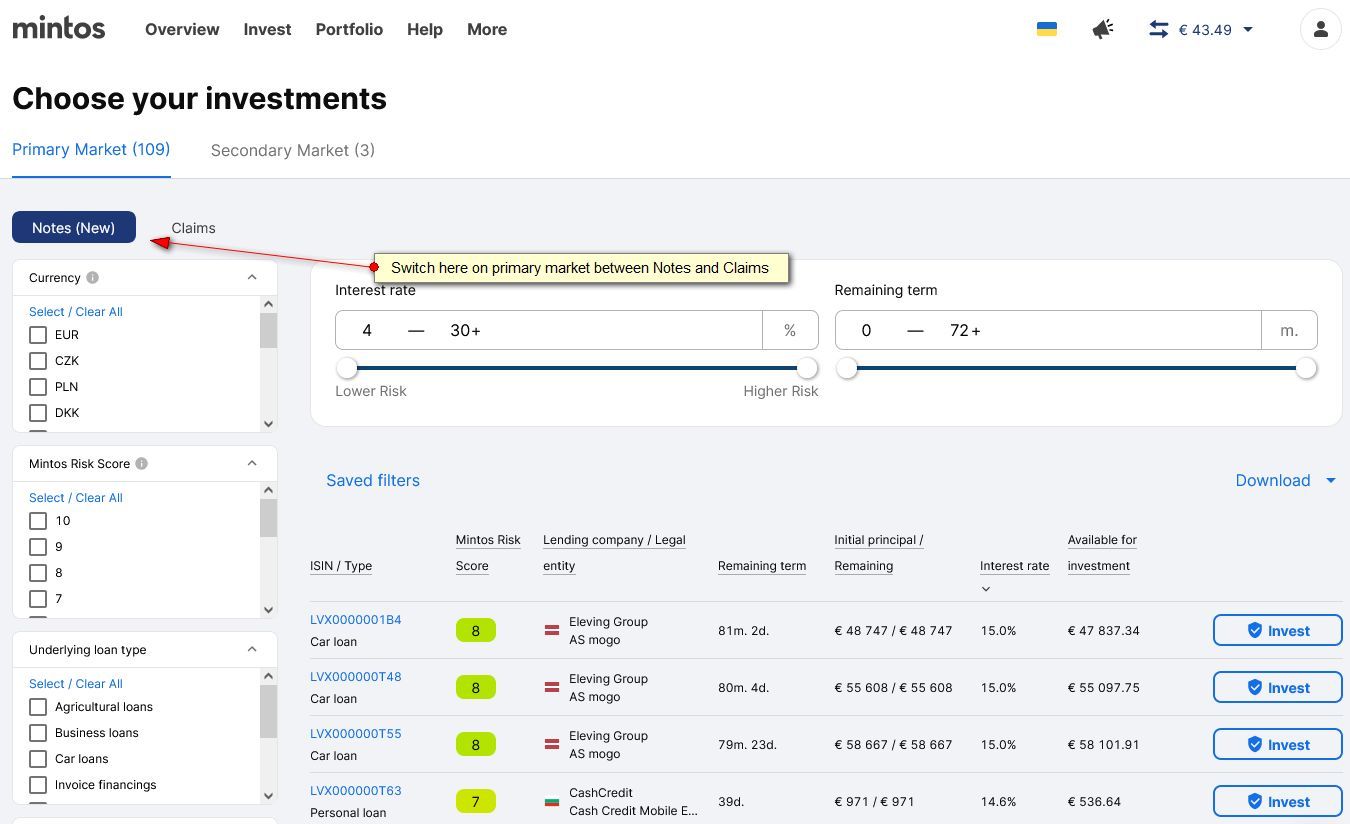

To see the new notes listed on the Mintos primary market, investors can toggle a switch on the upper left side

Screenshot May 25th, 2022, click for larger view

Initially there are notes from the loan originators Eleving Group, CashCredit and Sun Finance listed. Notes for more loan originators will be added as soon as they have published the required prospectus.

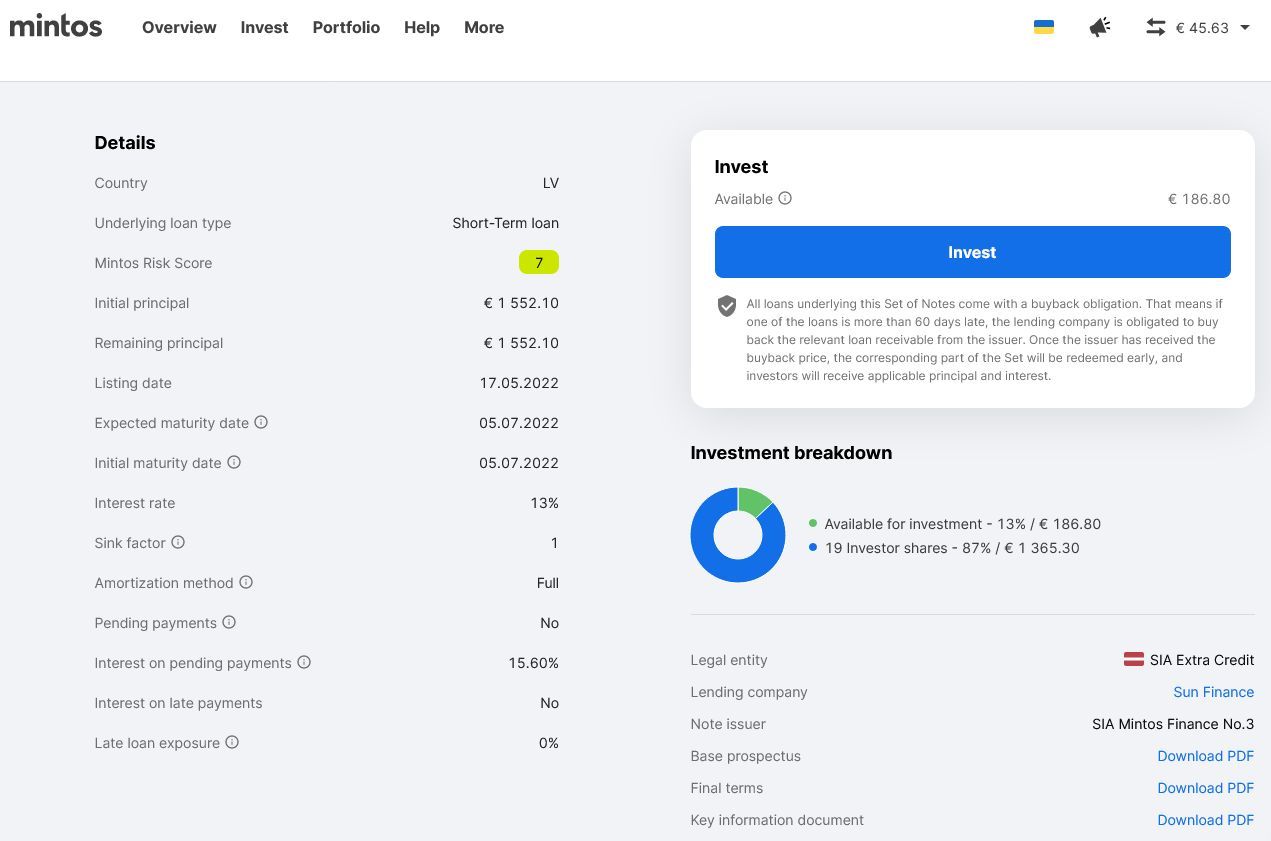

Clicking on an ISIN brings up the detailed information about the loan set. Most of the offered information mirrors that available for claims, but there are some new parameters, e.g. ‘sink factor’

Screenshot May 25th, 2022, click for larger view

Investors have voiced questions and concerns around the shift from the claims to the notes product. Mintos has adressed common questions in this Q&A. One of the most discussed aspects is that Mintos is required to withhold 20% taxes. This amount can be lowered for residents of these countries as soon as they submit a tax residency certifacte from their tax authority to Mintos.

Despite all communication efforts by Mintos it seems an uphill battle. On the German forum in a recent survey 55% of respondents answered that they will stop investing at Mintos as a result of the introduction of the new notes. Another 24% are unsure about it. Similar sentiments can be read on the Czech forum.

If investors will suit the action to the word this might impact Mintos origination volumes in the coming months. Some investors might switch to competing platforms with similar offers, e.g.

- Lendermarket* (Creditstar loans, up to 15% interest rate, 1% Cashback when registering through this link)

- Esketit* (Creamfinance loans, up to 14% interest)

- Moncera* (Placet Group loans up to 10% interest)

- Afranga* (Stik Credit loans up to 14% interest)

- Bondster* (various)

- Income Marketplace* (various)

It will also be interesting to see if there is an impact on the discounts on the secondary market for claims, as investors might try to sell claims before the secondary market sunset for claims on June 30th. If investors do not wish to hold claims to maturity there might be increasing supply outweighting demand and therefore offered YTMs might rise until June 30th.