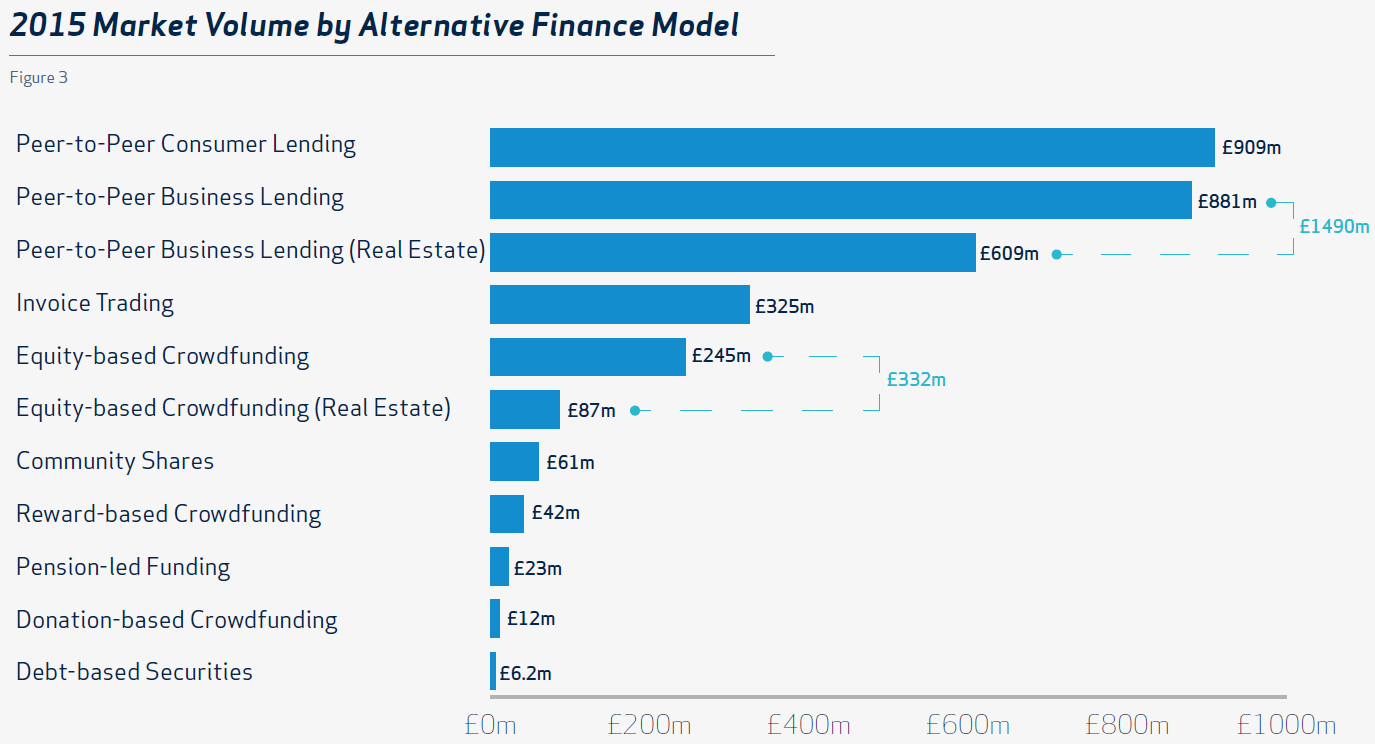

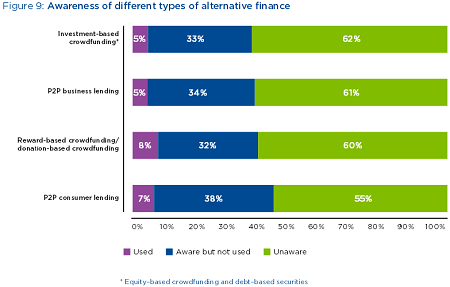

The report ‘Pushing Boundaries – The 2015 UK Alternative Finance Report‘ by Nesta and the University of Cambridge collected very interesting and comprehensive data on the market development by polling 94 marketplaces. The report looks at alternative finance, including p2p lending, crowdfunding (equity/reward/donation-based), invoice trading, community shares, pension-led funding and debt-based securities.

P2P Consumer Lending

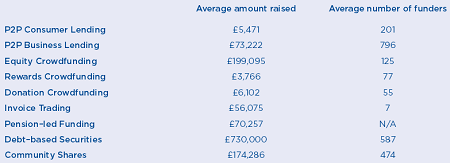

The total loan volume in 2015 was 909 million GBP, an increase of 66% compared to 2014. This is the sum of loans made to about 213,000 individual borrowers. A very high percentage (89%) of the investors used autoinvest features of the marketplaces to make the investments. 32% of p2p consumer lending was financed by institutional investors.

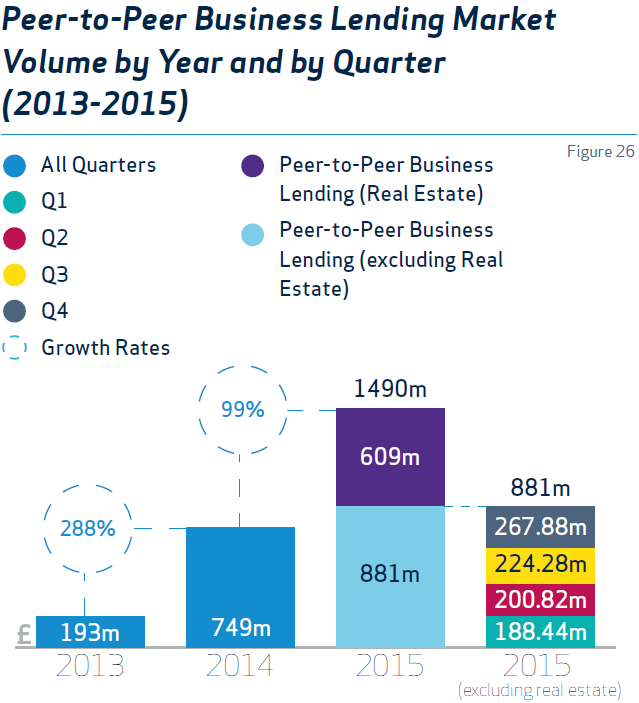

P2P Business Lending

This segment nearly doubled compared to the previous year to now 1.49 million GBP. An important factor are real estate related loans (609M GBP). There is a wide and partly complex range of loan types and terms.

The non real estate related loans compromise about 10,000 loans to SMEs. In this sector 42% of investors use autoinvest functionalities.

Depending on which data source is used for comparision p2p lending marketplaces in 2014 have gained a market share of 3.3% to 13.9% of all loans made to SMEs in the UK. Continue reading