What is Mintos all about?

Mintos is a marketplace lending platform that brings together investors and borrowers by enabling various loan originators to use a marketplace lending model in funding loans. Previously loan originators established their own platforms; now Mintos offers a single platform to those non-bank lenders that seek to sell loans. This means non-bank lenders do not have to make major investments in establishing and maintaining their own platforms. By connecting to the Mintos platform non-bank lenders get an instant access to investors that are looking to purchase marketplace lending assets. Thus, non-bank lenders can focus on their core skill of originating loans.

What are the main advantages for investors?

At Mintos investors can invest in loans that are originated by various non-bank lenders that use our platform to fund their loans. The main advantage for the investors, accordingly, is that they get an access to much broader investment opportunities as part of a single platform, both in geographic terms, and in terms of various loans originated by various non-bank lenders. Investors on the Mintos platform can invest in mortgage loans, secured car loans, small business loans, and soon also unsecured loans. Loans are currently originated in Estonia, Latvia, Lithuania, and we are about to add loan originators from Finland, Georgia, and Spain. This, combined with the fact that the minimum investment in one loan is EUR 10, means that investors can easily build very well diversified investment portfolios. Also, as a result of having various loan-originators and many investors on one platform our secondary market is very liquid.

It is also important that non-bank lenders whose loans are available to investors on our platform are experienced in underwriting. The platform is used by Capitalia, for instance, which is the leading small business lender in the Baltic sates and has been lending for five years. All lending processes are orderly at the company, it has experience, and it has access to historical data. That is essential for investors who can be sure that the detailed credit analysis are preceding the granting of a loan. Moreover, the loan originators on the Mintos platform are required to retain a part of each loan on their books, i.e., to have “skin in the game†to align their and investors’ interests.

Finally, all loans on the Mintos platform are prefunded by the loan originators; thus investors can start earning from the moment of the investment and there is no cash drag. At the moment more than EUR 1 million of loan inventory is readily available for investment on our platform.

What about borrowers? What are the advantages for them?

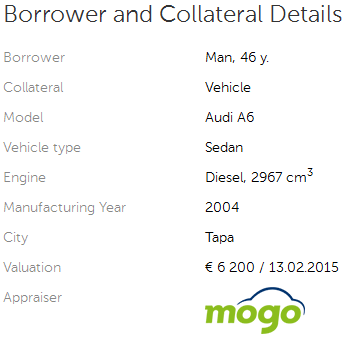

Mintos does not issue loans, but it is important for us that the loan originators who use our platform at the end of the day can offer cheaper rates to borrowers. Also, the lending process is much more convenient at these loan originators. When borrowing money from Capitalia, for instance, a small company can expect the money to arrive in its account in just a few days’ time, usually even faster. At a bank, by contrast, that could take several weeks. Finally, some of the loan originators who use our platform provide loans and services to those borrowers who might not have had an access to affordable credit before. For instance, among clients of Mogo, the largest non-bank car loan provider in the Baltic region that is also on our platform, there are those who are seeking a car loan, with the average requested sum being around EUR 3,000. This segment is underserved by the banks.

What ROI can investors expect?

What ROI can investors expect?

So far the average net annual return for investors investing via the Mintos platform have been slightly below 13%. We expect the average net annual return to hover around the low double digits also in the future. However, investors should look not just at the return, but also the relevant risks. In the case of Mintos, investors can easily build a very well diversified investment portfolio across different loan products and geographies, thus reducing unsystematic risk within the marketplace lending asset category. Also, the Mintos platform was the first with a buyback guarantee where some of the loan originators buy back non-performing loans from investors, thus substantially reducing risks for investors.

What is the background of Mintos?

We started to work on the idea in mid 2014 and launched the platform in January 2015. I come from the investment banking where I spent six years before going for an MBA at INSEAD. That, actually, was the first time I heard about the peer-to-peer lending because I borrowed from Prodigy Finance, a platform that provides funding to international postgraduate students attending top-ranked business schools, while also delivering competitive financial returns to institutional and private investors. The other Martins, Martins Valters, our CFO and also a Co-Founder, has 11 years of experience from Ernst & Young where he audited some of the largest financial institutions in the Nordic region.

To fuel our growth we have raised EUR 1 million in venture capital to date. That has helped us in forming a strong team and an experienced board of directors. In a bit more than six months since the launch, more than 2,400 investors from 30 countries have registered on the Mintos platform and funded more than 1,500 loans for a total of more than EUR 4 million, of which EUR 1 million in the last month alone.

Is yours a bespoke platform?

Yes. We began work on the platform half a year before we launched it to the public, and we developed it in-house from scratch. Each marketplace lending platform has its own nitty-gritty approach, so it is best to design the platform ourselves. The Mintos platform is used by various non-bank lenders, and so we see ourselves as a technology company with a strong finance background. Currently, we have eight software developers in our team. We listen carefully to what investors say and appreciate their feedback as it greatly helps in improving the platform. Continue reading

Latvian p2p lending marketplace

Latvian p2p lending marketplace