‘Earn rental income starting from €50 investment’. As of today, Mintos* is advertising a new offer that it describes as passive property investing.

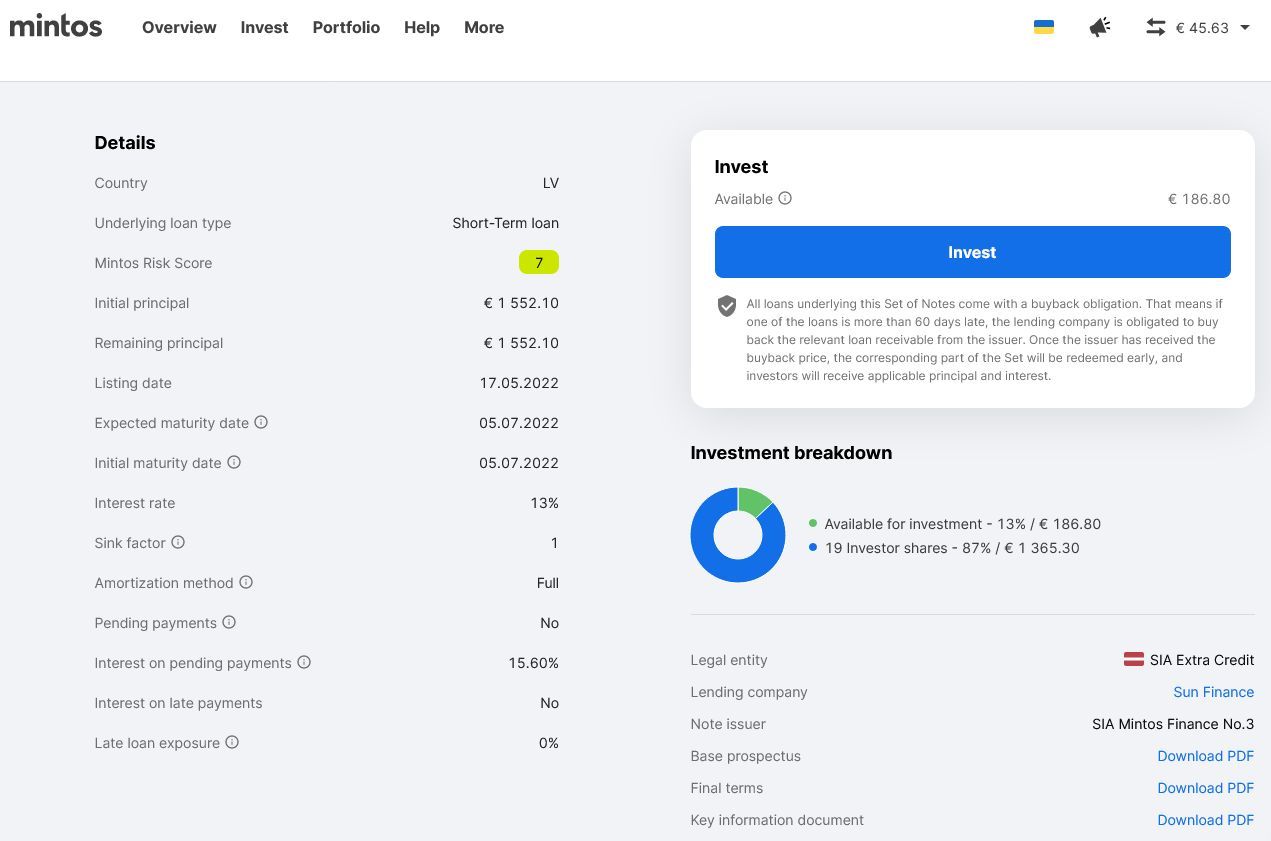

In fact, investors are investing in Real Estate Securities, which are an interest-bearing debt security backed by underlying bonds. Purchasing Real Estate Securities entitles the investor to receive interest payments for the Notes whenever net property payments are made on the underlying bonds and repayments when the underlying property is being sold.

So to summarise: If everything goes according to plan there is a monthly interest payment, which is fed from the rent, and at the end a payment for the increase in value, which is estimated but not guaranteed.

The underlying properties are located in Austria and come from the Bambus.io portfolio, which acquired them as part of a partial purchase. The older owners are therefore still living in their homes and are now paying rent for the sold portion (kind of a reverse mortage).

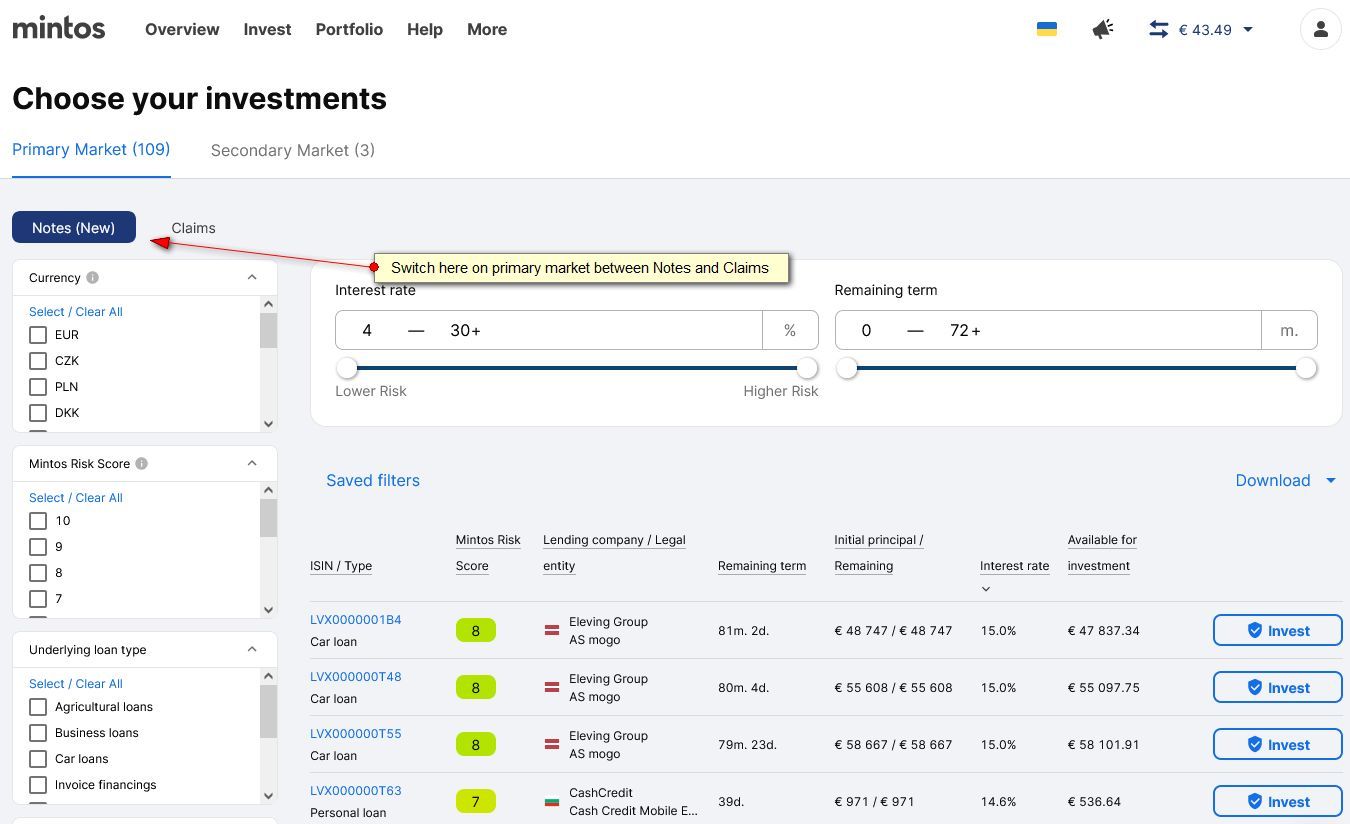

Illustration: The first property offer in the new Mintos product as an example (click for larger view)

Advantages for the investor:

- Good opportunity for diversification

- These are rented residential properties (and not projects of property developers or commercial properties as with some other platform offers)

- Invest from as little as 50 euros

- Regulated offer

Disadvantages for the investor:

- Very long term (20 years in the example)

- rather illiquid (although a sale via the secondary market is possible, it is questionable whether there will be demand)

- No information on how the valuation was carried out and how the increase in value was forecast

The property from the first offer was valued at 317,500 euros. Mintos* does not provide any further details. Brief research (e.g. here) shows that the valuation of 2,500 euros/m² is not overpriced. According to the Bambus FAQ, the market value of the partial purchase carried out by Bambus is determined by an independent expert. It can be assumed that the market value determined in this way corresponds to the property value stated on Mintos.

Unfortunately, there are no further details on how the increase in value was forecasted. According to the prospectus, Bambus, which has been operating since 2022, has not yet sold any properties. So there is no experience yet.

Is it worth it? My first impression

In my opinion, the interest rate offered is too low for the very long investment period. It is difficult for me to judge whether the increase in value has been realistically forecasted. After all, it could probably be enough to cover inflation.

Comparison with other investments

The question remains, why should investors use the Mintos* offer instead of alternative offers? I have started to build up a portfolio with Inrento* in the last few weeks. The property loans there offer a significantly higher interest rate of 8-9% p.a., interest payments are also monthly and there is also a payment for appreciation (1.5% p.a.). The advantage is the significantly shorter terms of 1 to 3 years.

Estateguru* also offers significantly higher interest rates of 9-11%. There is also a bonus of up to 2% on top for larger investment amounts. The terms are also often shorter at 12 to 18 months. Even taking into account the usual overdrafts of around one year, the investor is much more liquid than with the Mintos product.

Furthermore there are exchange-traded REITs as an alternative. These are much more liquid and enable broad diversification.