In 2008 we covered Noba with it’s plans for a p2p lending service in Hungary. Now CafeBabel.co.uk has great overview on the current situation of peer to peer lending in Hungary today. Noba has 3,450 (figure corrected) registered users. Most lenders are giving loans out of social motivations as due to regulation the loans do not carry interest.

market

Swiss Private Banker: P2P Lending a Threat to Bank Balance Sheets

In an video interview in June, Konrad Hummler, managing partner at Swiss Bank Wegelin & Co, states how he sees p2p lending as a threat to banks.

P2P lending services could replace vital functions of banks. He says government influenced major banks are to inefficient. Established institutions will use calls for regulation to protect their business against newcomers.

(The interview is in German language)

Will P2P Lending be Disruptive?

In this – rather long – article I’ll examine if and why p2p lending has the potential to become disruptive and displace the “conventional” way banks hand out consumer loans.

A good read to get some opinions before continuing is reading these posts:

Zopa blog: ‘Why the banks need Zopa‘, which led to the post of

James Gardner, ‘Zopa’s strategy is to be immaterial to banks‘, which was contradicted by

Chris Skinner, ‘Why social finance and particulary Zopa matters‘, countered by

James Gardner: ‘Followup: Zopa isn’t disruptive‘

What is a disruptive innovation?

Wikipedia gives the definition that Clayton M. Christensen has coined in 1995:

Disruptive technology and disruptive innovation are terms used in business and technology literature to describe innovations that improves a product or service in ways that the market does not expect, typically by being lower priced or designed for a different set of consumers.

Disruptive innovations can be broadly classified into low-end and new-market disruptive innovations. A new-market disruptive innovation is often aimed at non-consumption (i.e., consumers who would not have used the products already on the market), whereas a lower-end disruptive innovation is aimed at mainstream customers for whom price is more important than quality.

Disruptive technologies are particularly threatening to the leaders of an existing market, because they are competition coming from an unexpected direction. …

In contrast to “disruptive innovation”, a “sustaining” innovation does not have an effect on existing markets. Sustaining innovations may be either discontinuous (i.e. “revolutionary”) or “continuous” (i.e. “evolutionary”). Revolutionary innovations are not always disruptive.

There are multiple examples in the Wikipedia article. I want to give two others here. The newspapers ignored or at least failed to adapt to what the internet meant to their classified ads business. As a result they were one of the first to loose offline business to totally new competitors (multiple ad sites, Ebay, Craigslist and others). The music industry fought a downhill battle not to let CDs be replaced by replaced by (initially pirated) digital distribution.

In both cases the shift to the internet was inevitable, because the new technology offered a better process with superior customer experience at lower cost. The question here is if, had the dominant players faster reacted to the new medium, would they have retained (a larger part of) their dominant market position?

Cutting out the middleman?

One of the argument of p2p lending companies is that they are “cutting out the middleman”, meaning the bank out of the lending process. The way p2p lending works today, that is an argument open to attack. Continue reading

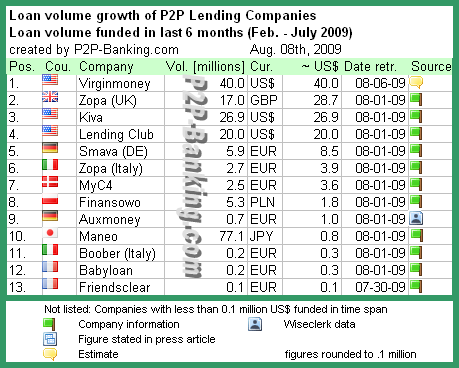

P2P Lending Companies Show Strong Growth – Aug. 09

P2P lending services continue to grow. In some markets the speed of growth has even accelerated.

P2P-Banking.com has created the following overview table listing services in operation and ranked them by loan volume funded in the past 6 months.

This image may be reprinted on other internet sites, provided it is not altered or resized and the following text (including the direct link to this article) is given as source directly below the image:

Source: P2P-Banking.com

For some service like the Korean Moneyauction and Popfunding no figures were available. Also omitted are some services that did not reply to information requests.

Note that Prosper.com was closed for most of the observed time span and did not make the minimum cutoff for the table. Also note that Zopa Italy is currently closed.

For a table listing more p2p lending companies check previous ‘P2P Lending Companies by Loan Volume – Jan. 09‘.

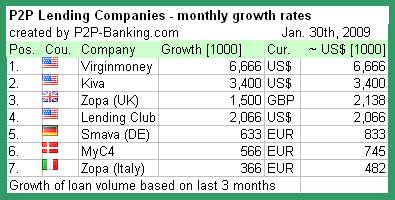

Especially british Zopa and the German services show strong growth lately. Smava nearly doubled loan volume in July compared to June (chart), whereas Auxmoney tripled it (chart). At Smava currently even 25,000 Euro loans (approx. 35,750 US$) are funded with bids in only 4 minutes (!) bidding time (example loan).

On the other hand MYC4‘s growth slowed in the last months (chart) due to problems with the providers loan picks.

Sobralaen brings p2p lending to Estonia

Today Sobralaen.ee, the first Estonian p2p lending service, has launched.

Today Sobralaen.ee, the first Estonian p2p lending service, has launched.

Sõbralaen’s borrowers fill in a loan application for up to 15,000 EEK (approx. 1,200 US$), specify the loan length (up to 2 years), maximum interest rate and sign the loan application. This application will start an auction, during which Sõbralaen’s investors can bid for the right to invest in that loan. When making a bid, Sõbralaen’s investors specify how much they are willing to invest and how high interest rate they are looking to earn. The investment amount can be between 100 and 15,000 EEK. Before making the investment, the investors can see the borrower’s credit score, history of previous Sõbralaen transactions and also personal details. Investors also have the possibility to ask various questions from the borrower. In the end of the auction, the system will automatically pick the best bids and combine them into one loan. Sõbralaen’s system will thereafter manage the rest of the loan process from the payment of loan to debt collection.

Estonians are fast in adapting new internet technologies. This is reflected in the process of Sobralaen’s sign-up, too. Users identification is done at the moment of sign-up electronically. This is possible, because users can only sign up using a government issued ID-card (currently 80% of Estonians had an active ID card – but only 20% make use of its functionalities so far) and a smart card reader or Mobile-ID. Furthermore banking transactions and court documents are signed with digital signatures.

Sobralaen was founded by Pärtel Tomberg, Mikhel Tasa and Martin Rask.

I was invited to test-drive the platform in summer 2008 while it was still under development. The usability was good and I liked the detailed FAQs that explained everything to the point.

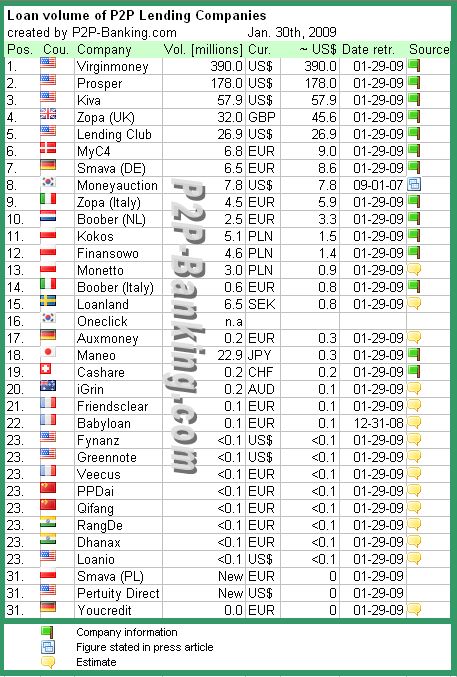

P2P lending companies by loan volume – Jan 09

P2P lending is spreading internationally. While the biggest loan volumes are generated in the US market, many p2p lending websites have been established in other international markets.

P2P-Banking.com has created the following overview table listing services that are in operation and ranked them by loan volume. The loan volumes are not directly comparable for they are cumulative since launch of each service and represent different time spans.

In total approx. 740 million US$ have been funded through peer to peer lending/social lending services so far worldwide.

This image may be reprinted on other internet sites, provided it is not altered or resized and the following text (including the direct link to this article) is given as source directly below the image:

Source: P2P-Banking.com

Since the previous version of this table especially Zopa (UK), Lending Club and Kiva thrived. With Prosper, Loanio and Fynanz halted, Lending Club profits from the situation.

This image may be reprinted under the same conditions as the first one.