The figure quoted for borrowers that are late with at least one payment at dutch Boober.nl is 3.8 percent. This strikes me as quite high, considering operations of started only February this year. A (user composed and maybe not complete) list of the loans that are currently late at Boober, can be found here.

loans

Ireloans to offer p2p lending in Ireland

Ireloans.com has announced that it will offer p2p lending in Ireland. (Source: barcampBank)

Other services still in prelaunch phase include CommunityLend.com in Canada and One2Money.de in Germany (Source: Springwise.com)

Lendingclub to introduce p2p lending to Facebook members

Today, Lendingclub.com launched offering a p2p lending service to Facebook members. Members can request loans between $1000 and $25000. Other facebook members can the lend the money to the borrower. While technically not arranging loans between freinds like CircleLending, Lendingclub makes uses of the social network and the trust that users have into it. Lendingclub combines aspects from other p2p lending sites like Prosper.com and Zopa.com.

Comparing it to Prosper:

- Lendingclub requires higher credit score as threshold for borrowers to apply (640 compared to Prosper’s 520)

- Lendingclub suggests an interest rate based on the borrowers credit grade rather than letting the borrower set an interest rate.

- There are groups like at Prosper

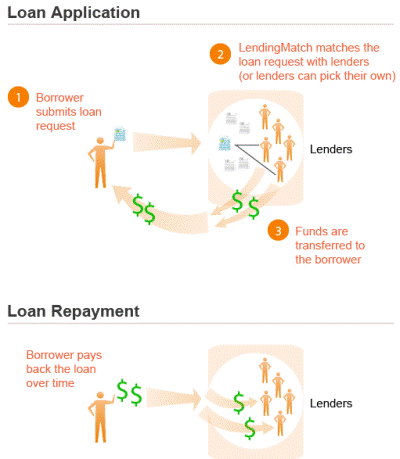

Lendingclub uses what it calls “LendingMatch” to automatically match parties on shared connection it finds. Lenders can additionally manually select and search loans.

The founders of Lendingclub, one of them has a background at Mastercard, raised $2 million in angel funding (source: VentureBeat).

Using an existing social network gives Lendingclub a great marketing advantage over competitor Prosper.com, which had to build its memberbase starting from zero.

Dutch p2p lending site Frooble stops beta after just a few days

The Dutch site Frooble.nl, which was announced to start as competition for Boober.nl, was in public beta mode for only a few days before it was closed to the public by the founders who cited technical problems and said they hope to launch again in September after solving these.

Booberwatch offers statistics on boober.nl p2p lending

The new website booberwatch.nl offers p2p lending stats for the Dutch p2p lending service boober.nl (as wiseclerk.com does for prosper.com stats). While the site is in Dutch language, it has many charts and tables that can be understood without speaking Dutch. The main page shows the fluctation of average interest for each credit grade over time. According to booberwatch 536207 Euros have been loaned so far.

P2P Lending in Denmark offered by Fairrates.dk

Today I received an email from Arkadiusz Hadjuk of Fairrates.dk informing me, that his company started to offer p2p lending in Denmark. Most of the following information was supplied by him.

At Fairrates.dk:

- There are individual listings, both lending and borrowing

- There are no groups

- There is auction bidding down interest rates, both lending and borrowing

- In case of non-payment (for over 1 month) a lender is assisted with

a collection procedure - Minimum loan is 1000 DKK (approx. 135 Euro; approx $100)

- There is no maximum a lender can lend

- Maximum per loan is 50.000 DKK (approx. 6700 Euro; approx. $5100)

- Borrower can request minimum 1000 DKK

- Borrower can request maximum 50000 DKK until his income information

is verified – then the limit is lifted up - Minimum bid is 1000 DKK

- Only people over 18 years old with Danish CPR number and Danish bank

account can lend/borrow - No interest on unlend deposits

- Simple fee structure (borrower pays 1% of loan amount)

- Risk assessment is based on information and documentation provided

by borrowers.

I did technorati and Google searches for additional information. Since I don't speak Danish I could not find much additional information, only a profile of Arkadiusz Hadjuk and a CV of Robert Pawel Bialek (CEO).

Judging by forum activity at Fairrates.dk there is not much traffic yet.

![]()