MyC4 has successfully funded 1000 loans to entrepreneurs in Africa since launch in May 2007. So far none of the loans has defaulted and average interest rate for lenders is 11.7%.

Tim Vang, one of the co-founders of the Danish startup told P2P-Banking.com that the MyC4 will release a new version in May with a new design and better interface. MyC4 also plans to provide loans in additional countries (currently Uganda, Kenya and Cote d'Ivoire).

MyC4's annual report 2007 is available on the Internet (English and Danish). While the company realised a loss of 2.8 million DKK (approx. 0.6 million US$) in 2007, it aims for break even in 2009.

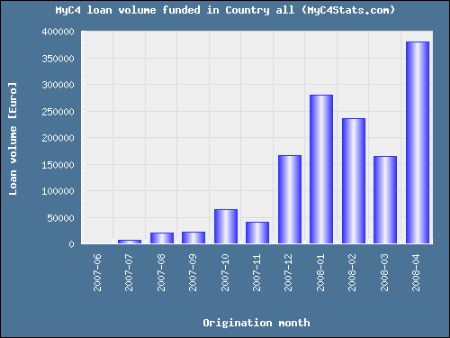

(Source: MyC4 loan statistics, Wiseclerk.com, Apr. 19th)