P2P Lending service Lendingclub.com, which launched last May, today surpasses 10 million US$ in loans. While the total amount is still much lower then the loan volume of competitor Prosper.com (currently over 120 million US$ loan volume) the growth acceleration of Lendingclub is really impressive.

Rob Garcia, Director Web production at Lending Club, told P2P-Banking.com:

This milestone confirms the validity of our approach to person-to-person lending, but more importantly, our value proposition to our borrowers and lenders. Borrowers are realizing 20-30% better rates than going through the banks, while our lenders enjoy 12% average returns. We are working to take this concept to a larger audience, so $10M is just a mile marker in our marathon.

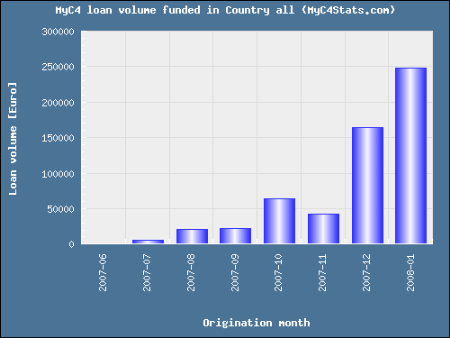

The growth can be seen in this chart. For Prosper loan volume compare chart on this page. So basically in February Lending Club has originiated close to the amount Prosper did, when taking into account only those loans that would fit the minimum criteria of Lending Club's 640 FICO score and <30% DTI.

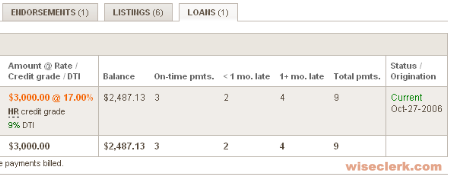

The statistic information at Lendingclub.com shows that over 1200 loans have been issued. So far few loans are late, but since most of the loans are very young, it is to early to tell which level of defaults will have to be expected. The statistic page also shows that Lendingclub declined over 80 million US$ in loan applications.

If you sign up via this link, you get a 25 US$ bonus by Lending Club (and I am paid a referral fee).