November was a month of mixed results for the listed p2p lending services. Some grew, some had a small decline in newly originated loan volume this month. Ratesetter crossed a total volume of 400 million GBP originated since inception. Ablrate profited from the deal with the first institutional investor, which boosted volume. I added one more service. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

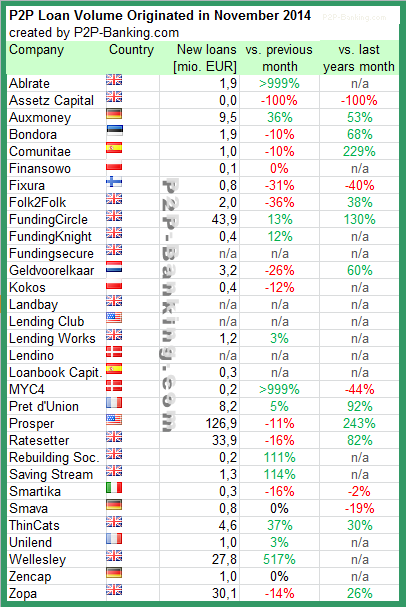

Table: P2P Lending Volumes in November 2014. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.

British laws must be very liberal to allow this. In many other European countries interest rates like this would be illegal under consumer protection laws against usury. But Wonga does have a consumer credit licence from the

British laws must be very liberal to allow this. In many other European countries interest rates like this would be illegal under consumer protection laws against usury. But Wonga does have a consumer credit licence from the