Heavyfinance* is a P2P platform where investors can lend to farmers, often secured by farm machinery. Recently, Heavyfinance* launched a new type of loan, which they have named “Green Loans“. The idea is that farmers cultivate their fields using climate-friendly methods (‘carbon farming‘). In the process, carbon emissions are reduced so that they receive carbon credits. Investors can invest specifically in loans that contribute to climate protection (‘carbon investing‘).

Unlike in ‘normal’ loans, the investor does not receive any interest, but in addition to the repayment of the loan, receives a share from the proceeds from the sale of the CO² certificates.

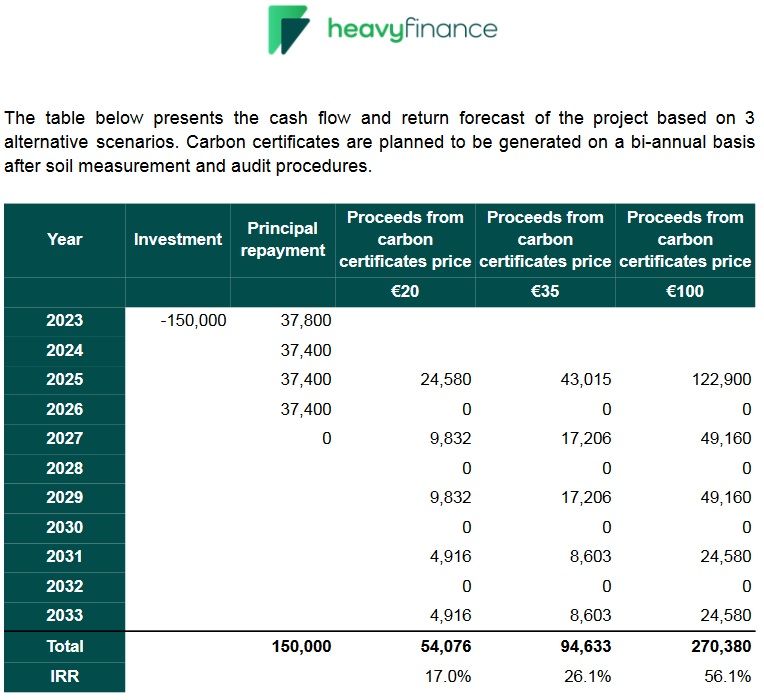

Illustration: Example of a cash flow plan for a green loan.

As the picture of the example loan illustrates, this is a very long-term investment. Although the loan amount is repaid within 3 years, the proceeds from the certificate sale are paid till the 10th year. Heavyfinance* forecasts an annual yield of 17% to 56%, depending on the price of the carbon credits.

Pros for investing in Green Loans:

- Support for climate-friendly measures

- High return, if everything works out as Heavyfinance predicts.

Cons for investing in Green Loans:

- No fixed interest rate, there is a risk that Heavyfinance’s forecasts are too optimistic

- Very long-term investment, though loans can be traded on the secondary market

- New model, no track-record so far

Incidentally, the farmer has a vested interest in the carbon certificates being issued and marketed, because he also participates. In the first 7 years he receives 60% of the proceeds (the investor 40%) and in years 7-10 80% of the proceeds (the investor 20%).

I asked Heavyfinance* how they deal with the risk that the farmer does not implement the climate measures after receiving the loan and thus no certificates can be marketed. In that case, the farmer has to pay penalty interest (10-13%) as agreed in the contract between Heavyfinance and him.

The certificates are not traded on a stock exchange. Heavyfinance* told me on request that they plan to sell them to carbon certificate traders who already trade in large volumes of carbon certificates. Another possibility is direct sales to selected large companies.

I will follow with great interest how the green loans at Heavyfinance* develop and what certificate proceeds are actually achieved.

The green loans are marked with a green background on the project overview page at Heavyfinance* and are therefore easy to see in the overview.

P2P lending marketplace

P2P lending marketplace