Today I will take a look at the communication approaches of Prosper, Lendingclub, Zopa and Smava. Since it is hard to judge the individual customer support these companies offer, the focus of this post is on the mass communication channels. To communicate their services to the lenders and borrowers the services can use the website's FAQ/tutorials, a forum, blog(s) and newsletter(s).

Prosper.com

Prosper has very detailed FAQs, which leave no aspect open. There are tutorials, videos and webinars. The Prosper forums are very active. While Prosper announce changes to the service in detail (here), the policy usually seems not to comment on individual users questions (except for the bug report section). Prosper seems to rely on users to communicate and educate each other in the forums. There has been criticism about censorship and deleted posts in the forums which led some users to set up an prosper independent forum.

As far as I can tell Prosper has no blog of its own, but there is a personal blog of the CTO John Witchel. But it is not very active and will probably not be found by the average Prosper user.

Zopa

The Zopa FAQs are detailed, too. The Zopa Forum is quite active with Zopa staff members responding to posts and questions. Zopa has a company blog which has a leisurely tone and often is offtopic. In my opinion it could get more informative for lenders or borrowers.

The same applies to the newsletters Zopa sends out.

Smava

Smava maintains a very detailed and good FAQ. The Smava forum is pretty quite, but Smava staff usually is responsive to user questions. There is no blog. Smava is only 3 month old and so far there have been only 2 or 3 newsletters, which were mainly a summary of developments.

Lendingclub

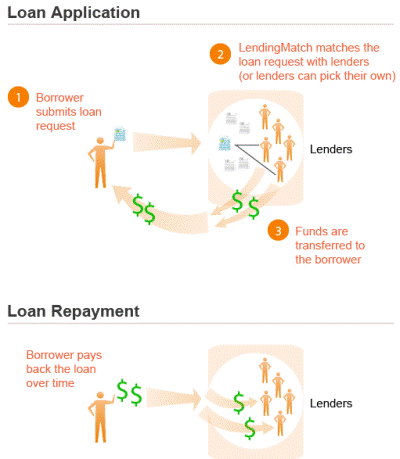

Lendingclub communicates very different from the others. Mainly it relies on it's blog which is in fact directly on the Lendingclub.com homepage. The blog is very active with up to 2 or 3 posts per day. Not only does it explain details of the lendingclub service but also has general advice on personal finance, e.g. on obtaining and maintaining good credit. Lendingclub has lots of guest authors contributing to the blog. The FAQ are somewhat hidden and only available to logged in users (unless you know the direct link). The information, when located, is detailed (e.g. states). As far as I am aware there is no Lendingclub forum.

My impression is that Prosper and Smava communicate in a style that appears more corporate and 'old fashioned' always pondering what information can be released and what for. Prosper has occasionaly received rather aggresive feedback of users, citing them of being non-responsive to the wishes of their users. Zopa has a more buddying tone – hey take it easy. Lendingclub sounds educational to borrowers, aiming to help them by supplying them information. On the other hand Lendingclub's approach seems a little marketing driven, because their approach gains them search engine and blog visibility.

Lendingclub's loan volume has surpassed 750000 US$. So far the average interest rate is 11.10%. As you can see in the table the majority of loans went to borrowers with good credit grades.

Lendingclub's loan volume has surpassed 750000 US$. So far the average interest rate is 11.10%. As you can see in the table the majority of loans went to borrowers with good credit grades.