P2P lending services continue to grow. In some markets the speed of growth has even accelerated.

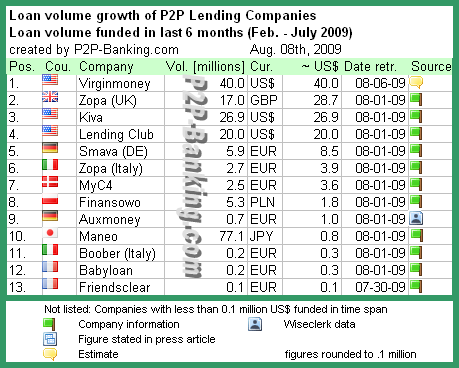

P2P-Banking.com has created the following overview table listing services in operation and ranked them by loan volume funded in the past 6 months.

This image may be reprinted on other internet sites, provided it is not altered or resized and the following text (including the direct link to this article) is given as source directly below the image:

Source: P2P-Banking.com

For some service like the Korean Moneyauction and Popfunding no figures were available. Also omitted are some services that did not reply to information requests.

Note that Prosper.com was closed for most of the observed time span and did not make the minimum cutoff for the table. Also note that Zopa Italy is currently closed.

For a table listing more p2p lending companies check previous ‘P2P Lending Companies by Loan Volume – Jan. 09‘.

Especially british Zopa and the German services show strong growth lately. Smava nearly doubled loan volume in July compared to June (chart), whereas Auxmoney tripled it (chart). At Smava currently even 25,000 Euro loans (approx. 35,750 US$) are funded with bids in only 4 minutes (!) bidding time (example loan).

On the other hand MYC4‘s growth slowed in the last months (chart) due to problems with the providers loan picks.

Matt Flannery has written a great article recapitulating the story of

Matt Flannery has written a great article recapitulating the story of