In this video animation each moving point is a Kiva loan share. A share leaves the lender on the fundraising date and returns from the borrower on the loan’s ended/repaid date. Absolutely stunning to watch the dimension.

Kiva

Gimmick – App for P2P Lenders

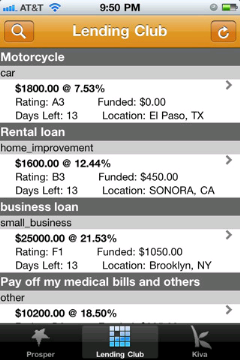

I just saw the first iPhone App that is to support lenders in using p2p lending services. It aims to help them keeping up to date with the latest listings at Prosper, Lending Club and Kiva.

I just saw the first iPhone App that is to support lenders in using p2p lending services. It aims to help them keeping up to date with the latest listings at Prosper, Lending Club and Kiva.

The features of this app are rather basic, but with the number of people lending at p2p services there could be a market for a sophisticated app that really helps lenders select loans while on the move.

Update: There are in fact two other free apps to browse Kiva loan listings.

P2P Start-ups: Finding an Opportunity in the Midst of a Lingering Recession

The global recession or what has come to be known as the ‘great recession’ –in direct reference to the 1930s era Great Depression-has been with us unbelievably for the last 3 and a half years. It doesn’t seem like it does it? Many had predicted that it would turn out to be a ‘W’ or maybe a ‘U shaped or even a ‘double dip’ recovery by now, with most commentators assuming that we would most likely have seen its tail end with a year or two. Most- if not all of them- have been proved embarrassingly wrong! Countries such as the UK, US, Spain, Ireland, Hungary, Portugal –the list goes one and on and on and on- are still counting the cost of the recession in terms of lost jobs, productivity and in some cases, sovereign default! Recovery it seems, whatever alphabet sounds sexy, W or U shaped –is still yet to be seen in many cases.

Looking at the effects of the recession from the microfinance industry perspective however is what makes very interesting reading. Microfinance as such, is an industry that is curiously not correlated directly to the mainstream financial markets. Continue reading

Awe-Inspiring: Lender funded 23,079 Kiva Loans

Today, when I funded 2 more Kiva loans, I stumbled across the profile of Laurent D, from Belgium, who has funded 23,079 Kiva loans in the last 3 years. On his profile he states “I love the idea of helping people reach their financial independence”. Well said. And I bow to the dedication of making that many loans.

This got me wondering if there are lenders with even larger portfolio’s funded? There isn’t any information on this in the Kiva stats section.

Update: After using queries at Kivadata.org, it looks to me, that LaurentD actually is the lender, who did the most loans on Kiva, with Good Dogg, from the US, following second with 17,077 loans.

In Bed with the Enemy? Kiva and the Chevron Grant

100% of the money Kiva lenders loan goes to the borrowers via the MFIs. Kiva funds it’s operations by donations and grants. The list of corporate partners supporting Kiva is long and growing.

100% of the money Kiva lenders loan goes to the borrowers via the MFIs. Kiva funds it’s operations by donations and grants. The list of corporate partners supporting Kiva is long and growing.

When Kiva announced that they received a 0.5 million US$ one-year grant from Chevron to assist with operational needs across the organization on the one hand that means that Kiva can continue to grow and pursue it’s vision.

On the other hand it did raise concerns with some lenders given the reputation of Chevron. The company is criticized of negligence of environmental risks on multiple accounts (example, example2 or see links in Wikipedia article). Many of the incidents occurred in countries where Kiva is now trying to help.

It’ easy to see why Chevron chose to assist the Kiva cause – it could improve their tarnished reputation and Kiva has a high visibility.

The issue is more on the Kiva side. Why did Kiva accept this grant from a very controversial sponsor? As hard as it must be to keep an organisation running solely on grants and donations – does the end always justify the means?

I am a fan of Kiva but I do have large doubts whether it was the right decision to accept this grant.

One lender in this discussion thread put it this way:

An organization that has human rights issues, donating to a group trying to empower humans. Isn’t there something wrong with this picture? What, is Chevron trying not to have nightmares when they put their head on their pillow at night, and Kiva is supposed to make them feel better maybe? A good name for this partnership might be ‘sleeping with the enemy’ . . .

Kiva Video Contest

Kiva has announced a crowdsourcing contest to produce a 30 sec. to 2 min. video that is not only inspiring and explains how the Kiva process works but also raises awareness and attracts new lenders to Kiva.

Kiva has announced a crowdsourcing contest to produce a 30 sec. to 2 min. video that is not only inspiring and explains how the Kiva process works but also raises awareness and attracts new lenders to Kiva.

The contest is sponsored by Tongal, a startup that crowdsources the creation of content. The best videos win a total of 10,000 US$.