Recently, p2p lending service Isepankur opened to international lenders. Residents from any European Union country and Switzerland can now sign up and start investing. There are no fees for lenders. I wanted to gain first hand experience as soon as possible so I signed up immediately and now share the process.

Recently, p2p lending service Isepankur opened to international lenders. Residents from any European Union country and Switzerland can now sign up and start investing. There are no fees for lenders. I wanted to gain first hand experience as soon as possible so I signed up immediately and now share the process.

Getting started – Registration

Registration takes place completely online. First click on ‘Join for free’ and choose a username and a password. Isepankur now sends an verification email. After confirming that, there is a form where the personal details are entered. Also choose between confirming bids via password or mobile ID.

Depositing funds

Depositing funds is done via SEPA bank transfer. For transfers done in Euro this does cost the same bank fee as a domestic bank transfer – in my case it was free. I transferred 1,000 Euro in and the amount was credited to my account the next day.

Before investing is possible, Isepankur needs to confirm the identity of the lender. That was completed the same day the money arrived, and I was ready to start investing.

First investment

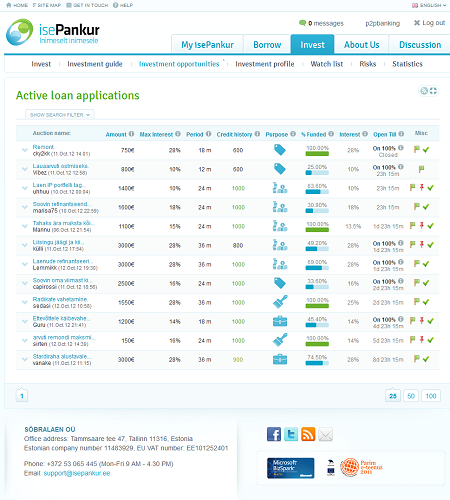

Isepankur uses an auction model, where individual p2p loan applications are listed. Lenders can either manually bid or use investment profiles for automatic bidding. Under ‘Invest’, ‘Investment Opportunities’ is the list of open loan auction. There are two different types: those that close immediately once 100% funded and those that continue to run until the auction time ends with investors underbidding each other’s interest rates once 100% funding is reached.

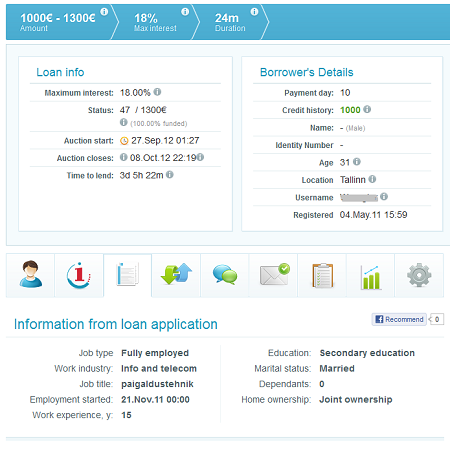

By clicking on a loan listing, the detail information can be reviewed. Isepankur only allows fully employed borrowers on the marketplace and checks their income and credit history.

Sample of the detail information on the loan application. Lists age, type of employment, length of employment, education level and home ownership.

Sample of the detail information on the loan application. The borrower has an income of 775 Euro and existing liabilities of 165 Euro per month. Continue reading

German p2p lending service

German p2p lending service  (Photo by

(Photo by