P2P Lending marketplace Isepankur yesterday rebranded as Bondora. Bondora is active for borrowers in Estonia, Spain, Finland and Slovakia and lenders in 29 countries across Europe (all European Union countries plus Switzerland).

P2P Lending marketplace Isepankur yesterday rebranded as Bondora. Bondora is active for borrowers in Estonia, Spain, Finland and Slovakia and lenders in 29 countries across Europe (all European Union countries plus Switzerland).

Following a new 1.3M Euro round of financing raised for the company, Bondora welcomes a new board to help the company in delivering an innovative business idea across the borders.

Mark Noetzold (a member of various supervisory boards and a lecturer for risk management in Germany, Switzerland and Austria), João P. S. Monteiro (an international manager responsible for global development at a blue-chip company) and Mati Otsmaa (a C-level management executive with extensive experience in consumer credit lending at American Express, Barclays, Citibank, Chase, Experian and HSBC) join forces to improve, market and raise awareness for the first cross-border peer-lending platform Bondora.

„Direct or p2p lending is the most rapidly developing financial service today and has a huge future potential by offering the best solutions to the borrowers and high returns for the lenders. I believe that Bondora, with its cross-border strategy, strong team and the ability to execute fast, has the potential to change the world of finance to be more transparent and straightforward,†– commented João P. S. Monteiro, board member and one of the angel investors.

According to an article in E24 Postimees the new investors now hold about 19% to 20% of the company shares.

„Over the last 5 years we have brought together over 70,000 customers from 29 countries to borrow and lend on our platform. The newly raised capital will be used to improve, market and raise awareness of our service further. Today we have a product, where a telephone engineer from Estonia could get funds to renovate his flat from a dozen of lenders located in any European country. Not only our borrowers get a chance to have their loans financed, but they get the best available deal on the marketplace. A secretary from Slovakia, for example, ready to pay 28% for a 600 Euro loan to study English, might end up paying only 12% because lenders pile in. It is a simple and secure application process for the borrowers and a possibility to diversify private investment for the lenders. At the moment 26% of our lenders come from Germany, 11% from the UK and 4% from Switzerland (with the rest being spread across Europe). With the rapid growth of the company in the last year, the old name could no longer accommodate room for our cross-border growth, that is why today we are also launching our new name – Bondora, and our website available in 23 languages,†– commented the CEO of Bondora, Pärtel Tomberg. Continue reading

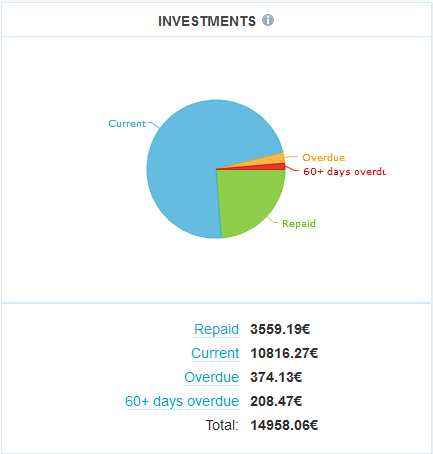

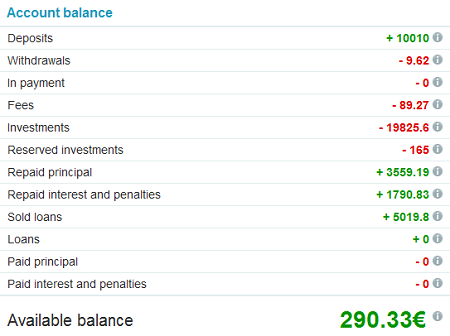

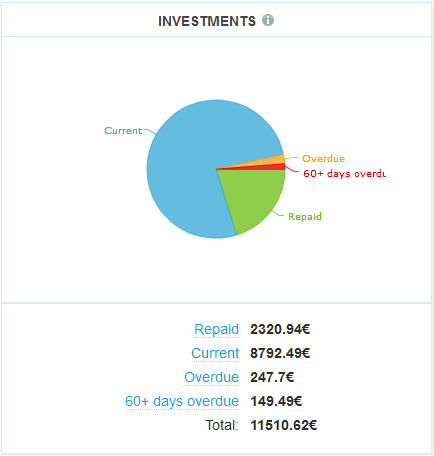

As you all know, if you are a regular reader of this blog, I have been investing on the

As you all know, if you are a regular reader of this blog, I have been investing on the