This is a guest post by British Bondora investor ‘ParisinGOC’.

Introduction

Financial institutions across the world have many ways of assessing whether a loan is worth making. A simple search on the web reveals that many use Data Mining. More specifically, “Decision Trees†are a particular tool within Data Mining that has been analysed and I quickly found at least 2 papers (Mining Interesting Rules in Bank Loans Data and Assessing Loan Risks: A Data Mining Case Study) amongst many pointing in this direction.

Having had some experience of Data Mining in a financial environment, I believed I could use these same techniques in my own P2P lending which, after over 12 months activity, I felt could be improved.

In this document, I explore the use of the freely available Data Mining Software “RapidMiner†and its Decision Tree capabilities when applied to the data available to investors from Bondora, a peer-to-peer (P2P) lending site.

Bondora

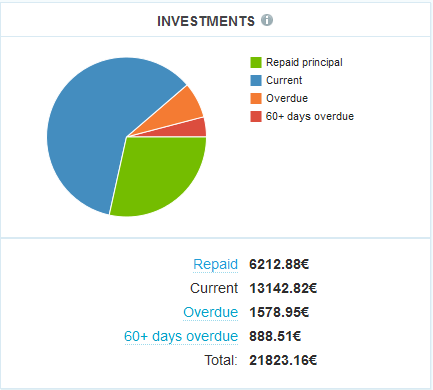

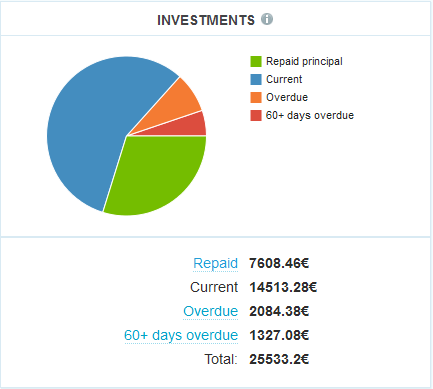

Bondora is a P2P lending site based in Estonia that “unites investors and borrowers from all corners of the worldâ€, allowing investors to invest funds to satisfy advertised borrowing needs.

Fundamentally, Bondora also provides comprehensive data to investors, allowing detailed data downloads of the individual loans held by the investor, as well as data on every application made to Bondora (originally known as Isepankur) since the first application on 21st February, 2009.

It is the complete Bondora data set that I have used as the raw data for analysis as it is the best data available to find out which potential borrowers are the right match to the potential lenders. Only if enough lenders feel that a loan application is worth investing in will the loan be fulfilled. Self-selection is taking place in both elements of the loan fulfilment and this data is the result of that interaction.

Also shown in this data are some elements of loan performance post-drawdown. Crucially, it shows those loans that subsequently defaulted (failed to make any payments for a period in excess of 60 days). Although Bondora will chase the debt on behalf of the investor and have a track record of some success, there is no guarantee that the investment, or any part of it, will be returned.

Decision Trees

www.investopedia.com/terms/d/decision-tree.asp states: A schematic tree-shaped diagram used to determine a course of action or show a statistical probability.

In this case, I am using the data provided by Bondora on all its previous applications to reveal how the resulting loans that share similar characteristics have performed.

Specifically, I am using this data to show the percentage of those previous loans that have defaulted and using this to indicate how a similar, new application may perform should the application succeed in attracting enough investors.

In other words, I am using past performance data to show how future investments may perform – I feel sure I have seen this phrase somewhere before! Continue reading

One advantage of

One advantage of