![]() Plenti*, formerly Ratesetter Australia, is seeking to raise 55M AUD from investors in Australia and New Zealand through an IPO. The IPO takes place from Sep. 7th and the plan is to list the shares on the Australian stock exchange on Sep. 23rd.

Plenti*, formerly Ratesetter Australia, is seeking to raise 55M AUD from investors in Australia and New Zealand through an IPO. The IPO takes place from Sep. 7th and the plan is to list the shares on the Australian stock exchange on Sep. 23rd.

The Plenti IPO prospectus reveals that Plenti will be valued at 280M AUD in the IPO.

Plenti wants to use the majority of the raised capital for warehouse funding for equity tranches and as working capital (see section 7.1.2)

Plenti’s Chairmen Mary Ploughman states: ‘Plenti’s proprietary technology platform provides borrowers, investors and commercial partners with simple digital experiences. The Company believes its technology platform provides a meaningful competitive advantage in markets where speed and ease of services are increasingly important, and believes its technology platform provides an important foundation to support continued growth and operational leverage over coming years.’

The initiative comes after Ratesetter UK announced it will be acquired by Metro Bank. The shares Ratesetter UK held in Ratesetter Australia were not part of the operation and the 18 million shares Ratesetter UK held in Plenti (Ratesetter AUS) will still benefit the original shareholders in Ratesetter UK.

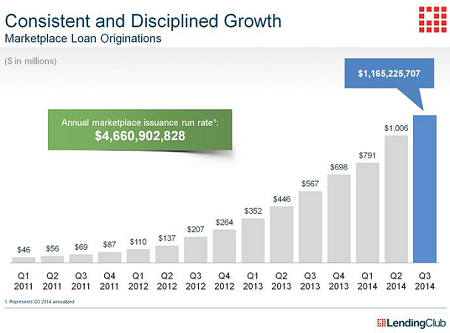

As of August 2020, Plenti has originated 724 million AUD (this figure is from the online statistics, the prospectus states 870M) in consumer loans since the launch of the marketplace in 2014. In July 2020 Plenti introduced maximum rate caps for investors forcing interest rates down in order to attract more borrowers after the new volumes had about halfed since the start of the COVID 19 crisis. Ratesetter results for the financial year 2020 (ending March 31st, 2020) were a loss of 16.4M AUD (see section 4.7).

The long announced IPO of marketplace lender

The long announced IPO of marketplace lender