Read part one of the interview first

This is the second part of an interview with Julia Kurnia, Director and Founder of Zidisha Microfinance.

Does the Euro crisis in any way impact Zidisha’s business?

The Euro is the home currency of many of our lenders. To the extent that the Euro crisis causes it to depreciate against the US dollar (in which Zidisha account balances are denominated) and against the borrowers’ currencies in which loan values are fixed, it will increase financial returns when these funds are converted back to Euros.

That said, lending with Zidisha is intended to be a philanthropic activity, and most of our members seek to generate social benefits in a way that is financially sustainable. Zidisha loans typically allow economically disadvantaged households to expand their cash businesses to the point where incomes are increased by 150% to 200%. The additional cash is very often invested in the children’s education – both by providing sufficient living income so that teenagers do not need to drop out of school to support their families, and by covering the costs of continued schooling. The return to society from this kind of investment in education of the next generation of the rural poor in developing countries is impossible to quantify. This will continue to be true regardless of currency fluctuations.

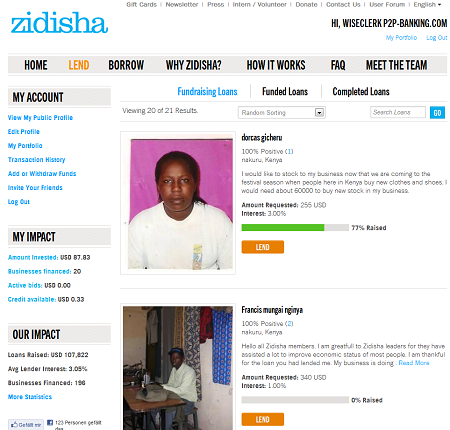

A week ago Zidisha got a new design. What is new?

Our new design reflects feedback from the Zidisha community, and the growth of our organization. We opted for a clean, modern style and an uncluttered, simple layout that is in keeping with our values of directness and transparency. The new site is more effortless to navigate, easier to learn and read about Zidisha entrepreneurs, and simpler than ever to make a loan. We’ve also included more social media buttons so that visitors can conveniently share Zidisha with friends and family, and connect with us via Facebook and Twitter.

Zidisha is doing direct p2p lending. Do you think it is likely that there will be a substantial shift from indirect p2p lending (like Kiva does) to a direct model without MFIs in the future?

Yes, I think that is the future of online microlending. As Zidisha has proven that the concept is viable, I’m sure that we will inspire many similar initiatives. I expect to see other organizations – both new start-ups and established platforms – experiment with direct P2P lending across the international wealth divide. This will be a welcome development, generating positive social impact beyond the reach of our organization, valuable learning opportunities for P2P lending and microfinance practitioners, and useful variety for our clients. Continue reading

Unlike the postings on other microlending platforms, the loan applications and comments posted on Zidisha’s loan pages are written by the borrowers themselves. This opens the way for dialogue between lenders and borrowers, so that lenders can receive answers to their inquiries about the loan and business directly from the entrepreneur they are funding. At the same time, the direct peer-to-peer connection reduces the administrative cost of loans by automating and outsourcing to borrowers and lenders themselves many of the record-keeping and credit-screening functions traditionally performed manually by local microfinance institutions. As a result, the average Zidisha borrower pays about 8% in annual interest and fees, including interest paid out to lenders. Over the past two years we’ve facilitated over 100,000 US$ in microloans for low-income individuals in four countries. Zidisha borrowers have maintained a repayment rate of 99.5% for ended loans – disproving the notion that the working poor in developing countries cannot be trusted to repay loans without the support of expensive local organizations.

Unlike the postings on other microlending platforms, the loan applications and comments posted on Zidisha’s loan pages are written by the borrowers themselves. This opens the way for dialogue between lenders and borrowers, so that lenders can receive answers to their inquiries about the loan and business directly from the entrepreneur they are funding. At the same time, the direct peer-to-peer connection reduces the administrative cost of loans by automating and outsourcing to borrowers and lenders themselves many of the record-keeping and credit-screening functions traditionally performed manually by local microfinance institutions. As a result, the average Zidisha borrower pays about 8% in annual interest and fees, including interest paid out to lenders. Over the past two years we’ve facilitated over 100,000 US$ in microloans for low-income individuals in four countries. Zidisha borrowers have maintained a repayment rate of 99.5% for ended loans – disproving the notion that the working poor in developing countries cannot be trusted to repay loans without the support of expensive local organizations. How did you get the idea for Symbid?

How did you get the idea for Symbid? In early summer 2010

In early summer 2010  In a telephone call MYC4 executive Jes Colding yesterday gave P2P-Banking.com a preview of the future positioning of MYC4. The two main goals are risk mitigation and new provider structure.

In a telephone call MYC4 executive Jes Colding yesterday gave P2P-Banking.com a preview of the future positioning of MYC4. The two main goals are risk mitigation and new provider structure.