Since last August I am investing on the Indemo* platform. In an earlier article I described in detail how Indemo works and why it was attractive to me. It has been going well so far. My portolio consist of 15 properties in 13 notes. Two further properties have already been successfully sold, yielding profits to investors including me that were well above the originally projected yield of 15.1% p.a.

Last week property A26 was sold, which gave me returns ranging from 15.9% to 24.2% (second column in the screenshot). The different yield numbers rsulting from the same property sale are due to the various different investment dates ranging from November 23rd to April 23rd (first column in grey). In this case the property was sold after only 7 month of being first listed on the platform meaning the success was achieved much quicker than the expected stated term of 24 month.

Click on screenshot for enlarged view

On the previous sale I had even higher yields ranging from 32% to 57% p.a.

Indemo Cashback Bonus

Starting today, Indemo* is offering new investors, that sign up via this Indemo* link 3% cashback on investments. Important: To get the cashback the new investor needs to enter the Indemo promo code “CASHBACK” (without the quotation marks) in the dedicated field during registration.

Existing investors get 2% cashback. The cashback will be applied on all investments till July, 31st 2024. The cashback amount is credited instantly. I just invested 800 Euro in a note and as existing customer got credited 16 Euro.

Screenshot: This is how to enter the Indemo Promo Code CASHBACK at registration

Screenshot: I got my cashback for my 800 EUR invest credited instantly

In the past two weeks Indemo* has:

- added multiple new features on the website, including a dashboard and analytics section, better account statements, and better information on the object composition in new notes.

I observed that Indemo is really aiming to implement features requested by investors to make the user experience better for the investors. - crossed 1,000 registered investors mark

- announced 2 million EUR assets under management, saying that growth accelerated compared to reaching the first million EUR

- added 3 new objects that are part of new notes offered

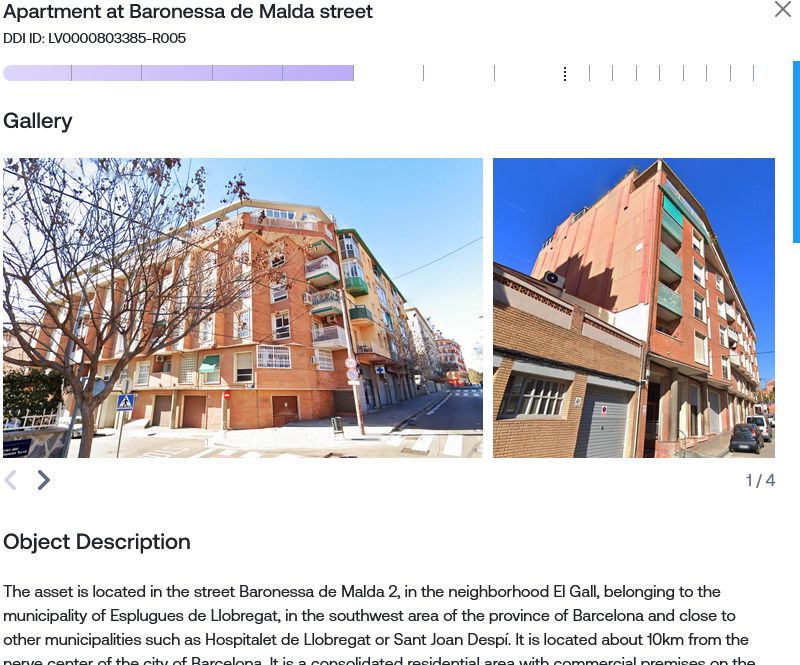

Screenshot: one of the recently added properties: an appartment in Barcelona

Most of the properties on the Indemo* platform are in towns on the Mediterranean coast.