In this video animation each moving point is a Kiva loan share. A share leaves the lender on the fundraising date and returns from the borrower on the loan’s ended/repaid date. Absolutely stunning to watch the dimension.

growth

Growth and other Recent News in P2P Lending

Zopa has announced that it reached the milestone of 150 million GBP in loans facilitated. Zopa says the new loan volume per month accounts for between 1% and 2% of new personal loan volume made in the UK.

P2P lending service Lending Club announced yesterday that it has been selected as a World Economic Forum 2012 Technology Pioneer. Lending Club was selected from amongst hundreds of applicants from around the world that hold the promise of significantly impacting the way business and society operate.

Both Lending Club and Prosper did continue their growth of monthly loan volume origination in August (Sociallending.net has charts and company comments).

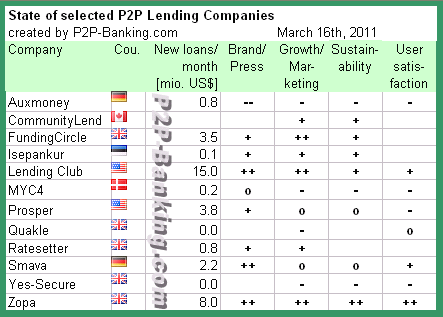

State of Selected P2P Lending Companies

More than 2 years have passed, since P2P-Banking.com published the first overview table of p2p lending companies. At that time the focus was to create a comprehensive list and to get a perspective on the loan volumes.

Today I want to look at a smaller selection of p2p lending companies and do a rating on more factors than just loan volume. While I describe below what factors led to my rating, please note that the rating represents my personal opinion.

The table lists the companies in alphabetical order and gives:

New loan volume per month

This amount is in most cases retrieved from the last month(s) figures from the company websites (if they have statistic sections), and then converted into US$ at today’s currency exchange rates. In other cases it is a rough estimate by me based on volume figures published in media in the recent past. For CommunityLend I failed to find a per month figure (the total figure from launch to mid-February is here).

Brand/Press

Extend and tone of press coverage in the past months. Since a large share of new users is introduced to p2p lending services via media, positive media coverage is extremely important. Continued positive media coverage has helped some companies to associate positive values to their brand.

Growth/Marketing

This column especially rates if the new loan volume is growing continuously month after month. Furthermore it puts the absolute volume into perspective to the size of the market. It is obvious that absolute numbers in a country with a small population (e.g. Canada) will be much lower than those in a country with a large population (e.g. US). Furthermore it takes into account if the (online) marketing measures of the the company succeed in winning new borrowers and lenders (though in most markets lenders do not need to be actively acquired).

Sustainability

Sustainability rates a mix of several factors:

- ROIs for lenders / default rates

Most p2p lending companies that failed in the past, did so as a result of high default rates which led to negative lender ROIs and caused massive lender churn - Ability of company to raise new funding

Most p2p lending companies still have to bridge a considerable time-span at their current growth rate before they become cash flow positive. The ability to raise more funding to finance continued operation is essential for their success - Business model

User satisfaction

This rates the publicly voiced user opinion. Major factor are the comments in forums. To a lesser degree I took the user experience published in blog articles into account. The problem with lender experiences published in blogs often is that the writer is casting a positive image, since he earns commissions for newly referred customers through the affiliate program of the p2p lending site. Also these review are often written at the start of the lending activity at which point the lender’s ROI is naturally unharmed by the experience of defaults.

Empty fields: I had not enough information to rate these. E.g. with some of the new UK p2p lending companies I felt I had too few indicators to reach an opinion on the sustainability.

Availability of information also influenced the selection of companies. Due to language barriers including more services (e.g. the Japanese p2p lending companies) was not feasible for me.

CommunityLend Raises 1.5 Million CAN$

CommunityLend has closed a 1.5 million CAN$ private placement from several individual angel investors and an institutional investment fund. The proceeds of this private placement will go to scaling up loan origination, loan adjudication, and loan servicing operations, the company says, continuing:

CommunityLend has closed a 1.5 million CAN$ private placement from several individual angel investors and an institutional investment fund. The proceeds of this private placement will go to scaling up loan origination, loan adjudication, and loan servicing operations, the company says, continuing:

This investment comes on the heels of a successful year since our launch as Canada’s 1st (and only) online consumer loan marketplace by CommunityLend Inc. Monthly loan volume has more than doubled each of the last 3 months and we are projecting this pace of growth to continue throughout 2011.

(Source: Communitylend blog)

Zopa Celebrates £100M in Funded Loans

This week Zopa celebrated the milestone of 100 million GBP in p2p loans funded (since it’s launch in 2005).

Here is how ITV London tonight featured Zopa yesterday:

Zopa Expects Record Loan Volume Growth in August

In the UK Zopa expects a record month of new p2p loans funded. CEO Giles Andrews told P2P-Banking.com today: “We are going through some dramatic growth at the moment. July was a record month with 908 loans for 4.5 million GBP, but we should do 1100 for 5.5 million GBP in August.”

In the UK Zopa expects a record month of new p2p loans funded. CEO Giles Andrews told P2P-Banking.com today: “We are going through some dramatic growth at the moment. July was a record month with 908 loans for 4.5 million GBP, but we should do 1100 for 5.5 million GBP in August.”