This post is based on the findings, which German investor ‘Bandit55555’ posted in his own blog p2p-anlage.de. ‘Bandit55555’ is the investor at Bondora with the highest ROI (at least that I am aware of): He calculates his XIRR ROI to be 35.4%, while Bondora displays 57.5% for his portfolio. He achieves that by very diligently using the public download data supplied by Bondora as a basis for his investing and trading. In fact he even developed his own scoring system based on the data.

The secondary market of p2p lending marketplace Bondora was introduced in March 2013. Right now more than 24,400 loan parts are on sale. Using the data Bondora makes publicly available for download the following charts were created.

Number of loans sold on Bondora’s secondary market. Source p2p-anlage.de, reproduced here with permission. Continue reading

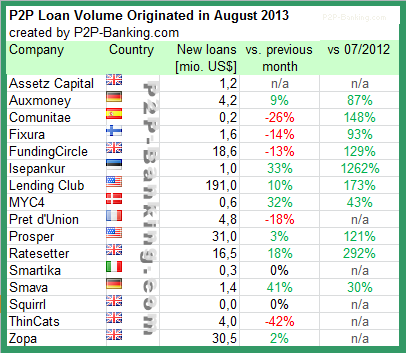

At German

At German

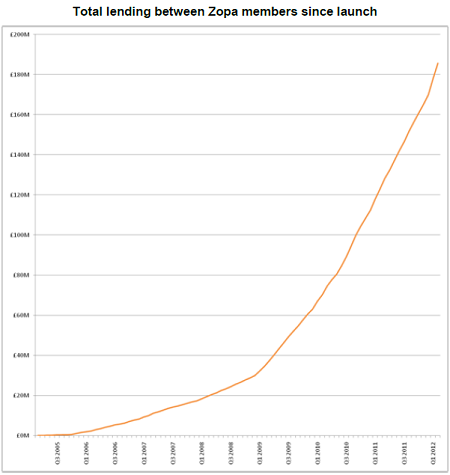

British P2P Lending marketplace

British P2P Lending marketplace