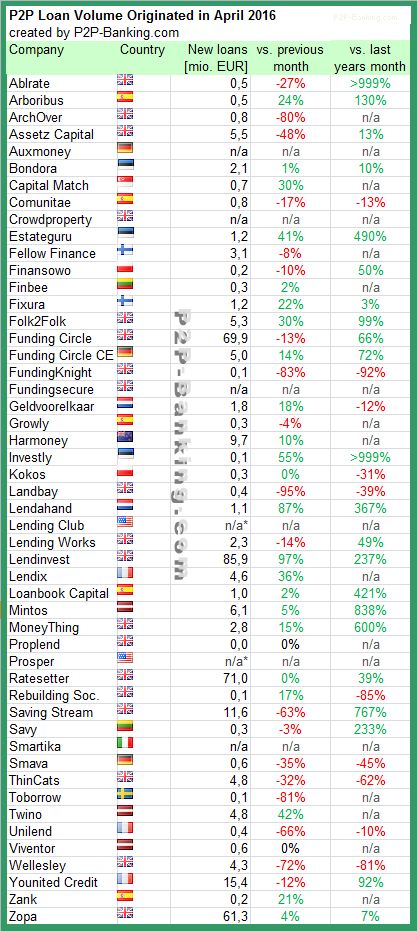

The following table lists the loan originations of p2p lending marketplaces in April. Lendinvest leads ahead of Ratesetter and Funding Circle UK. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending platforms.

Investors living in markets with no or limited choice of local p2p lending services can check this list of marketplaces open to international investors. Investors can also check how to make use of current p2p lending cashback offers available.

Last month Younited Credit (formerly Prêt d’Union) originated first loans in Italy. Geoffroy Guigou told P2P-Banking.com, Younited Credit had a great start, with 416,500 Euro loans originated.

Table: P2P Lending Volumes in April 2016. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

Notice to p2p lending services not listed: Continue reading