Globefunder announced the launch of Globefunder India, which it claims is the first p2p lending service in India.

GlobeFunder India is now up and running, making us the first online lending marketplace to establish operations there. If you are a lender in India, the good news is that you will soon have a way to capitalize on one of the most vibrant and fastest growing economies in the world.

I checked the website. "Up and running" does not mean that you can register as a lender or request a loan so far. In fact borrowers will not use the website in the Globefunder India process:

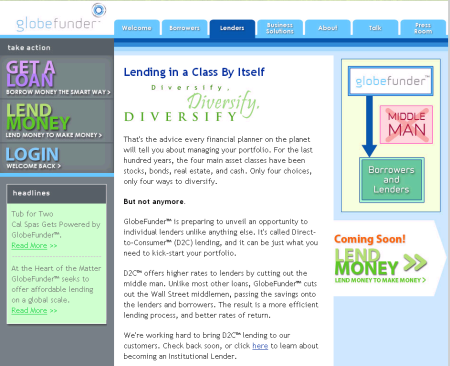

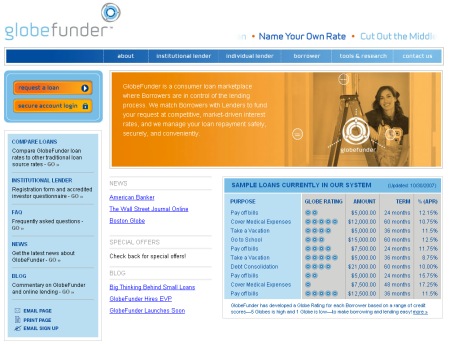

While in the U.S. lenders can access borrowers directly, in India the sheer size of the lending market and the regulatory environment necessitate a slightly different approach. In partnership with global managed services provider Intellecap and some of the leading banks in India, GlobeFunder India links lenders and borrowers through a network of well-established Micro Finance Institutions (MFIs).These MFIs are rated based on their credit worthiness similar to individual borrowers on the U.S. GlobeFunder marketplace, and these MFIs in turn work with individual borrowers through their extensive on-the-ground networks.

According to Globefunder there is an unmet loan demand in India of 40 billion US$.

If you are an Indian resident and use Globefunder India, please share your experiences in the Globefunder forum of Wiseclerk.com Thank you.