Video panel on p2p lending at Le Web with Samir Desai, CEO of Funding Circle, Renauld Laplanche, CEO of Lending Club and Raffael Johnen, CEO of Auxmoney.

fundingcircle

New Investment Fund Focussing on Investing in Global P2P Lending

‘P2P Income Partners‘ is a new investment fund by Symfonie Capital that will invest capital in p2p loans. The founder, Michael Sonenshine, an ex-investment banker, told P2P-Banking.com that he plans the first tranche to be 25 million Euro. He says: “Initially we will invest in loans issued by sites such as Prosper, Lending club, Funding Circle, Zopa, Isepankur and we will add fonds to the mix as we see fit. The P2P market is not only web-based. Â There are opportunities to make direct loan across Europe. Â The key to success is spreading the risk and doing careful due diligence.”. The fund is open to qualified investors. Minimum investment is stated as 100,000 US$.

Adwords Marketing Activity of British P2P Lending Marketplaces

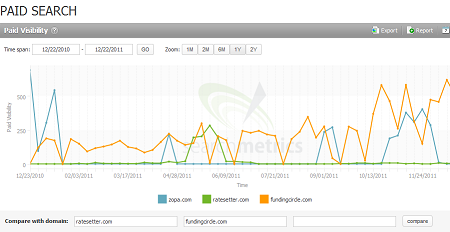

I did some research on use of Google Adwords in the online marketing strategy of Zopa, Funding Circle and Ratesetter.

Who is most active in search engine advertising?

I was surprised to see that Funding Circle is the most active in advertising on Google Adwords.

The chart shows that Fundingcircle had active ads nearly the whole year, while Zopa ran the ads only for certain intervals and Ratesetter only gave it a small try. Continue reading

Peer-to-Peer Finance Association Founded by British P2P Lending Services

Zopa, Fundingcircle and Ratesetter announced the launch of the ‘Peer2Peer Finance Association‘.

Zopa, Fundingcircle and Ratesetter announced the launch of the ‘Peer2Peer Finance Association‘.

The members say that the new UK trade body is set up primarily to ensure the growing sector maintains high minimum standards of protection for consumers and small business customers, as it brings much-needed new competition and innovation to the banking market. In Britain this year, peer-to-peer finance will account for more than £100 million of loans to individuals and small businesses. As new financial regulatory structures are put in place by the Government over the next 18 months or more, the Peer-to-Peer Finance Association will also work hard to ensure that the new rules will include effective regulation for the peer-to-peer finance market.

The association is open to other peer-to-peer providers subject to meeting the required standards.

The Association has established a wide definition of peer-to-peer finance providers as:

‘platforms that facilitate funding via direct, one-to-one contracts between a single recipient and multiple providers of funds, where the majority of providers and borrowers are consumers or small businesses. Generally, funding is in the form of a simple loan, but other instruments may evolve over time.’

The Association’s Rules and Operating Principles set out the key requirements for the transparent, fair, robust and orderly operation of peer-to-peer finance platforms and cover:

1. Senior management systems and controls;

2. Minimum capital requirements;

3. Segregation of participants’ funds;

4. Clear rules governing use of the platform, consistent with these Operating Principles;

5. Marketing and customer communications that are clear, fair and not misleading;

6. Secure and reliable IT systems;

7. Fair complaints handling; and

8. The orderly administration of contracts in the event a platform ceases to operate.

Rhydian Lewis, CEO of RateSetter, said: “The message we want to send to the wider world is that Peer to Peer is working: Lenders across a number of sites are getting market beating returns on their savings, Borrowers are getting lower cost loans, and increasingly P2P finance is becoming more established in the mainstream. As an industry, we would all encourage clearer regulation of P2P finance (not least because it would address the perception that P2P is somehow not regulated). The Association will give us a platform with which to lobby for P2P to be considered on an equal footing with other financial services.â€

This is the first formal trade organisation of p2p lending services. In the US several companies including Prosper and Lending Club did combine efforts to lobby for congress to ease regulation on p2p lending. Users on the other side, united in the PIVN in the Netherlands.

Funding Circle Raises 1.1M to do P2C Lending

![]() London based Funding Circle has announced that it has raised 1.1 million US$ form undisclosed private investors and will launch it’s p2c lending service Fundingcircle.com in Q2 2010.

London based Funding Circle has announced that it has raised 1.1 million US$ form undisclosed private investors and will launch it’s p2c lending service Fundingcircle.com in Q2 2010.

Director and co-founder James Meekings informed P2P-Banking.com:

When the platform launches later this year, people will lend small amounts to a range of different, creditworthy businesses to spread their risk. In turn, those businesses will be borrowing from a multitude of people to get a lower interest rate. … Funding Circle will also empower people to support their local community, by allowing lenders to target businesses with characteristics, such as locale, that are valued by them.

Small businesses will initially be able to apply for unsecured loans of 5,000 to 50,000 GBP. The businesses are checked for fraud and must meet a number of minimum credit requirements verified by the UK’s leading credit agency. Experienced underwriters then further analyse and screen businesses before allowing them onto the Funding Circle platform.