Today, new p2p lending marketplace Crosslend launched offering unsecured loans to consumers. Opening to borrowers and investors in Germany and Spain as well as investors in the UK, Crosslend aims for further European expansion and creating a unified European marketplace.

The Berlin headquartered startup was founded by Oliver Schimek and Daniel Schlotter (both had previous FinTech experience at Kreditech) and Marie Louise Seelig (formerly Skrill). Crosslend already raised a funding round prelaunch from Lakestar, Atlantic Internet and others.

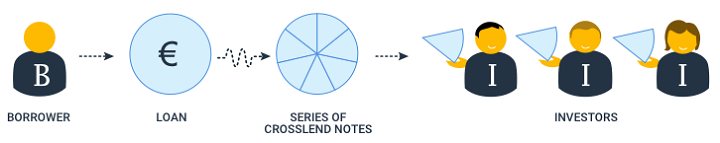

When a loan is granted it is purchased and acquired by Luxembourg based Crosslend Securities SA and securitized by a series of ‘notes’. Notes are debt securities which can be purchased by investors. A series of notes is made up of a number of notes, each with a denomination of 25 EUR. The total nominal value of a series of notes is equivalent to the amount of the loan. When a borrower makes their loan repayments, CrossLend Securities SA makes the corresponding payments of interest and principal pro rata to the holders of the notes.

This will enable Crosslend to offer a secondary market, which is due to be launched in a few months.

Borrowers can apply for loans from 1,500 to 30,000 Euro for loan terms from 6 to 60. Crosslend will grade loans in risk classes A to G, HR. Interest rates (APRs range from about 3.5% to about 17%) and borrower fees are dependent on the assigned risk classes. Crosslend checks submitted proofs of income for all loan applications.

To invest lenders first open an account with biw Bank, the partner bank of Crosslend, this involves a short video verification process of the investor’s identity (webcam required). Video verification is an innovative account opening process which several German online banks started to use to replace the identification via postal communication.

Investors then deposit money into their account (250 Euro minimum). Then investors can choose which loans they want to invest into (25 EUR minimum bid per loan). Crosslend charges investors a 1% fee at origination.

UK investors should consider using Transferwise or Currencyfair to exchange money into Euro to avoid possible bank fees and a bad exchange rate applied by the bank. Continue reading