P2P lending holds great promise: more transparency, purposeful direction of investments and economic advantages for borrowers and lenders. Some even talk of democratization of financial processes.

But are advantages and risks evenly balanced between borrowers and lenders?

For the borrower p2p lending fulfills most promises and the only risk is that the desired loan goes unfunded. Most services have a simple fee structure with no hidden fees and the borrower only pays fees when he does receive the wanted loan. And within a time frame of a few weeks after sign-up the borrower reaches his goal – once his loan is funded and the money is transferred to his account. Platforms with auction mechanisms can even benefit the borrower further in supplying the loan at a lower interest rate then the maximum he set.

The lender on the other side is promised an attractive return on investment but faces multiple risks:

- borrower fails to repay the loan

- (identity) fraud

- p2p lending company fails and ceases to service loans (e.g. Boober Netherlands)

- unreliable forecasts of ROI and default rates

- on some services: open/undefined tax and legal issues

- on some microfinance services: currency exchange risks

- on some microfinance services: risk of MFI failure

There is also an information asymmetry. The borrower usually has most of the information he needs in advance and the information he has is accurate. Should the information be not accurate (e.g. wrong information on at what interest rates he can be funded) then he can retry at no additional costs only incurring a delay. The lender has information, which is partly based on estimates or forecasts that might prove unreliable and other parts of the information might be untrue (e.g. borrower reported income or borrower description of purpose of the loan). For privacy reasons it might also be a subset of the information the p2p lending service itself has on the borrower (e.g. town of residence omitted, or income or jobs listed only in categories instead of values).

The lending experience of the lender is further hindered by the timeline. The problems may impact him at any point in time of a several year loan term. And he either has no way to terminate his investment immediately or if there is a secondary market he might be only able to do so by accepting economic disadvantages in return for the option to selling off.

The situation of the lenders in this comparison to the borrowers is worsened by the alignment of interests of the p2p lending service company with the borrowers. This is due to several factors:

- in most models borrowers pay the larger part of the fees and are thereby important for the revenues

- in some markets attracting borrowers is the limiting factor for growth

- for obvious image and marketing reasons the p2p lending company is not eager to share information on fraud and (in some cases) default details

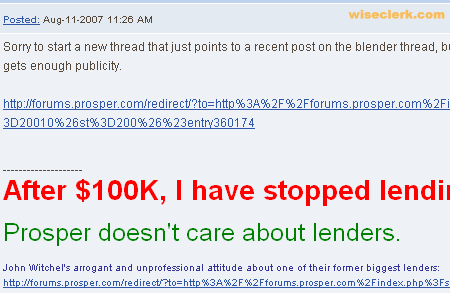

- for the same reasons companies are slow to react and change their lender information when real default levels are much higher then fore-casted (or even advertised) default levels (examples are Prosper, MYC4)

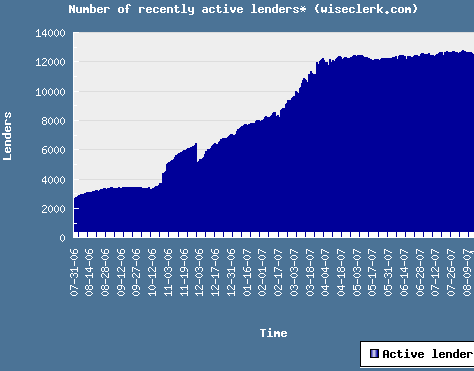

This imparity results in different levels of satisfaction with the p2p lending service for lenders and borrowers. While those p2p lending services that offer (unmoderated) discussion forums have only few unsatisfied borrowers voicing their opinion (and then mostly on technical issues) lender concern and critic rises over time on some of these services (to the extend that Prosper even deleted it’s forum at one point in time).