Well that was a surprise. When I went to bed last midnight the news reported more indications for a remain vote than for a leave. Even with psephologists cautioning that the referendum is very hard to predict due to the lack of comparision data from earlier votes, it seemed to me that the outcome was likely pro EU.

While I had personally wished the Brits to stay in the Union they took a democratic decision and now the politicans have to act upon it to execute divorce.

Awakening to the new reality I now have to assess what this means for my personal p2p investment strategy – as a foreign investor. Only a small portion of my p2p investment portfolio is invested in UK platforms (a substantial amount at Saving Stream, small amounts with Ablrate, MoneyThing and Rebuilding Society). The markets are in turmoil, and I have already taken the hit by the pound dropping sharply compared to the Euro this night.

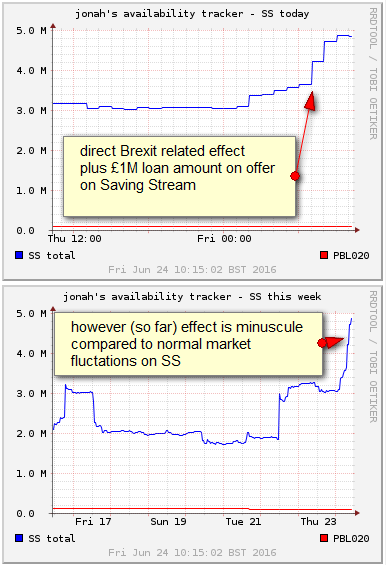

Another effect is that the uncertainty is causing more investors to put up loan parts for sale – the effect is measureable on Saving Stream and currently accounts for a plus of approx. 1M GBP loans on offer there. Still this amount is very small compared to fluctations of liquidity levels due to other factors. For most loans this now means that there is a considerable delay in selling loans, due to queue size. However this could be cleared up quickly by one or two large loans repaying and the interest payout on July 1st.

(Source: jonah; own edits)

With Saving Stream and Moneything loans will depend highly on the development of the property prices. Some expect a drop in property prices. I think it is to early to tell if that will happen, but I think it is very likely that there will be slow down in new development activity while everbody waits to see what the outcome will be. This will affect the demand for bridging loans and thereby Saving Stream and Moneything to a cetain degree.

And then totally unpredictable there is the question how this new direction will effect the European economy as a whole and whether it might trigger a recession. While I am optimistic that it will not, there is an extreme amount of uncertainty and I have to consider that this might impact my p2p investments on continental European platforms.

For now I have decided that I will not deposit new funds on UK platforms (which I was planning to do) but will not withdraw funds either at the moment and will just keep reinvesting the proceeds. I see little point in selling off loans (would be hard right now anyhow as liquidity seems to dry off temporarily), and exchange the amounts back to Euro. That would guard me from further drops of the pound exchange rate, but I think it is not sure that the pound will fall into a continuing decline (even so that seems more likely than any rise in the pound rate vs the Euro).

For the continental platforms my strategy remains unchanged by the event, even though I think that the risks on some platforms have risen somewhat too in the mid-term outlook.

Lendwithcare has partnered with local MFIs in Benin, Togo, Philippines, Cambodia and Indonesia that disburse the loan to the borrower. Lenders do not receive interest. Aside from the default risk (Lendwithcare claims less than 2% bad debt) lenders also bear the currency exchange rate risk. Lenders do fill their account via Paypal or credit card, withdrawels are through Paypal.

Lendwithcare has partnered with local MFIs in Benin, Togo, Philippines, Cambodia and Indonesia that disburse the loan to the borrower. Lenders do not receive interest. Aside from the default risk (Lendwithcare claims less than 2% bad debt) lenders also bear the currency exchange rate risk. Lenders do fill their account via Paypal or credit card, withdrawels are through Paypal. Today was another conference call by

Today was another conference call by