![]() 15 month ago I joined the British platform Seedrs and started to invest in startups I consider interesting. Since then I have built my small portfolio, holding equity stakes in more than a dozen mostly British companies. In this article I share my experiences in the process.

15 month ago I joined the British platform Seedrs and started to invest in startups I consider interesting. Since then I have built my small portfolio, holding equity stakes in more than a dozen mostly British companies. In this article I share my experiences in the process.

What is it about?

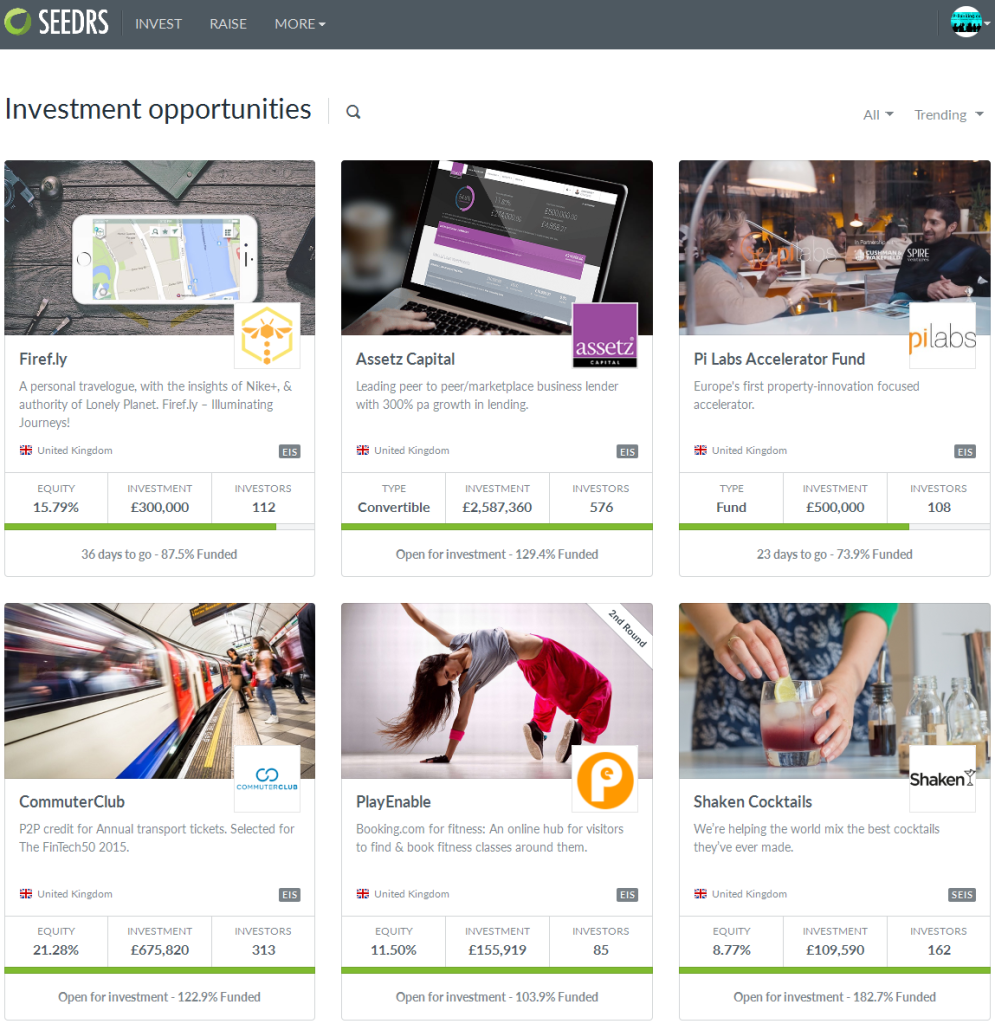

On Seedrs startups can pitch to raise money offering investors an equity stake in the company. This is called p2p equity or equity crowdfunding. The startup discloses information about their product, plans (e.g. intended impact, monetisation strategy, use of proceed) and achievements so far to registered users. There is further information about the market they operate in and the team is presented.

The equity share offered is stated (e.g. 5%). This and the amount to be raised (e.g. 75,000 GBP) define the valuation of the startup that the startup has applied (in this example 1,425,000 pre-money, so post-money, that is after completed funding the startup’s valuation would be 1,500,000 GBP and the 5% equity share of the new investors represent 5% of 1,500,000 = 75,000 GBP raised). Note that the valuation is based solely on what the startup deems appropriate. Of course if the startup aims to high it risks that there is not enough investor demand and the funding fails.

How to get started as an investor?

I just signed up online and submitted some documents to verify my identity. The process is pretty straightforward. Seedrs is open to international investors, so investors do not have to be UK residents.

After signing up, investors can browse the pitches that are currently raising money. A pitch is usually open for 60 days, but maybe closed early by the startup if the goal is reached earlier.

Current screenshot showing some of the open pitches

Clicking on any one of the pitches reveals the detailed information. It also shows who has invested and how much. Investors can opt to show their bid as ‘Anonymous’ in order not to disclose thier name to the Seedrs community. When an investor likes a pitch bidding is possible through the “Invest” button. As long as the pitch is below 100% funding an investor can bid first, and pay later (within 7 days of the pitch completing 100% funding). Once the pitch reaches over 100% it is marked as “overfunding” and investors can only bid, if they have already deposited funds available in their account. Payment is possible via bank transfer or credit card.

What happens after the funding

Seedrs completes all the paperwork with the startup. As Seedrs acts as a nominee for investors the individual investor does not have to do anything. The nominee structure means that the startup does not have to deal with each of the many individual investors but rather only with Seedrs as Seedrs represents all of these investors. Seedrs charges the investors a fee of 7.5% on the profits the investors make (note that this is not a fee on the investment amount (example: an investor invests 200 GBP in a pitch. Should there be an exit later where the value of the investors shares is now 300 GBP then Seedrs charges 7.5% of the 100 GBP profit; therefore the investor would be paid back 292.50 GBP). Note that your investment will be illiquid until the exit; as there are restrictions on selling the shares. Continue reading

Roughly a year ago I came across an idea that sounded extreme. There was a crowdfunding pitch for a startup that had no team and no idea. What? Well the idea was that the startup once founded would use the ‘Design Thinking’ method to develop the idea and the business model in the first months after funding and company foundation. The pitch was for 100,000 CHF. It had a strange appeal to me, so I invested a small amount. The pitch did fully fun and 4 applicants – students of the university of St. Gallen, Switzerland – were recruited as founders and off they went. The founders are not paid a salary but compensated in shares for their work.

Roughly a year ago I came across an idea that sounded extreme. There was a crowdfunding pitch for a startup that had no team and no idea. What? Well the idea was that the startup once founded would use the ‘Design Thinking’ method to develop the idea and the business model in the first months after funding and company foundation. The pitch was for 100,000 CHF. It had a strange appeal to me, so I invested a small amount. The pitch did fully fun and 4 applicants – students of the university of St. Gallen, Switzerland – were recruited as founders and off they went. The founders are not paid a salary but compensated in shares for their work. There are two major problems with Appbackr

There are two major problems with Appbackr