BLender, a p2p lending company from Israel, today announced its global expansion, beginning with new offices in Milan, Italy and Vilnius, Lithuania that will serve customers in Italy and the Baltics. The Israeli-based company delivers a P2P lending platform with a proprietary consumer credit rating system designed for territories without credit bureaus or traditional consumer credit information. BLender is a cloud-based platform that was built to work in a wide range of markets and languages.

BLender, a p2p lending company from Israel, today announced its global expansion, beginning with new offices in Milan, Italy and Vilnius, Lithuania that will serve customers in Italy and the Baltics. The Israeli-based company delivers a P2P lending platform with a proprietary consumer credit rating system designed for territories without credit bureaus or traditional consumer credit information. BLender is a cloud-based platform that was built to work in a wide range of markets and languages.

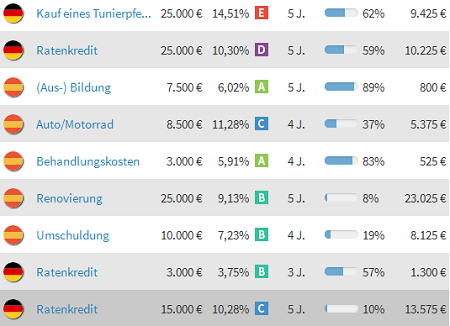

In Italy the platform charges borrowers a 4.5% origination fee and investors 1.5% of each repayment (principal and repayment). Compared to other marketplaces these fees are in the higher price range. The fee for selling a loan on the secondary market is 0.45%.

BLender has experienced exponential growth since its launch in 2014 and has already provided approximately 12 million USD in loans. The company will continue expanding its global operations into territories that are craving consumer credit. In 2017, BLender plans to launch operations in Africa, Latin America and other European Union (EU) countries.

“Offering multi-national P2P lending has been our vision since BLender’s establishment,†said Dr. Gal Aviv, CEO, BLender. “Since our Israeli launch in 2014, we have built the foundation, infrastructure and technology to enable BLender to operate in the global market, so we will be able to face operating, cultural, technological, regulatory and taxation challenges.â€

With the expansion into Italy and the Baltics, BLender is enabling users to lend and/or borrow across countries, making financial borders a thing of a the past, says the service.

“BLender identified a credit gap in countries where the supply of consumer credit is insufficient for the populations’ needs and is priced very high, and a gap in other countries where the savings options have very low or even negative yield,†said David Blumberg, founder and managing partner, Blumberg Capital, a San Francisco-based venture capital firm that led BLender’s last funding round. “BLender’s multi-national lending options mediate this credit gap by creating a meeting ground between borrowers from countries that lack consumer credit, to lenders from countries where the yield on their savings in insufficient. We support and strongly believe in the vision, management capabilities and business potential of the BLender team.â€

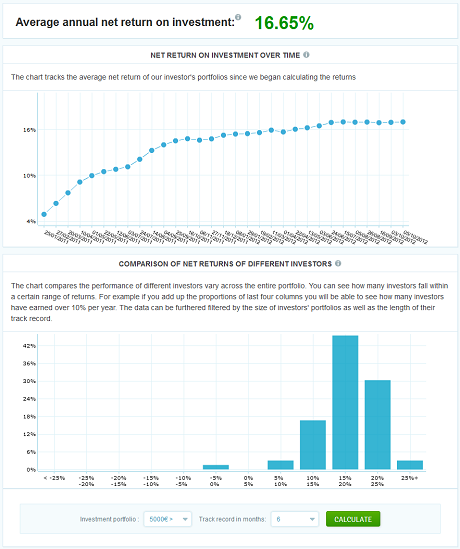

Investors on the BLender platform will earn predicted interest rates of 5-6% annually. The safeguard fund acts as an additional layer of protection to the lenders in case of a default. BLender’s default rate is approximately 1% before activating the safeguard fund. Thanks to the SafeGuard fund, the effective default rate is 0% says the service. BLender also offers ReBlendTM, BLender’s secondary market that offers the lenders the option the trade their loan portfolios and enjoy liquidity.

Recently BLender was chosen to participate in the exclusive ELITE program of the UK Stock Exchange that finds and nurtures companies with the potential for an IPO. As part of the program, BLender receives the guidance of the program’s experts for two years that help promote the company’s activity.

Furthermore, the company was selected as one of the most promising Fin-Tech companies in the world for 2015 by the accounting firm – KPMG, and also by the United Kingdom Trade and Investment Department.

The multi-national expansion was done in collaboration with KPMG.

P2P Lending marketplace Isepankur yesterday rebranded as

P2P Lending marketplace Isepankur yesterday rebranded as  Estonian p2p lending service

Estonian p2p lending service